Problem 6 PV OF A CASH FLOW STREAM. A rookie quarterback is negotiating his first NFL contract. His opportunity cost is 10%. He has been offered three possible 4-year contracts. Payments are guaranteed, and they would be made at the end of each year. Terms of each contract are as follows: 3 + Contract 1 $3,000,000 $3,000,000 $3,000,000 $3,000,000 Contract 2 $2,000,000 $3,000,000 $4,000,000 $5,000,000 Contract 3 $7,000,000 $1,000,000 $1,000,000 $1,000,000 As his adviser, which contract would you recommend that he accept?

Problem 6 PV OF A CASH FLOW STREAM. A rookie quarterback is negotiating his first NFL contract. His opportunity cost is 10%. He has been offered three possible 4-year contracts. Payments are guaranteed, and they would be made at the end of each year. Terms of each contract are as follows: 3 + Contract 1 $3,000,000 $3,000,000 $3,000,000 $3,000,000 Contract 2 $2,000,000 $3,000,000 $4,000,000 $5,000,000 Contract 3 $7,000,000 $1,000,000 $1,000,000 $1,000,000 As his adviser, which contract would you recommend that he accept?

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:h If she expects to earn 8% annually, which is the best choice?

- If she expects to earn 9% annually, which option would you recommend?

d Explain how interest rates influence the optimal choice.

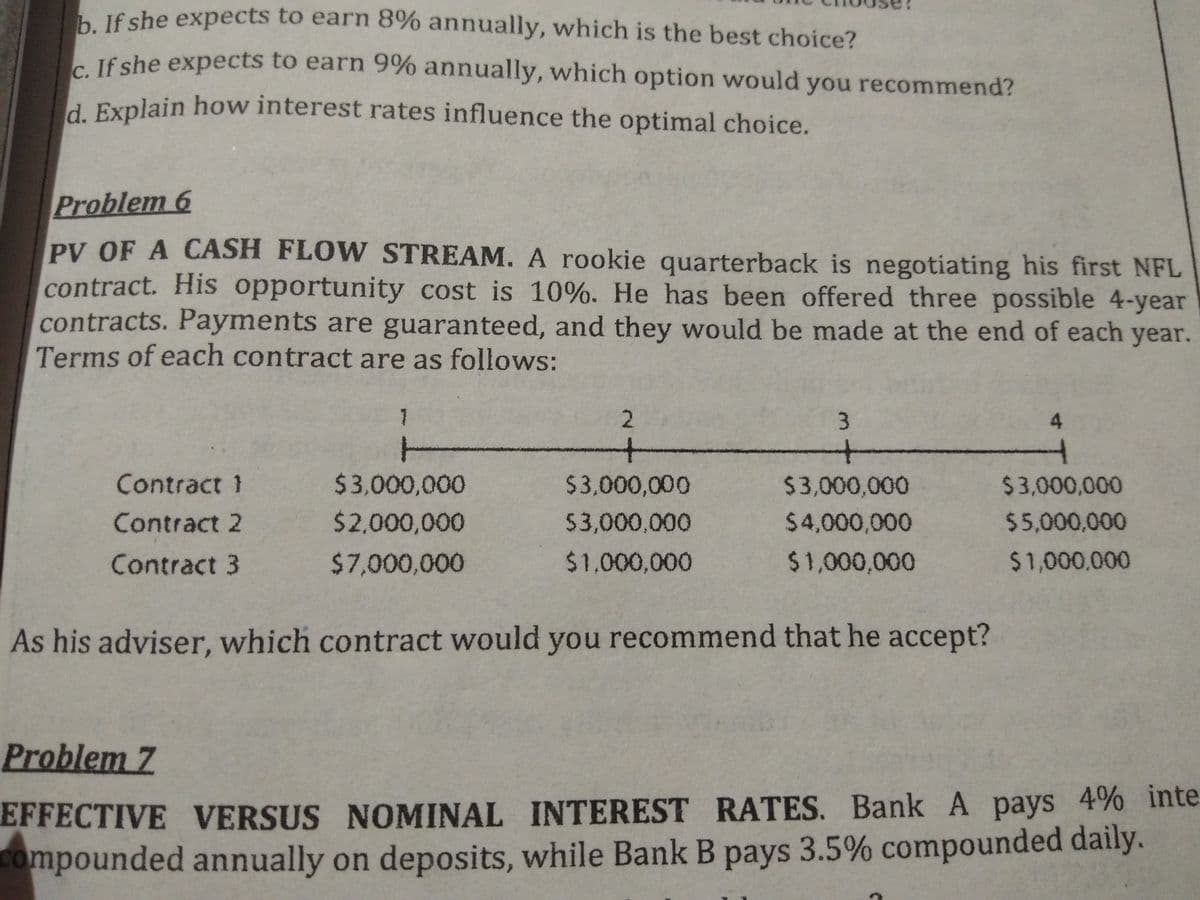

Problem 6

PV OF A CASH FLOW STREAM. A rookie quarterback is negotiating his first NFL

contract. His opportunity cost is 10%. He has been offered three possible 4-year

contracts. Payments are guaranteed, and they would be made at the end of each year.

Terms of each contract are as follows:

1

2

3.

+-

十

+一

-

Contract 1

$3,000,000

$3,000,000

$3,000,000

$3,000,000

Contract 2

$2,000,000

$3,000,000

$4,000,000

$5,000,000

Contract 3

$7,000,000

$1,000,000

$1,000,000

$1,000,000

As his adviser, which contract would you recommend that he accept?

Problem 7

EFFECTIVE VERSUS NOMINAL INTEREST RATES. Bank A pays 4% inte

Compounded annually on deposits, while Bank B pays 3.5% compounded daily.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT