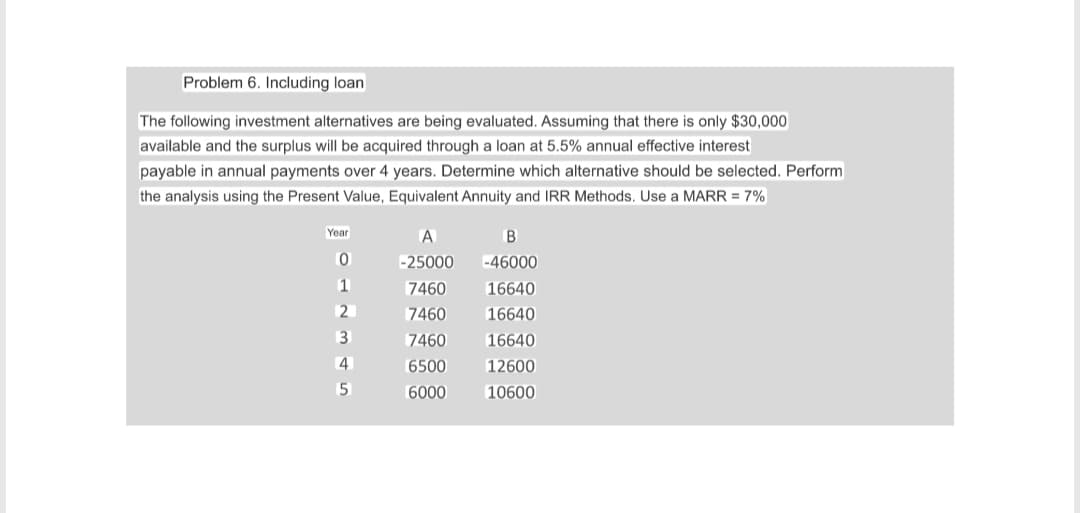

Problem 6. Including loan The following investment alternatives are being evaluated. Assuming that there is only $30,000 available and the surplus will be acquired through a loan at 5.5% annual effective interest payable in annual payments over 4 years. Determine which alternative should be selected. Perform the analysis using the Present Value, Equivalent Annuity and IRR Methods. Use a MARR = 7% Year A B 0 -25000 -46000 1 7460 16640 2 7460 16640 3 7460 16640 4 6500 12600 5 6000 10600

Problem 6. Including loan The following investment alternatives are being evaluated. Assuming that there is only $30,000 available and the surplus will be acquired through a loan at 5.5% annual effective interest payable in annual payments over 4 years. Determine which alternative should be selected. Perform the analysis using the Present Value, Equivalent Annuity and IRR Methods. Use a MARR = 7% Year A B 0 -25000 -46000 1 7460 16640 2 7460 16640 3 7460 16640 4 6500 12600 5 6000 10600

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 4BE: Internal rate of return A project is estimated to cost 463,565 and provide annual net cash flows of...

Related questions

Question

Transcribed Image Text:Problem 6. Including loan

The following investment alternatives are being evaluated. Assuming that there is only $30,000

available and the surplus will be acquired through a loan at 5.5% annual effective interest

payable in annual payments over 4 years. Determine which alternative should be selected. Perform

the analysis using the Present Value, Equivalent Annuity and IRR Methods. Use a MARR = 7%

Year

A

B

0

-25000

-46000

1

7460

16640

2

7460

16640

3

7460

16640

4

6500

12600

5

6000

10600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning