Problem 7-45 (LO. 7) During 2020, Rick and his wife, Sara, had the following items of income and expense to report: Gross receipts from business Business expenses Interest income from bank savings accounts Sara's salary Long-term capital gain on stock held as an investment Itemized deductions a. Assuming that Rick and Sara file a joint return, what is their taxable income (or loss) for 2020? If required, use the minus sign to indicate a loss. Adjusted gross income/loss Taxable income/loss -63,000 $400,000 525,000 8,000 50,000 4,000 $15,000 -87,800

Problem 7-45 (LO. 7) During 2020, Rick and his wife, Sara, had the following items of income and expense to report: Gross receipts from business Business expenses Interest income from bank savings accounts Sara's salary Long-term capital gain on stock held as an investment Itemized deductions a. Assuming that Rick and Sara file a joint return, what is their taxable income (or loss) for 2020? If required, use the minus sign to indicate a loss. Adjusted gross income/loss Taxable income/loss -63,000 $400,000 525,000 8,000 50,000 4,000 $15,000 -87,800

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 13DQ: A divorce agreement entered into in 2017 requires Alice to pay her former spouse 50,000 a year for...

Related questions

Question

Please do not give image format

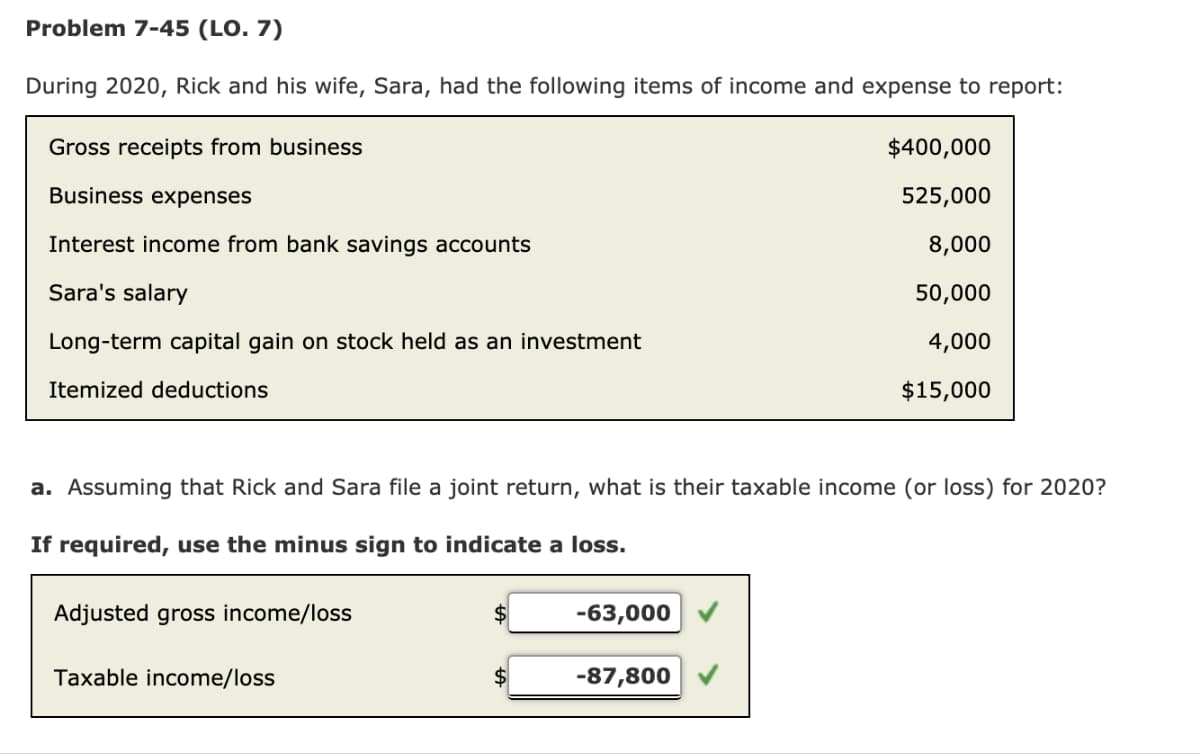

Transcribed Image Text:Problem 7-45 (LO. 7)

During 2020, Rick and his wife, Sara, had the following items of income and expense to report:

Gross receipts from business

Business expenses

Interest income from bank savings accounts

Sara's salary

Long-term capital gain on stock held as an investment

Itemized deductions

a. Assuming that Rick and Sara file a joint return, what is their taxable income (or loss) for 2020?

If required, use the minus sign to indicate a loss.

Adjusted gross income/loss

Taxable income/loss

-63,000

$400,000

525,000

8,000

50,000

4,000

$15,000

-87,800

Transcribed Image Text:b. What is the amount of Rick and Sara's NOL for 2020?

Rick and Sara's NOL for 2020 is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT