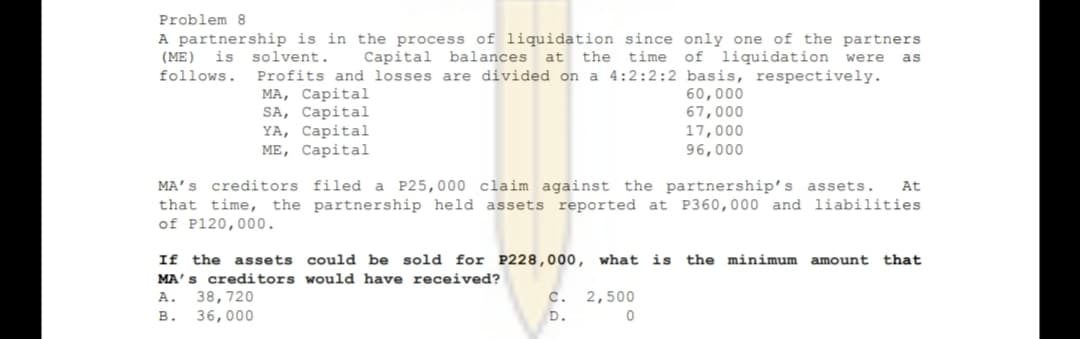

Problem 8 A partnership is in the process of liquidation since only one of the partners (ME) is solvent. Capital balances at the time of liquidation were as follows. Profits and losses are divided on a 4:2:2:2 basis, respectively. МА, Саpital SA, Capital YA, Capital ME, Capital 60,000 67,000 17,000 96,000 MA's creditors filed a P25,000 claim against the partnership's assets. At that time, the partnership held assets reported at P360,000 and liabilities of P120,000. If the assets could be sold for P228,000, what is the minimum amount that MA's creditors would have received? 38,720 36.000 А. с. 2,500 B.

Problem 8 A partnership is in the process of liquidation since only one of the partners (ME) is solvent. Capital balances at the time of liquidation were as follows. Profits and losses are divided on a 4:2:2:2 basis, respectively. МА, Саpital SA, Capital YA, Capital ME, Capital 60,000 67,000 17,000 96,000 MA's creditors filed a P25,000 claim against the partnership's assets. At that time, the partnership held assets reported at P360,000 and liabilities of P120,000. If the assets could be sold for P228,000, what is the minimum amount that MA's creditors would have received? 38,720 36.000 А. с. 2,500 B.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 9SPB

Related questions

Question

Show the solution in good accounting form

Transcribed Image Text:Problem 8

A partnership is in the process of liquidation since only one of the partners

at the time of liquidation were

(ME)

is

solvent.

Capital balances

as

follows.

Profits and losses are divided on a 4:2:2:2 basis, respectively.

МА, Саpital

SA, Capital

YA, Capital

ME, Capital

60,000

67,000

17,000

96,000

MA’S creditors filed a P25,000 claim against the partnership's assets.

that time, the partnership held assets reported at P360,000 and liabilities

of P120,000.

At

If the assets could be sold for P228,000, what is

MA's creditors would have received?

the minimum amount

that

38,720

36,000

2,500

D.

A.

с.

в.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning