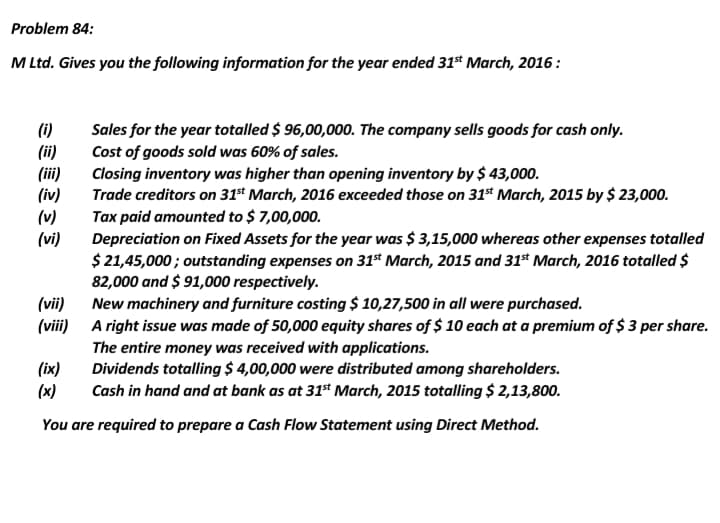

Problem 84: M Ltd. Gives you the following information for the year ended 31* March, 2016: (i) (ii) (ii) (iv) (v) (vi) Sales for the year totalled $ 96,00,000. The company sells goods for cash only. Cost of goods sold was 60% of sales. Closing inventory was higher than opening inventory by $ 43,000. Trade creditors on 31st March, 2016 exceeded those on 31s* March, 2015 by $ 23,000. Tax paid amounted to $ 7,00,000. Depreciation on Fixed Assets for the year was $ 3,15,000 whereas other expenses totalled $ 21,45,000; outstanding expenses on 31* March, 2015 and 31* March, 2016 totalled $ 82,000 and $ 91,000 respectively. New machinery and furniture costing $ 10,27,500 in all were purchased. (vii) (viii) A right issue was made of 50,000 equity shares of $ 10 each at a premium of $ 3 per share. (ix) (x) The entire money was received with applications. Dividends totalling $ 4,00,000 were distributed among shareholders. Cash in hand and at bank as at 31* March, 2015 totalling $ 2,13,800. You are required to prepare a Cash Flow Statement using Direct Method.

Problem 84: M Ltd. Gives you the following information for the year ended 31* March, 2016: (i) (ii) (ii) (iv) (v) (vi) Sales for the year totalled $ 96,00,000. The company sells goods for cash only. Cost of goods sold was 60% of sales. Closing inventory was higher than opening inventory by $ 43,000. Trade creditors on 31st March, 2016 exceeded those on 31s* March, 2015 by $ 23,000. Tax paid amounted to $ 7,00,000. Depreciation on Fixed Assets for the year was $ 3,15,000 whereas other expenses totalled $ 21,45,000; outstanding expenses on 31* March, 2015 and 31* March, 2016 totalled $ 82,000 and $ 91,000 respectively. New machinery and furniture costing $ 10,27,500 in all were purchased. (vii) (viii) A right issue was made of 50,000 equity shares of $ 10 each at a premium of $ 3 per share. (ix) (x) The entire money was received with applications. Dividends totalling $ 4,00,000 were distributed among shareholders. Cash in hand and at bank as at 31* March, 2015 totalling $ 2,13,800. You are required to prepare a Cash Flow Statement using Direct Method.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.4AP

Related questions

Question

Transcribed Image Text:Problem 84:

M Ltd. Gives you the following information for the year ended 31* March, 2016 :

(i)

(ii)

(ii)

(iv)

(v)

(vi)

Sales for the year totalled $ 96,00,000. The company sells goods for cash only.

Cost of goods sold was 60% of sales.

Closing inventory was higher than opening inventory by $ 43,000.

Trade creditors on 31t March, 2016 exceeded those on 31* March, 2015 by $ 23,000.

Tax paid amounted to $ 7,00,000.

Depreciation on Fixed Assets for the year was $ 3,15,000 whereas other expenses totalled

$ 21,45,000; outstanding expenses on 31* March, 2015 and 31s* March, 2016 totalled $

82,000 and $ 91,000 respectively.

New machinery and furniture costing $ 10,27,500 in all were purchased.

(vii)

(viii) A right issue was made of 50,000 equity shares of $ 10 each at a premium of $ 3 per share.

(ix)

(x)

The entire money was received with applications.

Dividends totalling $ 4,00,000 were distributed among shareholders.

Cash in hand and at bank as at 31* March, 2015 totalling $ 2,13,800.

You are required to prepare a Cash Flow Statement using Direct Method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning