Problem Schwartz & Co. obtained significant influence over Goldberg & Co. when they acquired a 40% interest in Goldberg |by acquiring 40% of the 80,000 outstanding shares of common stock at $28 per share on January 1, 2020. On July 1st, Goldberg paid a cash dividend of $150,000. On December 31, Goldberg reported net income of $500,000. Prepare the necessary journal entries to record the above transactions

Problem Schwartz & Co. obtained significant influence over Goldberg & Co. when they acquired a 40% interest in Goldberg |by acquiring 40% of the 80,000 outstanding shares of common stock at $28 per share on January 1, 2020. On July 1st, Goldberg paid a cash dividend of $150,000. On December 31, Goldberg reported net income of $500,000. Prepare the necessary journal entries to record the above transactions

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.4EX

Related questions

Question

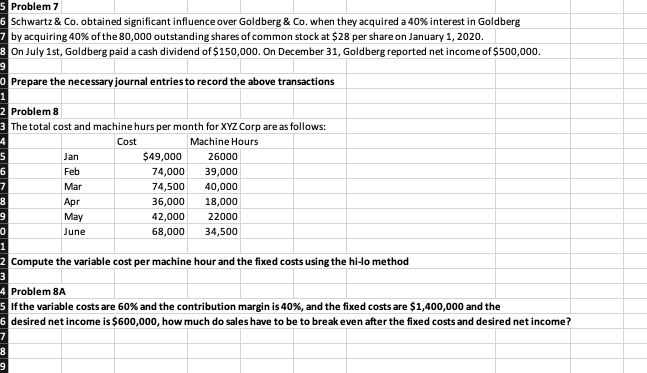

Transcribed Image Text:5 Problem 7

6 Schwartz & Co. obtained significant influence over Goldberg & Co. when they acquired a 40% interest in Goldberg

7 by acquiring 40% of the 80,000 outstanding shares of common stock at $28 per share on January 1, 2020.

8 On July 1st, Goldberg paid a cash dividend of $150,000. On December 31, Goldberg reported net income of $500,000.

O Prepare the necessary journal entries to record the above transactions

2 Problem 8

3 The total cost and machine hurs per month for XYZ Corp are as follows:

-4

Cost

Machine Hours

Jan

$49,000

26000

Feb

74,000

39,000

Mar

74,500

40,000

Apr

36,000

18,000

6.

May

42,000

22000

June

68,000

34,500

1

2 Compute the variable cost per machine hour and the fixed costs using the hi-lo method

3

4 Problem 8A

5 Ifthe variable costs are 60% and the contribution margin is 40%, and the fixed costs are $1,400,000 and the

6 desired net income is $600,000, how much do sales have to be to break even after the fixed costs and desired net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning