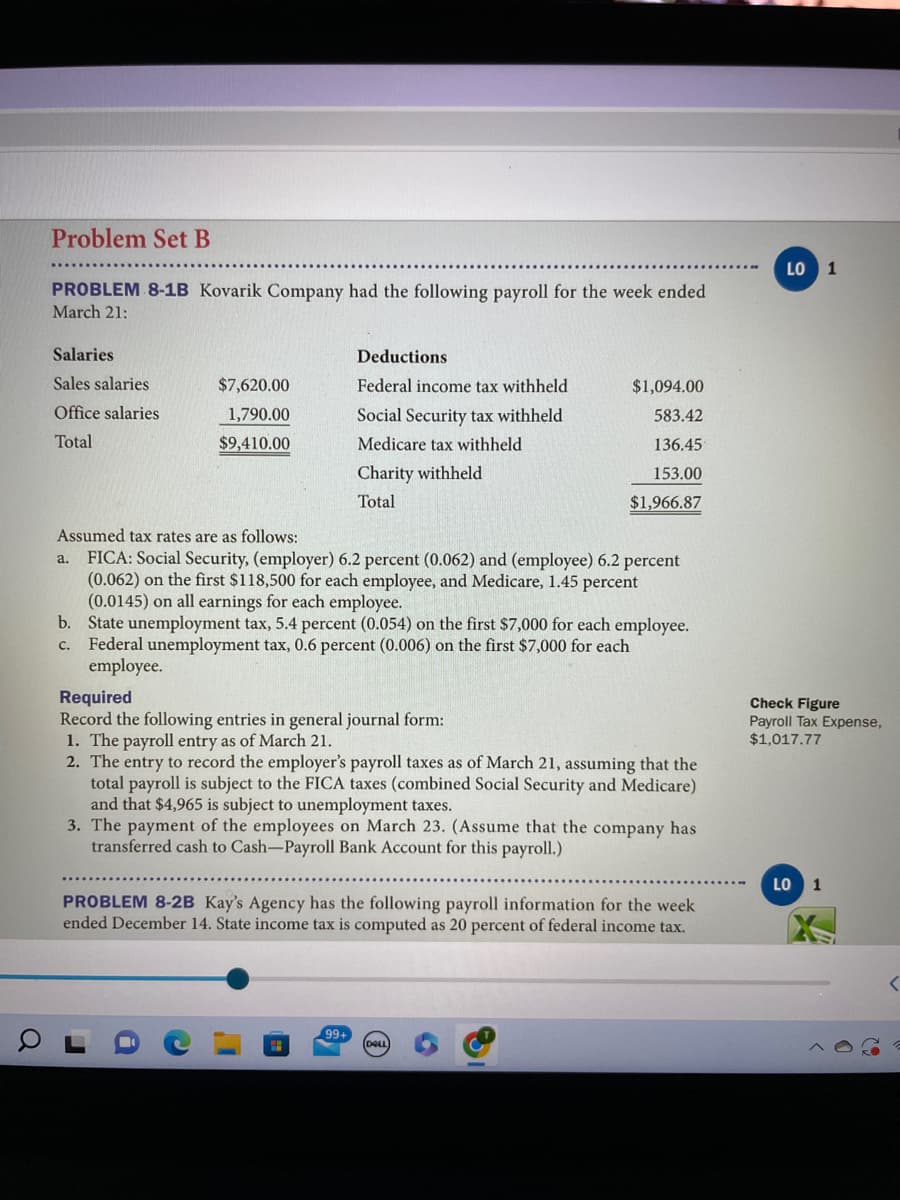

Problem Set B ..... PROBLEM 8-1B Kovarik Company had the following payroll for the week ended March 21: Salaries Sales salaries Office salaries Total $7,620.00 1,790.00 $9,410.00 Deductions Federal income tax withheld Social Security tax withheld Medicare tax withheld Charity withheld Total $1,094.00 583.42 136.45 153.00 $1,966.87 Assumed tax rates are as follows: a. FICA: Social Security, (employer) 6.2 percent (0.062) and (employee) 6.2 percent (0.062) on the first $118,500 for each employee, and Medicare, 1.45 percent (0.0145) on all earnings for each employee. b. State unemployment tax, 5.4 percent (0.054) on the first $7,000 for each employee. C. Federal unemployment tax, 0.6 percent (0.006) on the first $7,000 for each employee. Required Record the following entries in general journal form: 1. The payroll entry as of March 21. 2. The entry to record the employer's payroll taxes as of March 21, assuming that the total payroll is subject to the FICA taxes (combined Social Security and Medicare) and that $4,965 is subject to unemployment taxes. 3. The payment of the employees on March 23. (Assume that the company has transferred cash to Cash-Payroll Bank Account for this payroll.)

Problem Set B ..... PROBLEM 8-1B Kovarik Company had the following payroll for the week ended March 21: Salaries Sales salaries Office salaries Total $7,620.00 1,790.00 $9,410.00 Deductions Federal income tax withheld Social Security tax withheld Medicare tax withheld Charity withheld Total $1,094.00 583.42 136.45 153.00 $1,966.87 Assumed tax rates are as follows: a. FICA: Social Security, (employer) 6.2 percent (0.062) and (employee) 6.2 percent (0.062) on the first $118,500 for each employee, and Medicare, 1.45 percent (0.0145) on all earnings for each employee. b. State unemployment tax, 5.4 percent (0.054) on the first $7,000 for each employee. C. Federal unemployment tax, 0.6 percent (0.006) on the first $7,000 for each employee. Required Record the following entries in general journal form: 1. The payroll entry as of March 21. 2. The entry to record the employer's payroll taxes as of March 21, assuming that the total payroll is subject to the FICA taxes (combined Social Security and Medicare) and that $4,965 is subject to unemployment taxes. 3. The payment of the employees on March 23. (Assume that the company has transferred cash to Cash-Payroll Bank Account for this payroll.)

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.13EX

Related questions

Question

Problem 8-1B

Transcribed Image Text:Q

Problem Set B

PROBLEM 8-1B Kovarik Company had the following payroll for the week ended

March 21:

Salaries

Sales salaries

Office salaries

Total

$7,620.00

1,790.00

$9,410.00

a.

Deductions

Federal income tax withheld

Social Security tax withheld

Medicare tax withheld

Charity withheld

Total

Assumed tax rates are as follows:

FICA: Social Security, (employer) 6.2 percent (0.062) and (employee) 6.2 percent

(0.062) on the first $118,500 for each employee, and Medicare, 1.45 percent

(0.0145) on all earnings for each employee.

$1,094.00

583.42

136.45

153.00

$1,966.87

b. State unemployment tax, 5.4 percent (0.054) on the first $7,000 for each employee.

c. Federal unemployment tax, 0.6 percent (0.006) on the first $7,000 for each

employee.

Required

Record the following entries in general journal form:

1. The payroll entry as of March 21.

2. The entry to record the employer's payroll taxes as of March 21, assuming that the

total payroll is subject to the FICA taxes (combined Social Security and Medicare)

and that $4,965 is subject to unemployment taxes.

3. The payment of the employees on March 23. (Assume that the company has

transferred cash to Cash-Payroll Bank Account for this payroll.)

99+

PROBLEM 8-2B Kay's Agency has the following payroll information for the week

ended December 14. State income tax is computed as 20 percent of federal income tax.

DELL

LO

1

Check Figure

Payroll Tax Expense,

$1,017.77

LO 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning