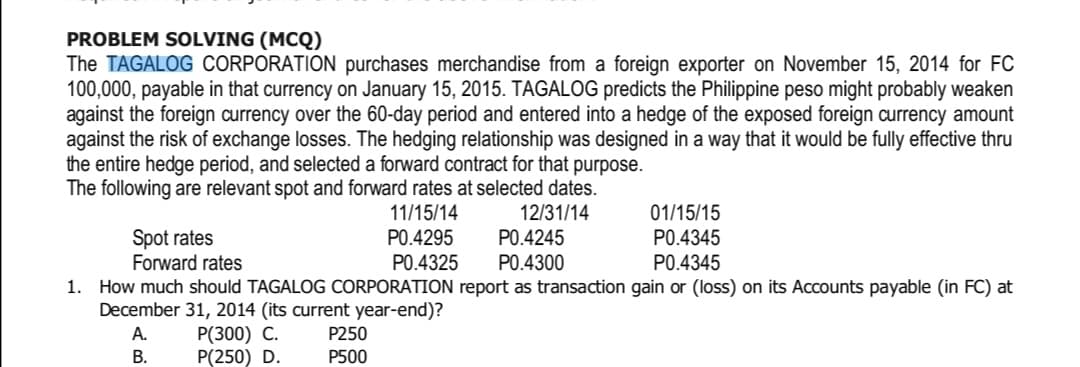

PROBLEM SOLVING (MCQ) The TAGALOG CORPORATION purchases merchandise from a foreign exporter on November 15, 2014 for FC 100,000, payable in that currency on January 15, 2015. TAGALOG predicts the Philippine peso might probably weaken against the foreign currency over the 60-day period and entered into a hedge of the exposed foreign currency amount against the risk of exchange losses. The hedging relationship was designed in a way that it would be fully effective thru the entire hedge period, and selected a forward contract for that purpose. The following are relevant spot and forward rates at selected dates. 11/15/14 12/31/14 01/15/15 P0.4345 Spot rates P0.4295 P0.4245 Forward rates P0.4325 PO.4300 P0.4345 1. How much should TAGALOG CORPORATION report as transaction gain or (loss) on its Accounts payable (in FC) at December 31, 2014 (its current year-end)? A. P(300) C. P250 B. P(250) D. P500

PROBLEM SOLVING (MCQ) The TAGALOG CORPORATION purchases merchandise from a foreign exporter on November 15, 2014 for FC 100,000, payable in that currency on January 15, 2015. TAGALOG predicts the Philippine peso might probably weaken against the foreign currency over the 60-day period and entered into a hedge of the exposed foreign currency amount against the risk of exchange losses. The hedging relationship was designed in a way that it would be fully effective thru the entire hedge period, and selected a forward contract for that purpose. The following are relevant spot and forward rates at selected dates. 11/15/14 12/31/14 01/15/15 P0.4345 Spot rates P0.4295 P0.4245 Forward rates P0.4325 PO.4300 P0.4345 1. How much should TAGALOG CORPORATION report as transaction gain or (loss) on its Accounts payable (in FC) at December 31, 2014 (its current year-end)? A. P(300) C. P250 B. P(250) D. P500

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 22E

Related questions

Question

Transcribed Image Text:PROBLEM SOLVING (MCQ)

The TAGALOG CORPORATION purchases merchandise from a foreign exporter on November 15, 2014 for FC

100,000, payable in that currency on January 15, 2015. TAGALOG predicts the Philippine peso might probably weaken

against the foreign currency over the 60-day period and entered into a hedge of the exposed foreign currency amount

against the risk of exchange losses. The hedging relationship was designed in a way that it would be fully effective thru

the entire hedge period, and selected a forward contract for that purpose.

The following are relevant spot and forward rates at selected dates.

11/15/14

12/31/14

01/15/15

P0.4345

Spot rates

P0.4295

P0.4245

Forward rates

P0.4325

PO.4300

P0.4345

1. How much should TAGALOG CORPORATION report as transaction gain or (loss) on its Accounts payable (in FC) at

December 31, 2014 (its current year-end)?

A.

P(300) C.

P250

B.

P(250) D.

P500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning