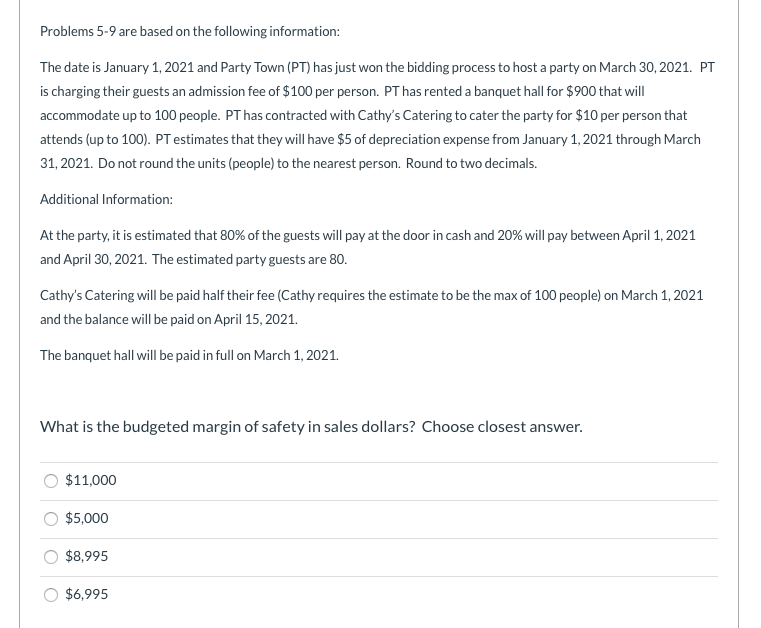

Problems 5-9 are based on the following information: The date is January 1, 2021 and Party Town (PT) has just won the bidding process to host a party on March 30, 2021. PT is charging their guests an admission fee of $100 per person. PT has rented a banquet hall for $900 that will accommodate up to 100 people. PT has contracted with Cathy's Catering to cater the party for $10 per person that attends (up to 100). PT estimates that they will have $5 of depreciation expense from January 1, 2021 through March 31, 2021. Do not round the units (people) to the nearest person. Round to two decimals. Additional Information: At the party, it is estimated that 80% of the guests will pay at the door in cash and 20% will pay between April 1, 2021 and April 30, 2021. The estimated party guests are 80. Cathy's Catering will be paid half their fee (Cathy requires the estimate to be the max of 100 people) on March 1, 2021 and the balance will be paid on April 15, 2021. The banquet hall will be paid in full on March 1, 2021. What is the budgeted margin of safety in sales dollars? Choose closest answer. $11,000 $5,000 $8,995 $6,995

Problems 5-9 are based on the following information: The date is January 1, 2021 and Party Town (PT) has just won the bidding process to host a party on March 30, 2021. PT is charging their guests an admission fee of $100 per person. PT has rented a banquet hall for $900 that will accommodate up to 100 people. PT has contracted with Cathy's Catering to cater the party for $10 per person that attends (up to 100). PT estimates that they will have $5 of depreciation expense from January 1, 2021 through March 31, 2021. Do not round the units (people) to the nearest person. Round to two decimals. Additional Information: At the party, it is estimated that 80% of the guests will pay at the door in cash and 20% will pay between April 1, 2021 and April 30, 2021. The estimated party guests are 80. Cathy's Catering will be paid half their fee (Cathy requires the estimate to be the max of 100 people) on March 1, 2021 and the balance will be paid on April 15, 2021. The banquet hall will be paid in full on March 1, 2021. What is the budgeted margin of safety in sales dollars? Choose closest answer. $11,000 $5,000 $8,995 $6,995

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter6: Statistical Inference

Section: Chapter Questions

Problem 23P: The manager of the Danvers-Hilton Resort Hotel stated that the mean guest bill for a weekend is 600...

Related questions

Question

Transcribed Image Text:Problems 5-9 are based on the following information:

The date is January 1, 2021 and Party Town (PT) has just won the bidding process to host a party on March 30, 2021. PT

is charging their guests an admission fee of $100 per person. PT has rented a banquet hall for $900 that will

accommodate up to 100 people. PT has contracted with Cathy's Catering to cater the party for $10 per person that

attends (up to 100). PT estimates that they will have $5 of depreciation expense from January 1, 2021 through March

31, 2021. Do not round the units (people) to the nearest person. Round to two decimals.

Additional Information:

At the party, it is estimated that 80% of the guests will pay at the door in cash and 20% will pay between April 1, 2021

and April 30, 2021. The estimated party guests are 80.

Cathy's Catering will be paid half their fee (Cathy requires the estimate to be the max of 100 people) on March 1, 2021

and the balance will be paid on April 15, 2021.

The banquet hall will be paid in full on March 1, 2021.

What is the budgeted margin of safety in sales dollars? Choose closest answer.

$11,000

$5,000

$8,995

$6,995

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning