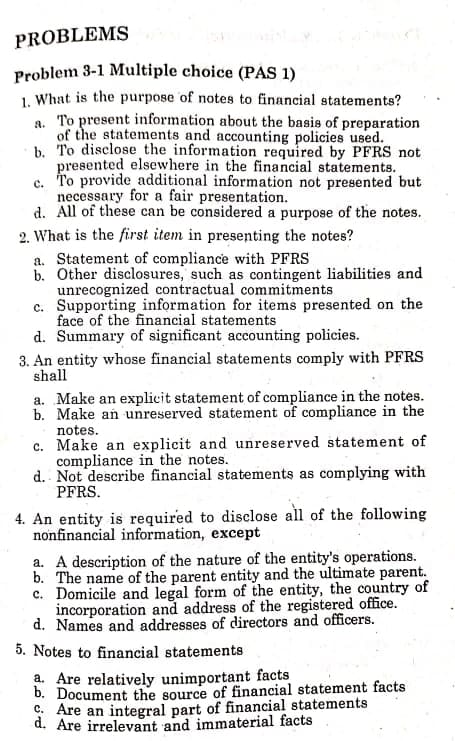

PROBLEMS Problem 3-1 Multiple choice (PÁS 1) 1. What is the purpose of notes to financial statements? a. To present information about the basis of preparation of the statements and accounting policies used. b. To disclose the information required by PFRS not presented elsewhere in the financial statements. c. To provide additional information not presented but necessary for a fair presentation. d. All of these can be considered a purpose of the notes. 2. What is the first item in presenting the notes? a. Statement of compliance with PFRS b. Other disclosures, such as contingent liabilities and unrecognized contractual commitments c. Supporting information for items presented on the face of the financial statements d. Summary of significant accounting policies. 3. An entity whose financial statements comply with PFRS shall a. Make an explicit statement of compliance in the notes. b. Make an unreserved statement of compliance in the notes. c. Make an explicit and unreserved statement of compliance in the notes. d. Not describe financial statements as complying with PFRS. 4. An entity is required to disclose all of the following nonfinancial information, except a. A description of the nature of the entity's operations. b. The name of the parent entity and the ultimate parent. c. Domicile and legal form of the entity, the country of incorporation and address of the registered office. d. Names and addresses of directors and officers. 5. Notes to financial statements a. Are relatively unimportant facts b. Document the source of financial statement facts . Are an integral part of financial statements d. Are irrelevant and immaterial facts

PROBLEMS Problem 3-1 Multiple choice (PÁS 1) 1. What is the purpose of notes to financial statements? a. To present information about the basis of preparation of the statements and accounting policies used. b. To disclose the information required by PFRS not presented elsewhere in the financial statements. c. To provide additional information not presented but necessary for a fair presentation. d. All of these can be considered a purpose of the notes. 2. What is the first item in presenting the notes? a. Statement of compliance with PFRS b. Other disclosures, such as contingent liabilities and unrecognized contractual commitments c. Supporting information for items presented on the face of the financial statements d. Summary of significant accounting policies. 3. An entity whose financial statements comply with PFRS shall a. Make an explicit statement of compliance in the notes. b. Make an unreserved statement of compliance in the notes. c. Make an explicit and unreserved statement of compliance in the notes. d. Not describe financial statements as complying with PFRS. 4. An entity is required to disclose all of the following nonfinancial information, except a. A description of the nature of the entity's operations. b. The name of the parent entity and the ultimate parent. c. Domicile and legal form of the entity, the country of incorporation and address of the registered office. d. Names and addresses of directors and officers. 5. Notes to financial statements a. Are relatively unimportant facts b. Document the source of financial statement facts . Are an integral part of financial statements d. Are irrelevant and immaterial facts

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 36E

Related questions

Question

Transcribed Image Text:PROBLEMS

Problem 3-1 Multiple choice (PÁS 1)

1. What is the purpose of notes to financial statements?

a. To present information about the basis of preparation

of the statements and accounting policies used.

b. To disclose the information required by PFRS not

presented elsewhere in the financial statements.

c. T'o provide additional information not presented but

necessary for a fair presentation.

d. All of these can be considered a purpose of the notes.

2. What is the first item in presenting the notes?

a. Statement of compliance with PFRS

b. Other disclosures, such as contingent liabilities and

unrecognized contractual commitments

c. Supporting information for items presented on the

face of the financial statements

d. Summary of significant accounting policies.

3. An entity whose financial statements comply with PFRS

shall

a. Make an explicit statement of compliance in the notes.

b. Make an unreserved statement of compliance in the

notes.

c. Make an explicit and unreserved statement of

compliance in the notes.

d. Not describe financial statements as complying with

PFRS.

4. An entity is required to disclose all of the following

nonfinancial information, except

a. A description of the nature of the entity's operations.

b. The name of the parent entity and the ultimate parent.

c. Domicile and legal form of the entity, the country of

incorporation and address of the registered office.

d. Names and addresses of directors and officers.

5. Notes to financial statements

a. Are relatively unimportant facts

b. Document the source of financial statement facts

C. Are an integral part of financial statements

d. Are irrelevant and immaterial facts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning