Project 1 50% $120,000 50% -$50,000 Project 2 30% $100,000 40% $50,000 30% -$60,000 Project 3 70% $20,000 30% -$5,000 Project 4 30% $40,000 30% $30,000 20% $20,000 20% -$50,000

Project 1 50% $120,000 50% -$50,000 Project 2 30% $100,000 40% $50,000 30% -$60,000 Project 3 70% $20,000 30% -$5,000 Project 4 30% $40,000 30% $30,000 20% $20,000 20% -$50,000

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 9EP

Related questions

Question

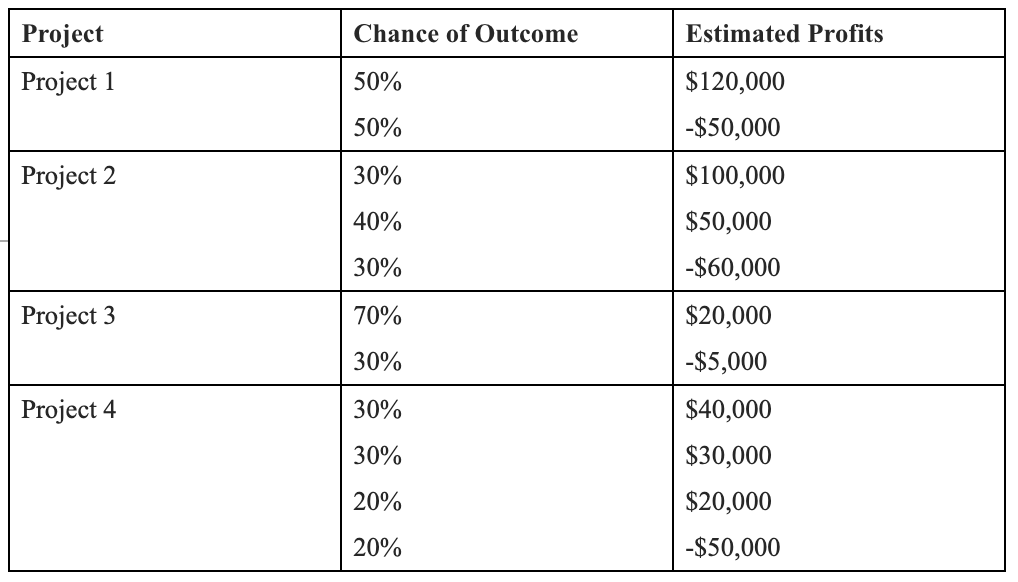

Suppose that your organization is deciding which of four projects to bid on, as summarized in the following table. Assume that all up-front investments are not recovered, so they are shown as negative profits. Draw a diagram and calculate the EMV for each project. Write a few paragraphs explaining which projects you would bid on. Be sure to use the EMV information and your personal risk tolerance to justify your answer.

Transcribed Image Text:Project

Chance of Outcome

Estimated Profits

Project 1

50%

$120,000

50%

-$50,000

Project 2

30%

$100,000

40%

$50,000

30%

-$60,000

Project 3

70%

$20,000

30%

-$5,000

Project 4

30%

$40,000

30%

$30,000

20%

$20,000

20%

-$50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you