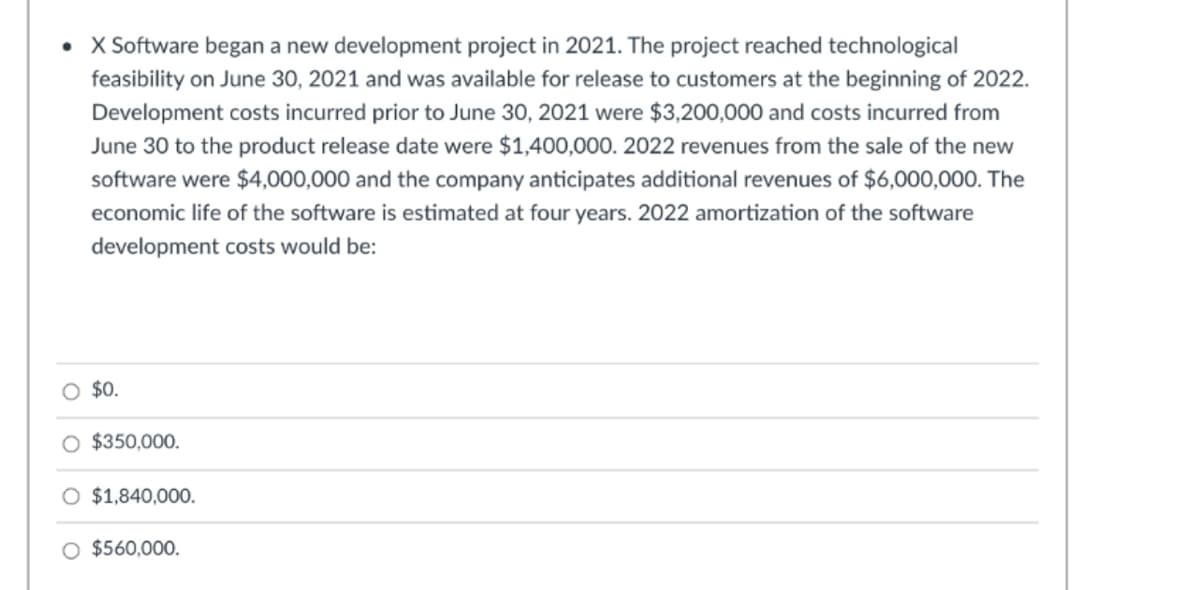

project in 2021. The project re ailable for release to custome ne 30, 2021 were $3,200,000 ere $1,400,000. 2022 revenue npany anticipates additional re ted at four years. 2022 amorti

Q: The Slow company has started the construction of an asset on September 1, 2019 and finished it on…

A: As per the standard accounting practice . all revenue expenses…

Q: On January 1, 2018, Liquid Company accepted a long-term construction project for an initia contract…

A: The financial ratio that demonstrates the link between gross profit and net sales is gross profit…

Q: sets and obligations Plan assets (at fair value) $600,000 Accumulated benefit obligation 1,110,000…

A: Pension expense refers to the amount which the business charges to the expense in relation to the…

Q: During 2020, FAITH Inc constructed assets costing P30,000,000. The weighted-average accumulated…

A: the amount of interest capitalized for 2020 Construction Loan * Rate of borrowing +…

Q: Bebe Co. purchased equipment costing P560,000 on March 5, 2021. How much would be the claimable…

A: Value Added Tax(VAT)-:It is a value-added tax, understood in a few countries as a product and…

Q: On January 1, 2018, Liquid Company accepted a long-term construction project for an ini contract…

A: Revenue earned from state and local taxes imposed on transactions happening during the eligibility…

Q: The Leto Construction Company began work on a $12.000 contract on 1/1/20. Planned completion was in…

A:

Q: In 2020, Sandstorm Corporation incurs $25,000 in research and experimental expenses. Benefits from…

A: 174 - Research and experimental expenditures (a)Treatment as expenses A taxpayer may treat…

Q: In 2021, Cupid Construction Co. (CCC) began work on a two-year fixed price contract project. CCC…

A: The cash that remains to be collected is calculated by deducting the cash received from the contract…

Q: t had an estimated u P60,000 in success g of 2019. the compa: Ee of its original paten

A: The carrying value computation as,

Q: Coronado Corporation had a projected benefit obligation of $2,890,000 and plan assets of $3,097,000…

A: Corridor rule says that losses or gains which exceed 10 % of Higher of Pension benefit obligation…

Q: Bebe Co. purchased equipment with an invoice price of P1,680,000 on March 5, 2021. How much would be…

A: Value Added Tax(VAT)-:It is a value-added tax, understood in a few countries as a product and…

Q: On January 1, 2021, Dreamlover Corporation purchased equipment from Daydream Company for P3,600,000.…

A: Present value refers to the current value of all the cash flows which is to be received in the…

Q: On January 1, 2021, the Montgomery Company agreed to purchase a building by making six payments. The…

A: Cost of building: Annual payment PV Factor at 9% Present Value Year 1 $44,000 0.91743…

Q: Triple Take Construction Co. began construction of a project in 2017 for a contract price of…

A: The question is based on the concept of Accounting Standard on Construction contracts.

Q: Paul Constructions has entered into a contract beginning January 1, 2020, to build a pool. It has…

A: In this question, we have to find out recognized gross profit and CIP.

Q: On June 15, 2018, Sanderson Construction entered into a long-term construction contract to build a…

A: 1. How much revenue and gross profit will Sanderson report in its 2018, 2019, and 2020 income…

Q: on January 1, 2020, Katrina Company obtained a loan of P4,000,000 at anpomt interest rate of 10%…

A: PLEASE LIKE THE ANSWER, YOUR RESPONSE MATTERS Solution Amount P Total borrowing…

Q: Aylmer Inc signed a 3-year contract to construct a new school on January 1, 2020 for $ 10,000,000…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: For the next 3 questions.. What amount should be reported as pretax revaluation surplus on…

A: solution : What amount should be reported as pretax revaluation surplus on December 31, 2019?…

Q: Triple Take Construction Co. began construction of a project in 2017 for a contract price of…

A: The accounting treatment of construction expenses and revenue is guided by the…

Q: ta Company is constructing a production complex that qualifies for interest capitalization. The…

A: The computation of the amount of interest cost capitalized of 2019 and 2020 is shown below:-…

Q: a construction agreement in 2018 for t ct price was P20,000,000 but a change ,000. The percentage of…

A: Given: Profit or loss of construction contract: the foreseeable loss on the construction contract is…

Q: On January 1, 2021, the company obtained a $3 million loan with a 11% interest rate. The building…

A: Total debt =Construction Loan + Value of Long Term Notes=$3,000,000 + $4,200,000 +…

Q: ABC Co. had these loans outstanding for the year 2020: Specific Loan: P1,000,000 at 10% General Loan…

A: Borrowing cost means where the assets like building , take substantial time to build , then interest…

Q: On January 1, 2021, the company obtained a $3 million loan with a 10% interest rate. The building…

A: Here, the calculation of average accumulated expenditure-2021 is shown. The total weighted…

Q: On January 1, 2021, the Montgomery Company agreed to purchase a building by making six payments. The…

A: Answer: Part 1: PV factor for deferred annuity = PVA factor, n = 6, i = 12% - PVA factor, n = 3, i =…

Q: On January 1, 2021, the company obtained a $3 million loan with a 10% interest rate. The building…

A: Weighted average rate of debt = Total Interest Amount / Total Borrowings Amount

Q: On February 5, 2020, Diamond Company purchased a new machine on a deferred payment basis. A down…

A: Fixed assets means the asset which is used by company for many years to come for the purpose of…

Q: On January 31, 2020, Manning Company acquired a new machine by paying $40,000 cash and agreeing to…

A: Present value method is used to evaluate the different level of investment projects. With the help…

Q: MacDonalds Construction Co. was a low bidder on a construction project to build a dam for$1,800,000.…

A: As per construction contracts, Revenues and expenses are recognized on the percentage of completion…

Q: 1. Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the…

A: Given: Loan on Jan 1 2021 = $ 3 million Interest rate = $ 10 % Expenses: January 1, 2021 =…

Q: kit Company borrows $6 million at 12% on January 1, 2019, specifically for the purpose of financing…

A: Given as,

Q: January 1, 2019, A contract with a 6 percent retainage clause was sig ned with Arab Construction…

A: The tracking of costs linked with a specific contractual agreement is known as contract costing. A…

Q: Sandstorm Corporation decides to develop a new line of paints. The project begins in 2018. Sandstorm…

A: Calculation of the amortization expense per month:

Q: Bebe Co. purchased equipment with an invoice price of P1,680,000 on March 5, 2022. How much would be…

A: Value Added Tax(VAT)-:It is a value-added tax, understood in a few countries as a product and…

Q: On January 1, 2022, Charis Company adopted a plan anuary 1, 2026 at an estimated cost of P20,000,000…

A: In this question, we have to find out the annual deposit to the fund.

Q: Triple Take Construction Co. began construction of a project in 2017 for a contract price of…

A: The construction contracts are long-term contracts that means it is completely performed in…

Q: The 12/31/24 CIP balance is:

A: Percentage of completion method is the method which is used by the company which deals with the…

Q: MacDonalds Construction Co. was a low bidder on a construction project to build a dam for…

A:

Q: On January 1, 2018, the Montgomery Company agreed to purchase a building by making six payments. The…

A: 1)

Q: As of December 31, 2020, Andrei Corporation has P 5,000,000 contract in progress on which the…

A: Percentage completion method uses the percentage of work that has completed. So, the income is…

Q: How much is the cost of constructed building on December 31, 2020?

A: Loans are provided by various financial institutes such that any business can expand or perform…

Q: On January 1, 2021, the company obtained a $3 million loan with a 12% interest rate. The building…

A: a. The amount of interest that Mason should capitalize in 2021 and 2022 using the weighted-average…

Q: Road Ltd started construction of equipment, a qualifying asset in terms of IAS23 Borrowing costs,…

A: Management determines the amount of borrowing costs eligible for capitalisation by applying a…

Q: GinebraCorporation recognizes construction revenue and cost using the percentage of completion…

A: The percentage of completion technique seems to be a revenue recognition accounting technique that…

Q: 8. How much is the Gross Profit/Loss Realized in 2018? Taiple Take Construction Co. began…

A: ‘’Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: ABC Co. had these loans outstanding for the year 2020: Specific Loan: P1,000,000 at 10% General Loan…

A: The expenditures incurred by ABC Company are calculated as per the weighted average method and…

Q: Alta Company is constructing a production complex that qualifies for interest capitalization. The…

A:

Q: Record the amount of amortization of capitalized computer development software costs for 2020.

A:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- On March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for 7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of 600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by 150,000. Elkhart provides the following completion schedule: Required: 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price? 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price? 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?Micropolis Technology began a new development project in 2020. The project reached technological feasibility on September 1, 2021, and was available for release to customers at the beginning of 2022. Development costs incurred prior to September 1, 2021, were $4,560,000, and costs incurred from June 30 to the product release date were $1,920,000. The 2022 revenues from the sale of the new software were $3,950,000, and the company anticipates additional revenues of $11,850,000. The economic life of the software is estimated at three years. Amortization of the software development costs for the year 2022 would be:A company began a new software development project in 2023. The project reached technological feasibility on June 30, 2024, and was available for release to customers at the beginning of 2025. Development costs incurred prior to June 30, 2024, were $3,260,000 and costs incurred from June 30, 2024, to the product release date were $1,460,000. The economic life of the software is estimated at four years. For what amount will software be capitalized in 2024?

- Early in 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $6 million. Of this amount, $4 million was spent before technological feasibility was established. Excalibur expects a useful life of five years for the new product with total revenues of $10 million. During 2022, revenue of $3 million was recognized.Required:Prepare a journal entry to record the 2021 development costs.[2] In May 2021, Oliver Queen Company began work on a project that has a contact price of P5,000,000. Any costs incurred are expected to be recoverable. Progress billing, collections are of equal amount with costs incurred. 2021 2022 Cost incurred to date 1,125,000 3,825,000 Estimated cost to complete 3,375,000 1,275,000 Total estimated cost 4,500,000 5,100,000 In its income statement for the year 2022, the company would recognize a gross profit of (1) under percentage of completion method; (2) under cost recovery method: 225,000; (75,000) (200,000); zero (225,000); (100,000) (225,000); zeroDuring 2019, Latte Inc., spent P5,000,000 developing its new "Hyperion" software package. Of this amount, P2,200,000 was spent before technological feasibility was established for the product, which is to be marketed to third parties. The package was completed at December 31, 2019. Latte expects a useful life of 8 years for this product with total revenues of P16,000,000. During the first year (2020), Latte realizes revenues of P3,200,000 a. What journal entries should have been prepared by the accountant in 2019 for the foregoing facts? b. Prepare the entry to record amortization at December 31, 2020

- In 2020, Lalli Corporation incurred R&D costs as follows:Materials and equipment P100,000Personnel 100,000Indirect costs 50,000P250,000These cost relate to a product that will be marketed in 2021. The Company estimates that these costs will be recouped by December 31, 2024.Required What is the amount of R&D costs expense in 2020? Show the solution step by stepOn August 1, 2021, Reliable Software began developing a software program to allow individuals to customize their investment portfolios. Technological feasibility was established on January 31, 2022, and the program was available for release on March 31, 2022. Development costs were incurred as follows: August 1 through December 31, 2021 $ 6,400,000 January 1 through January 31, 2022 1,210,000 February 1 through March 31, 2022 1,610,000 Reliable expects a useful life of five years for the software and total revenues of $8,100,000 during that time. During 2022, revenue of $2,106,000 was recognized. Required:Prepare the journal entries to record the development costs in 2021 and 2022.A price company from time to time embarks on a research program when a special project seems to offer possibilities in 2019 the company expands $325,000 on a research project, but by the end of 2019, it is possible to determine whether any benefits will be driven from it. What account should be charged from 325,000 and how should be shown in the financial statement? Additional engineering and consulting costs incurred in 2021 are required to advance the design of the project in the manufacturing stage. Total $60,000. These costs enhance the design of the product considerably. Discuss the proper account treatment for this cost.

- Sandstorm Corporation decides to develop a new line of paints. The project begins in 2023. Sandstorm incurs the following expenses in 2023 in connection with the project: Salaries $170,000 Materials 51,000 Depreciation on equipment 25,500 The benefits from the project were realized starting in July 2024. If an amount is zero, enter "0". What are Sand-storm’s related deductions in 2023 and 2024 in connection with the project?Suneilert Construction Company had a contract starting April 2021, to construct a P15,000,000 building that is expected to be completed in September 2022, at an estimated cost of P13,750,000. At the end of 2021, the costs to date were P6,325,000 and the estimated total costs to complete had not changed. The progress billings during 2021 were P3,000,000 and the cash collected during 2021 was P2,000,000. Suneilert uses the percentage-of-completion method.For the year ended December 31, 2021, Suneilert would recognize gross profit on the building of?During 2024, a software company incurred development costs of $2,000,000 related to a new software project. Of this amount, $400,000 was incurred after technological feasibility was achieved. The project was completed in the middle of the year and the product was available for release to customers on July 1. Revenues from the sale of the new software in 2024 were $500,000 and the company anticipated future additional revenues of $4,500,000. The economic life of the software is estimated at four years. What is amortization in 2024?