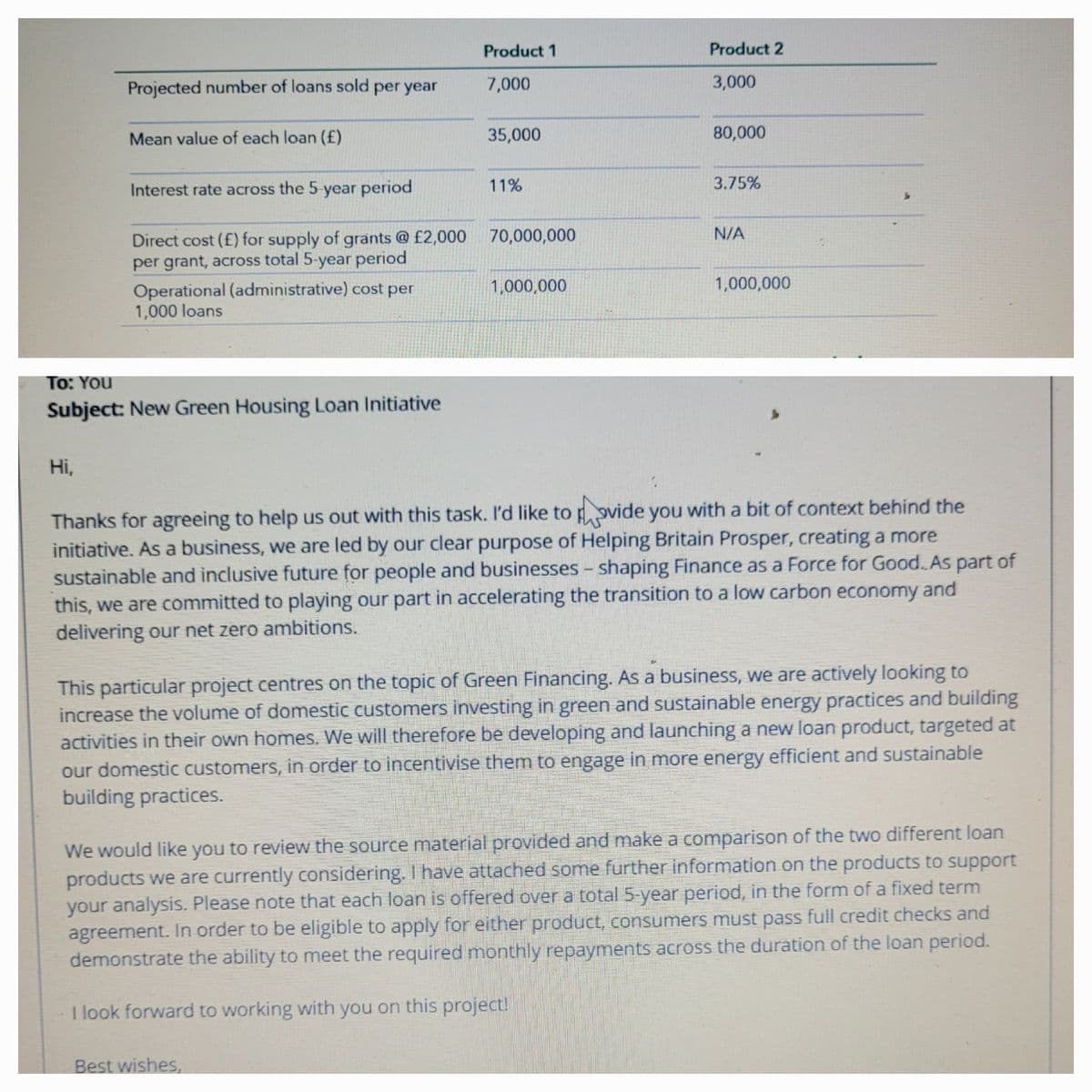

Projected number of loans sold per year Hi, Mean value of each loan (£) Interest rate across the 5-year period To: You Subject: New Green Housing Loan Initiative Product 1 7,000 35,000 Direct cost (£) for supply of grants @£2,000 70,000,000 per grant, across total 5-year period Operational (administrative) cost per 1,000 loans 11% Best wishes, 1,000,000 Product 2 3,000 80,000 3.75% N/A 1,000,000 Thanks for agreeing to help us out with this task. I'd like to povide you with a bit of context behind the initiative. As a business, we are led by our clear purpose of Helping Britain Prosper, creating a more sustainable and inclusive future for people and businesses - shaping Finance as a Force for Good. As part of this, we are committed to playing our part in accelerating the transition to a low carbon economy and delivering our net zero ambitions. This particular project centres on the topic of Green Financing. As a business, we are actively looking to increase the volume of domestic customers investing in green and sustainable energy practices and building activities in their own homes. We will therefore be developing and launching a new loan product, targeted at our domestic customers, in order to incentivise them to engage in more energy efficient and sustainable building practices. We would like you to review the source material provided and make a comparison of the two different loan products we are currently considering. I have attached some further information on the products to support your analysis. Please note that each loan is offered over a total 5-year period, in the form of a fixed term agreement. In order to be eligible to apply for either product, consumers must pass full credit checks and demonstrate the ability to meet the required monthly repayments across the duration of the loan period. I look forward to working with you on this project!

Projected number of loans sold per year Hi, Mean value of each loan (£) Interest rate across the 5-year period To: You Subject: New Green Housing Loan Initiative Product 1 7,000 35,000 Direct cost (£) for supply of grants @£2,000 70,000,000 per grant, across total 5-year period Operational (administrative) cost per 1,000 loans 11% Best wishes, 1,000,000 Product 2 3,000 80,000 3.75% N/A 1,000,000 Thanks for agreeing to help us out with this task. I'd like to povide you with a bit of context behind the initiative. As a business, we are led by our clear purpose of Helping Britain Prosper, creating a more sustainable and inclusive future for people and businesses - shaping Finance as a Force for Good. As part of this, we are committed to playing our part in accelerating the transition to a low carbon economy and delivering our net zero ambitions. This particular project centres on the topic of Green Financing. As a business, we are actively looking to increase the volume of domestic customers investing in green and sustainable energy practices and building activities in their own homes. We will therefore be developing and launching a new loan product, targeted at our domestic customers, in order to incentivise them to engage in more energy efficient and sustainable building practices. We would like you to review the source material provided and make a comparison of the two different loan products we are currently considering. I have attached some further information on the products to support your analysis. Please note that each loan is offered over a total 5-year period, in the form of a fixed term agreement. In order to be eligible to apply for either product, consumers must pass full credit checks and demonstrate the ability to meet the required monthly repayments across the duration of the loan period. I look forward to working with you on this project!

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 19E

Related questions

Question

Which loan you would recommend llyods to take forward and why? Please read the email before you give answer to the question.

Transcribed Image Text:Projected number of loans sold per year

Hi,

Mean value of each loan (£)

Interest rate across the 5-year period

To: You

Subject: New Green Housing Loan Initiative

Product 1

7,000

35,000

Direct cost (£) for supply of grants @£2,000 70,000,000

per grant, across total 5-year period

Operational (administrative) cost per

1,000 loans

11%

Best wishes,

1,000,000

Product 2

3,000

80,000

3.75%

N/A

1,000,000

Thanks for agreeing to help us out with this task. I'd like to povide you with a bit of context behind the

initiative. As a business, we are led by our clear purpose of Helping Britain Prosper, creating a more

sustainable and inclusive future for people and businesses - shaping Finance as a Force for Good. As part of

this, we are committed to playing our part in accelerating the transition to a low carbon economy and

delivering our net zero ambitions.

This particular project centres on the topic of Green Financing. As a business, we are actively looking to

increase the volume of domestic customers investing in green and sustainable energy practices and building

activities in their own homes. We will therefore be developing and launching a new loan product, targeted at

our domestic customers, in order to incentivise them to engage in more energy efficient and sustainable

building practices.

We would like you to review the source material provided and make a comparison of the two different loan

products we are currently considering. I have attached some further information on the products to support

your analysis. Please note that each loan is offered over a total 5-year period, in the form of a fixed term

agreement. In order to be eligible to apply for either product, consumers must pass full credit checks and

demonstrate the ability to meet the required monthly repayments across the duration of the loan period.

I look forward to working with you on this project!

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College