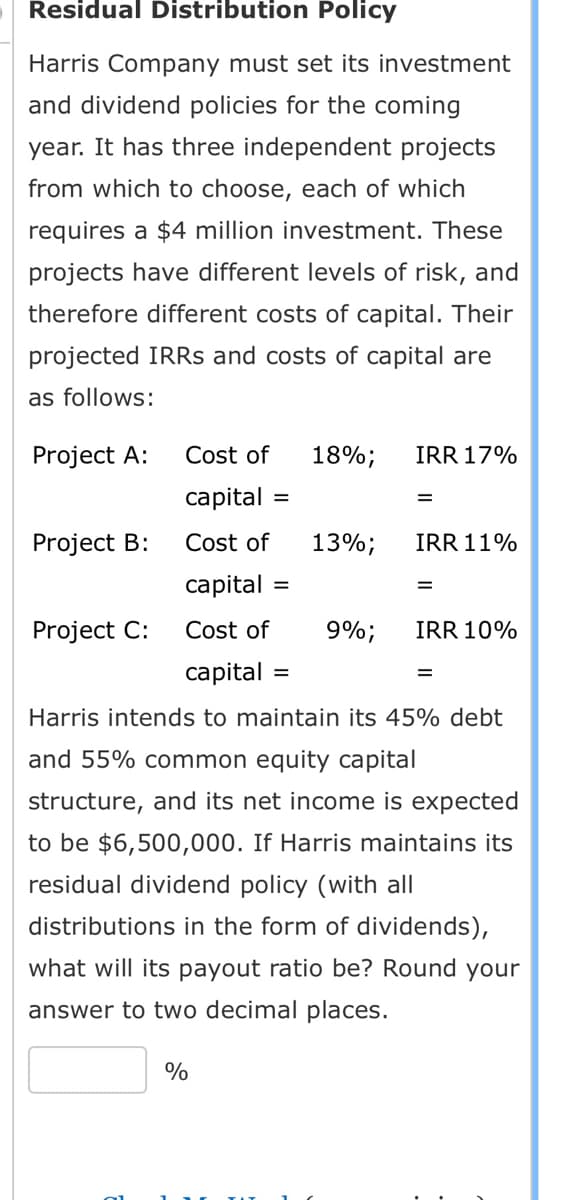

projects Harris Company must set its investment and dividend policies for the coming year. It has three independent from which to choose, each of which requires a $4 million investment. These projects have different levels of risk, and therefore different costs of capital. Their projected IRRs and costs of capital are

projects Harris Company must set its investment and dividend policies for the coming year. It has three independent from which to choose, each of which requires a $4 million investment. These projects have different levels of risk, and therefore different costs of capital. Their projected IRRs and costs of capital are

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter15: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 9P: Residual Distribution Policy Harris Company must set its investment and dividend policies for the...

Related questions

Question

Transcribed Image Text:Residual Distribution Policy

projects

Harris Company must set its investment

and dividend policies for the coming

year. It has three independent

from which to choose, each of which

requires a $4 million investment. These

projects have different levels of risk, and

therefore different costs of capital. Their

projected IRRs and costs of capital are

as follows:

Cost of

capital =

Cost of

capital

Cost of

capital =

Harris intends to maintain its 45% debt

and 55% common equity capital

structure, and its net income is expected

to be $6,500,000. If Harris maintains its

residual dividend policy (with all

distributions in the form of dividends),

what will its payout ratio be? Round your

answer to two decimal places.

Project A:

Project B:

Project C:

%

18%;

=

13%;

9%;

IRR 17%

=

IRR 11%

=

IRR 10%

=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning