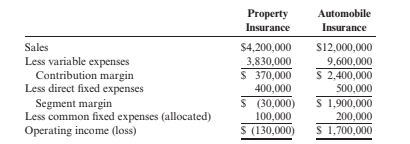

Property Automobile Insurance Insurance Sales $4,200,000 S12,000,000 Less variable expenses Contribution margin Less direct fixed expenses Segment margin Less common fixed expenses (allocated) Operating income (loss) 3,830,000 9,600,000 S 370,000 S 2,400,000 500,000 400,000 $ ( 30,000) 100,000 S 1,900,000 200,000 S 1,700,000 $ (130,000)

Devern Assurance Company provides both property and automobile insurance. The

income statements

The president of the company is considering dropping the property insurance. However, some

policyholders prefer having their property and automobile insurance with the same company, so

if property insurance is dropped, sales of automobile insurance will drop by 12 percent. No sig-

nificant non-unit-level activity costs are incurred.

Required:

1. If Devern Assurance Company drops property insurance, by how much will income increase

or decrease? Provide supporting computations.

2. Assume that dropping all advertising for the property insurance line and increasing the cor-

porate advertising budget by $450,000 will increase sales of property insurance by 10 percent and automobile insurance by 8 percent. Prepare a segmented income statement that reflects

the effect of increased advertising. Should advertising be increased?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images