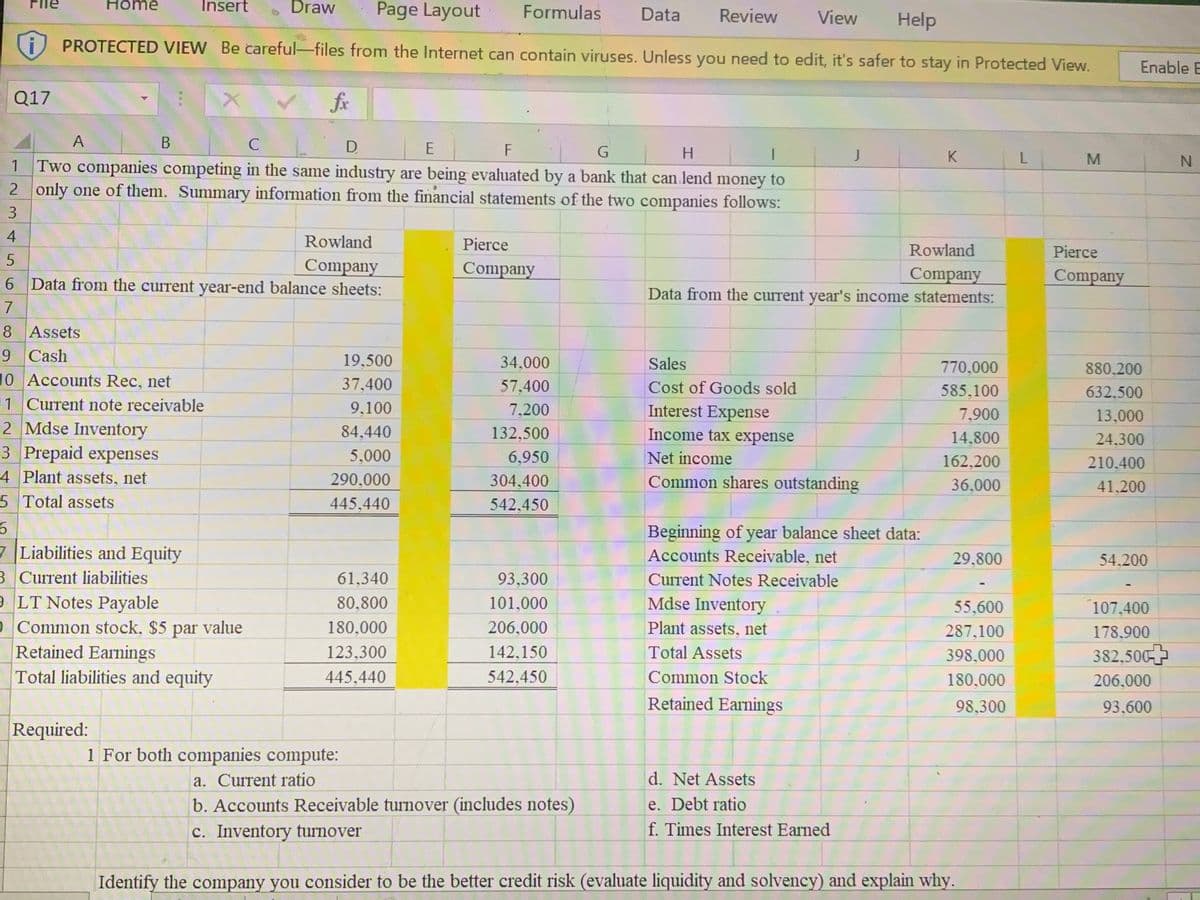

PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Q17 fx C E 1 Two companies competing in the same industry are being evaluated by a bank that can lend money to 2 only one of them. Summary information from the financial statements of the two companies follows: G H. K M Rowland Pierce Rowland Pierce Company Data from the current year-end balance sheets: Company Company Data from the current year's income statements: Company Assets Cash 19.500 34,000 Sales 770,000 880.200 Accounts Rec, net 37,400 57,400 Cost of Goods sold 585.100 632.500 Current note receivable Mdse Inventory Prepaid expenses 9.100 7,200 Interest Expense Income tax expense 7.900 13,000 84,440 132,500 14,800 24.300 5,000 6,950 Net income 162,200 210,400 Plant assets, net 290.000 Common shares outstanding 304,400 36,000 41,200 Total assets 445.440 542,450 Beginning of year balance sheet data: Accounts Receivable, net Liabilities and Equity 29.800 54.200 Current liabilities 61,340 93,300 Current Notes Receivable LT Notes Payable 80.800 101.000 Mdse Inventory 55,600 107.400 Common stock, $5 par value 180,000 206.000 Plant assets, net 287.100 178,900 Retained Earnings Total liabilities and equity 123,300 142,150 Total Assets 398,000 382,500 445.440 542,450 Common Stock 180,000 206.000 Retained Earnings 98,300 93,600 Required: 1 For both companies compute: a. Current ratio d. Net Assets b. Accounts Receivable turnover (includes notes) e. Debt ratio c. Inventory turnover f. Times Interest Earned

PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Q17 fx C E 1 Two companies competing in the same industry are being evaluated by a bank that can lend money to 2 only one of them. Summary information from the financial statements of the two companies follows: G H. K M Rowland Pierce Rowland Pierce Company Data from the current year-end balance sheets: Company Company Data from the current year's income statements: Company Assets Cash 19.500 34,000 Sales 770,000 880.200 Accounts Rec, net 37,400 57,400 Cost of Goods sold 585.100 632.500 Current note receivable Mdse Inventory Prepaid expenses 9.100 7,200 Interest Expense Income tax expense 7.900 13,000 84,440 132,500 14,800 24.300 5,000 6,950 Net income 162,200 210,400 Plant assets, net 290.000 Common shares outstanding 304,400 36,000 41,200 Total assets 445.440 542,450 Beginning of year balance sheet data: Accounts Receivable, net Liabilities and Equity 29.800 54.200 Current liabilities 61,340 93,300 Current Notes Receivable LT Notes Payable 80.800 101.000 Mdse Inventory 55,600 107.400 Common stock, $5 par value 180,000 206.000 Plant assets, net 287.100 178,900 Retained Earnings Total liabilities and equity 123,300 142,150 Total Assets 398,000 382,500 445.440 542,450 Common Stock 180,000 206.000 Retained Earnings 98,300 93,600 Required: 1 For both companies compute: a. Current ratio d. Net Assets b. Accounts Receivable turnover (includes notes) e. Debt ratio c. Inventory turnover f. Times Interest Earned

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter24: Recording International And Internet Sales

Section: Chapter Questions

Problem 1CS

Related questions

Question

100%

Transcribed Image Text:Home

Insert

Draw

Page Layout

Formulas

Data

Review

View

Help

PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View.

Enable E

Q17

fix

A

C

F

H.

K

Two companies competing in the same industry are being evaluated by a bank that can lend money to

2 only one of them. Summary information from the financial statements of the two companies follows:

1

3.

4.

Rowland

Pierce

Rowland

Pierce

Company

6 Data from the current year-end balance sheets:

Company

Company

Data from the current year's income statements:

Company

7

8 Assets

9 Cash

10 Accounts Rec, net

19,500

34,000

Sales

770,000

880.200

37,400

57,400

Cost of Goods sold

585,100

632.500

11 Current note receivable

2 Mdse Inventory

3 Prepaid expenses

4 Plant assets, net

9,100

7,200

Interest Expense

7,900

13,000

84,440

132,500

Income tax expense

14,800

24.300

5,000

6,950

Net income

162,200

210,400

290,000

304,400

Common shares outstanding

36,000

41,200

5 Total assets

445,440

542,450

Beginning of year balance sheet data:

7Liabilities and Equity

3 Current liabilities

9LT Notes Payable

O Common stock, $5 par value

Retained Earnings

Total liabilities and equity

Accounts Receivable, net

29,800

54,200

61,340

93,300

Current Notes Receivable

80,800

101,000

Mdse Inventory

55,600

107,400

180,000

206,000

Plant assets, net

287,100

178,900

123,300

142,150

Total Assets

398,000

382,500

445,440

542,450

Common Stock

180,000

206,000

Retained Earnings

98,300

93,600

Required:

1 For both companies compute:

a. Current ratio

d. Net Assets

b. Accounts Receivable turnover (includes notes)

e. Debt ratio

c. Inventory turnover

f. Times Interest Earned

Identify the company you consider to be the better credit risk (evaluate liquidity and solvency) and explain why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage