Provide the 2020 adjusting journal entry (both accounts and amounts) that Newell Brands made to record depreciation on its Property and Equipment. Assume that Newell Brands makes one adjusting journal entry for depreciation expense at the end of each fiscal year as part of its adjusting entries

Provide the 2020 adjusting journal entry (both accounts and amounts) that Newell Brands made to record depreciation on its Property and Equipment. Assume that Newell Brands makes one adjusting journal entry for depreciation expense at the end of each fiscal year as part of its adjusting entries

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 1TIF: Ethics in Action You are the Cookie division controller for Auntie Ms Baked Goods Company. Auntie M...

Related questions

Question

100%

Provide the 2020 adjusting

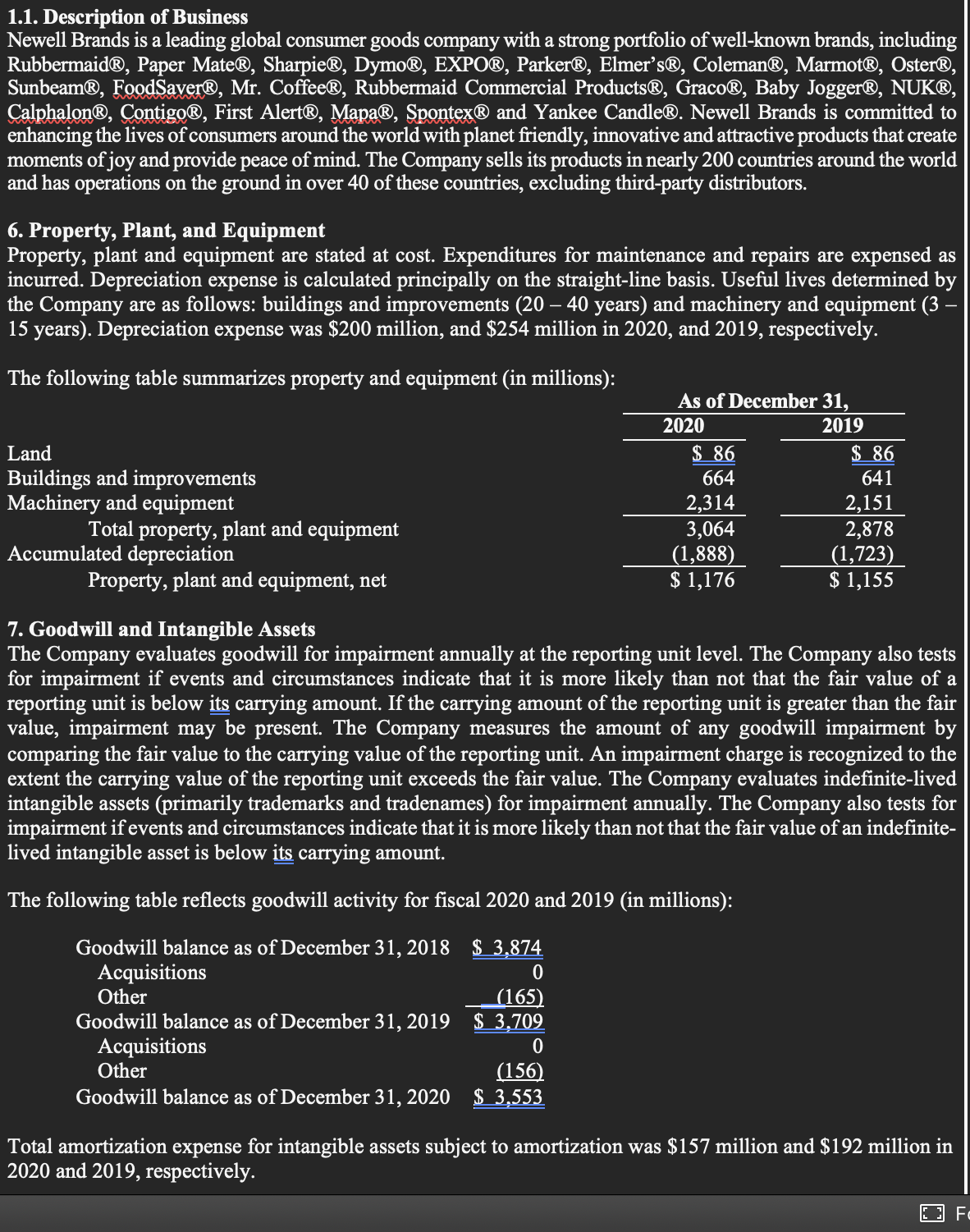

Transcribed Image Text:1.1. Description of Business

Newell Brands is a leading global consumer goods company with a strong portfolio of well-known brands, including

Rubbermaid®, Paper Mate®, Sharpie®, Dymo®, EXPO®, Parker®, Elmer’s®, Coleman®, Marmot®, Oster®,

Sunbeam®, FoodSaver®, Mr. Coffee®, Rubbermaid Commercial Products®, Graco®, Baby Jogger®, NUK®,

Calphalon®, Contigo®, First Alert®, Mapa®, Spontex® and Yankee Candle®. Newell Brands is committed to

enhancing the lives of consumers around the world with planet friendly, innovative and attractive products that create

moments of joy and provide peace of mind. The Company sells its products in nearly 200 countries around the world

and has operations on the ground in over 40 of these countries, excluding third-party distributors.

6. Property, Plant, and Equipment

Property, plant and equipment are stated at cost. Expenditures for maintenance and repairs are expensed as

incurred. Depreciation expense is calculated principally on the straight-line basis. Useful lives determined by

the Company are as follows: buildings and improvements (20 – 40 years) and machinery and equipment (3 -

15 years). Depreciation expense was $200 million, and $254 million in 2020, and 2019, respectively.

The following table summarizes property and equ

nent (in

As of December 31,

2020

2019

Land

$ 86

$ 86

Buildings and improvements

Machinery and equipment

664

641

2,314

3,064

|(1,888)

$ 1,176

2,151

2,878

|(1,723)

$ 1,155

Total property, plant and equipment

Accumulated depreciation

Property, plant and equipment, net

7. Goodwill and Intangible Assets

The Company evaluates goodwill for impairment annually at the reporting unit level. The Company also tests

for impairment if events and circumstances indicate that it is more likely than not that the fair value of a

reporting unit is below its carrying amount. If the carrying amount of the reporting unit is greater than the fair

value, impairment may be present. The Company measures the amount of any goodwill impairment by

comparing the fair value to the carrying value of the reporting unit. An impairment charge is recognized to the

extent the carrying value of the reporting unit exceeds the fair value. The Company evaluates indefinite-lived

intangible assets (primarily trademarks and tradenames) for impairment annually. The Company also tests for

impairment if events and circumstances indicate that it is more likely than not that the fair value of an indefinite-

lived intangible asset is below its carrying amount.

The following table reflects goodwill activity for fiscal 2020 and 2019 (in millions):

Goodwill balance as of December 31, 2018 $ 3,874

Acquisitions

Other

Goodwill balance as of December 31, 2019 $ 3,709

Acquisitions

Other

(165)

(156)

Goodwill balance as of December 31, 2020 $ 3,553

Total amortization expense for intangible assets subject to amortization was $157 million and $192 million in

2020 and 2019, respectively.

Fo

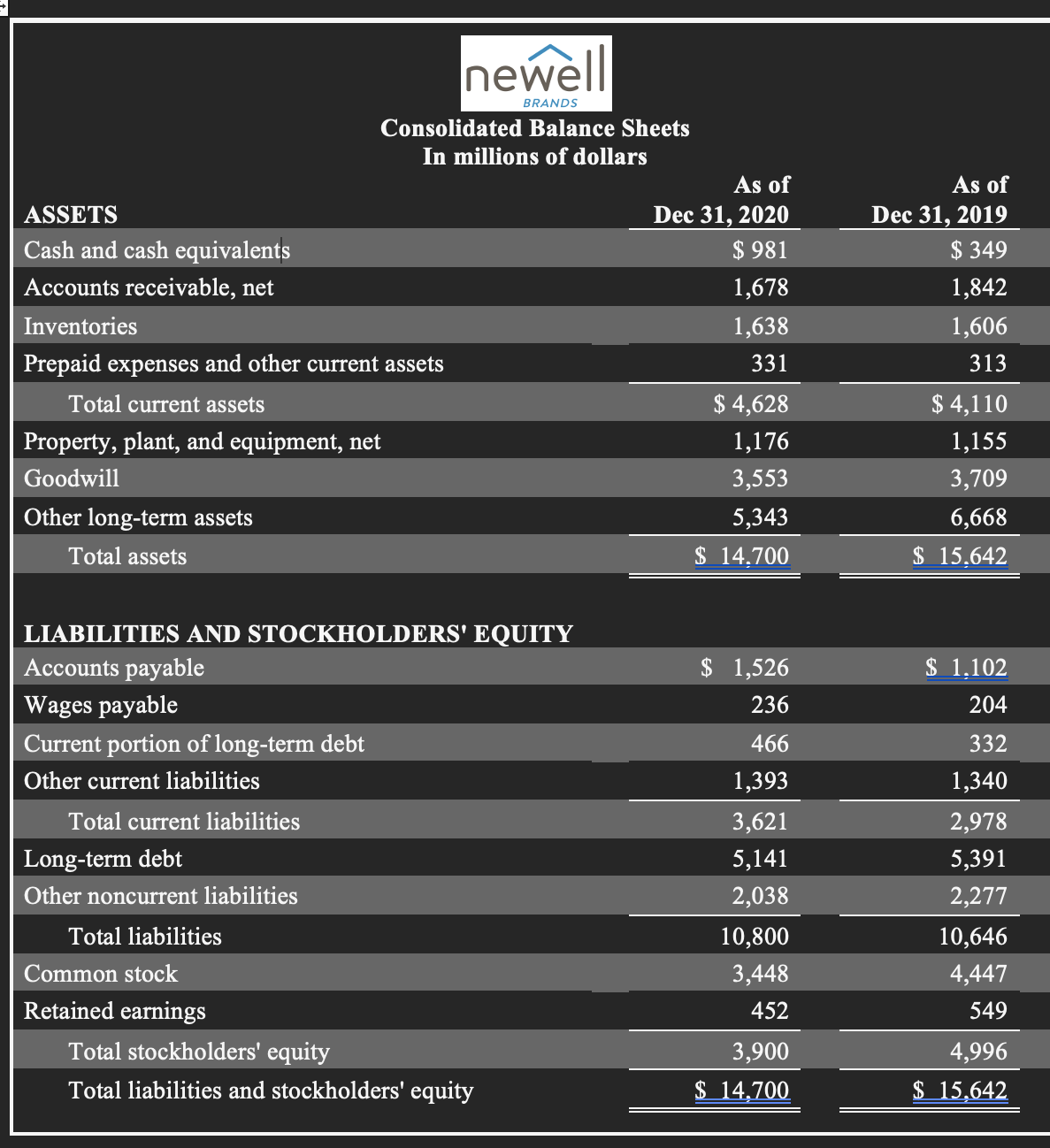

Transcribed Image Text:newell

BRANDS

Consolidated Balance Sheets

In millions of dollars

As of

As of

ASSETS

Dec 31, 2020

Dec 31, 2019

Cash and cash equivalents

$ 981

$ 349

Accounts receivable, net

1,678

1,842

Inventories

1,638

1,606

Prepaid expenses and other current assets

331

313

Total current assets

$ 4,628

$ 4,110

Property, plant, and equipment, net

1,176

1,155

Goodwill

3,553

3,709

Other long-term assets

5,343

6,668

Total assets

$ 14,700

$ 15,642

LIABILITIES AND STOCKHOLDERS' EQUITY

Accounts payable

$ 1,526

$ 1,102

Wages payable

236

204

Current portion of long-term debt

466

332

Other current liabilities

1,393

1,340

Total current liabilities

3,621

2,978

Long-term debt

5,141

5,391

Other noncurrent liabilities

2,038

2,277

Total liabilities

10,800

10,646

Common stock

3,448

4,447

Retained earnings

452

549

Total stockholders' equity

3,900

4,996

Total liabilities and stockholders' equity

$ 14,700

$ 15,642

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning