provision of GST advice 620 tax penalty imposed by the ATO for lodging his 2021 tax return late 230 general interest charge (GIC) imposed by the ATO for late payment 62 attendance at a tax audit by the tax agent involving a dispute with the ATO 1,800 What amount is deductible to Joe under Section 25-5 of the ITAA (1997) ?

provision of GST advice 620 tax penalty imposed by the ATO for lodging his 2021 tax return late 230 general interest charge (GIC) imposed by the ATO for late payment 62 attendance at a tax audit by the tax agent involving a dispute with the ATO 1,800 What amount is deductible to Joe under Section 25-5 of the ITAA (1997) ?

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 47P: How do the all events and economic performance requirements apply to the following transactions by...

Related questions

Question

Plz help me

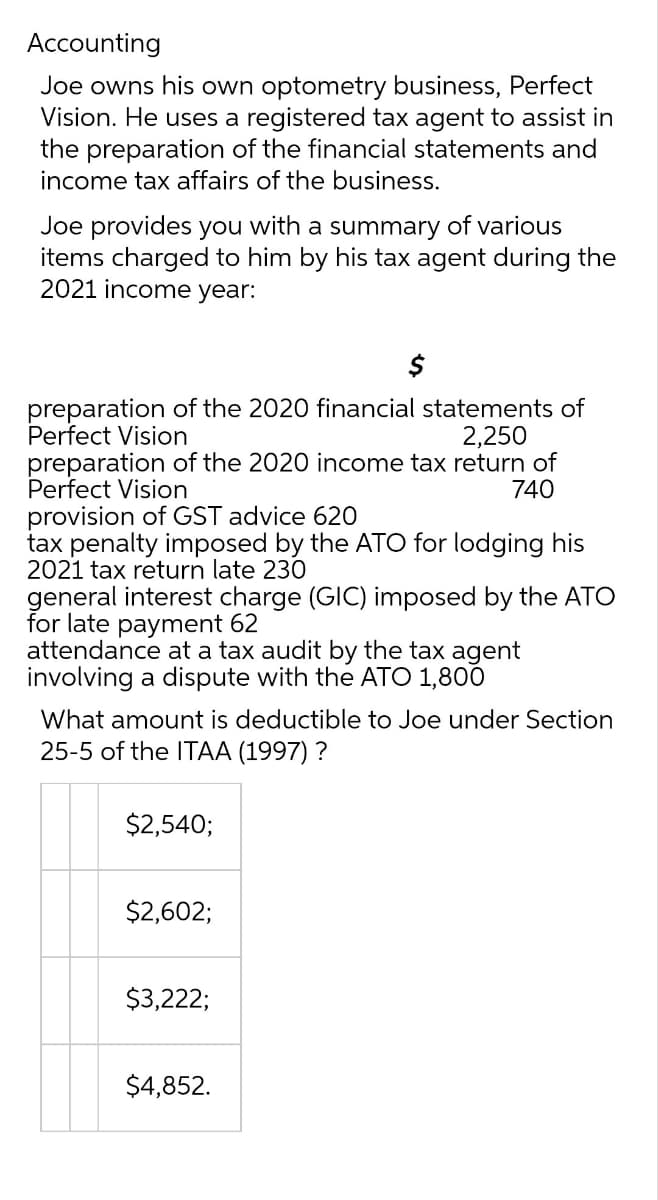

Transcribed Image Text:Accounting

Joe owns his own optometry business, Perfect

Vision. He uses a registered tax agent to assist in

the preparation of the financial statements and

income tax affairs of the business.

Joe provides you with a summary of various

items charged to him by his tax agent during the

2021 income year:

preparation of the 2020 financial statements of

Perfect Vision

2,250

preparation of the 2020 income tax return of

Perfect Vision

740

provision of GST advice 620

tax penalty imposed by the ATO for lodging his

2021 tax return late 230

general interest charge (GIC) imposed by the ATO

for late payment 62

attendance at a tax audit by the tax agent

involving a dispute with the ATO 1,800

What amount is deductible to Joe under Section

25-5 of the ITAA (1997) ?

$2,540;

$2,602;

$3,222;

$4,852.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT