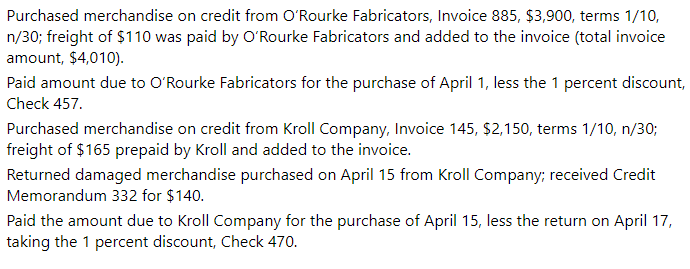

Purchased merchandise on credit from O'Rourke Fabricators, Invoice 885, $3,900, terms 1/10, n/30; freight of $110 was paid by O'Rourke Fabricators and added to the invoice (total invoice amount, $4,010). Paid amount due to O'Rourke Fabricators for the purchase of April 1, less the 1 percent discount Check 457. Purchased merchandise on credit from Kroll Company, Invoice 145, $2,150, terms 1/10, n/30; freight of $165 prepaid by Kroll and added to the invoice. Returned damaged merchandise purchased on April 15 from Kroll Company; received Credit Memorandum 332 for $140. Paid the amount due to Kroll Company for the purchase of April 15, less the return on April 17, taking the 1 percent discount, Check 470.

Purchased merchandise on credit from O'Rourke Fabricators, Invoice 885, $3,900, terms 1/10, n/30; freight of $110 was paid by O'Rourke Fabricators and added to the invoice (total invoice amount, $4,010). Paid amount due to O'Rourke Fabricators for the purchase of April 1, less the 1 percent discount Check 457. Purchased merchandise on credit from Kroll Company, Invoice 145, $2,150, terms 1/10, n/30; freight of $165 prepaid by Kroll and added to the invoice. Returned damaged merchandise purchased on April 15 from Kroll Company; received Credit Memorandum 332 for $140. Paid the amount due to Kroll Company for the purchase of April 15, less the return on April 17, taking the 1 percent discount, Check 470.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter4: Accounting For Retail Operations

Section: Chapter Questions

Problem 4.1P: Purchase-related transactions The following selected transactions were completed by Epic Co. during...

Related questions

Question

100%

Transcribed Image Text:Purchased merchandise on credit from O'Rourke Fabricators, Invoice 885, $3,900, terms 1/10,

n/30; freight of $110 was paid by O'ʻRourke Fabricators and added to the invoice (total invoice

amount, $4,010).

Paid amount due to O'Rourke Fabricators for the purchase of April 1, less the 1 percent discount,

Check 457.

Purchased merchandise on credit from Kroll Company, Invoice 145, $2,150, terms 1/10, n/30;

freight of $165 prepaid by Kroll and added to the invoice.

Returned damaged merchandise purchased on April 15 from Kroll Company; received Credit

Memorandum 332 for $140.

Paid the amount due to Kroll Company for the purchase of April 15, less the return on April 17,

taking the 1 percent discount, Check 470.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub