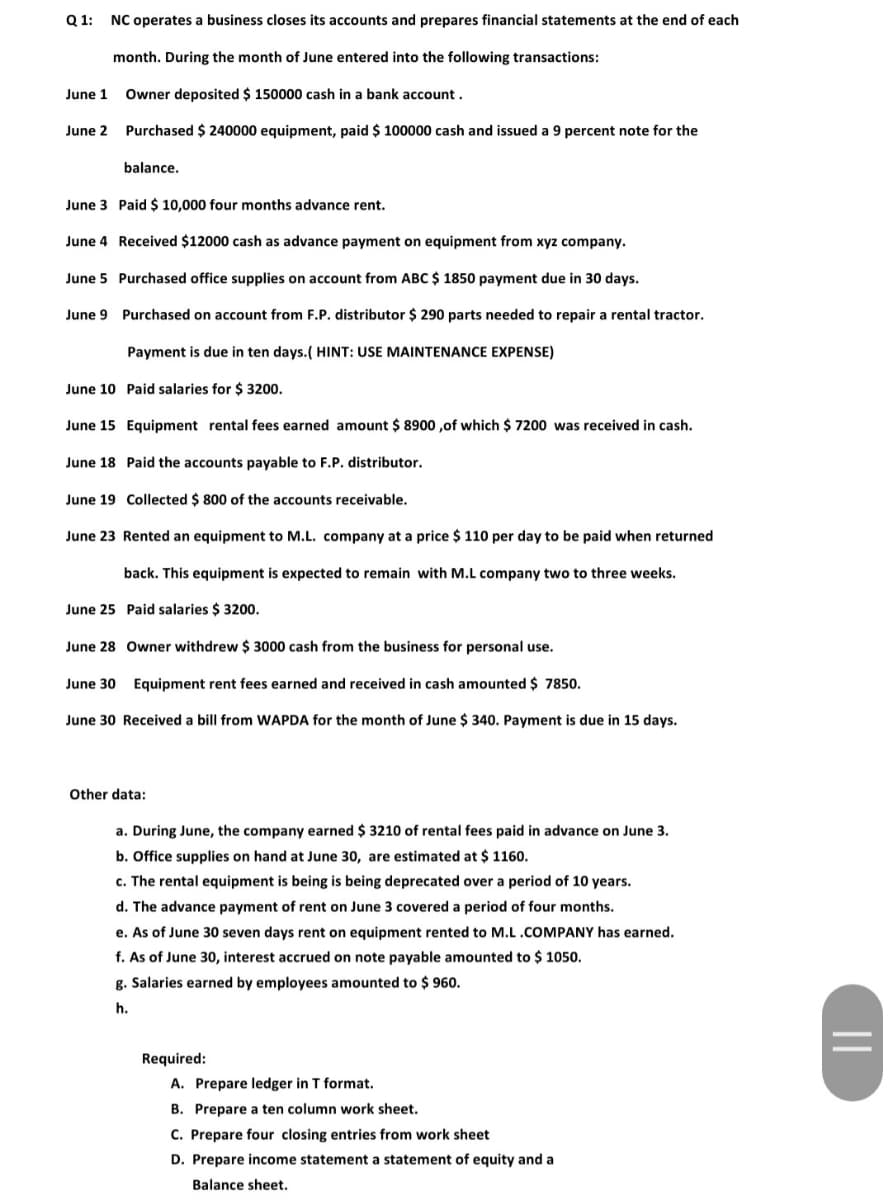

Q 1: NC operates a business closes its accounts and prepares financial statements at the end of each month. During the month of June entered into the following transactions: June 1 Owner deposited $ 150000 cash in a bank account. June 2 Purchased $ 240000 equipment, paid $ 100000 cash and issued a 9 percent note for the balance. June 3 Paid $ 10,000 four months advance rent. June 4 Received $12000 cash as advance payment on equipment from xyz company. June 5 Purchased office supplies on account from ABC $ 1850 payment due in 30 days. June 9 Purchased on account from F.P. distributor $ 290 parts needed to repair a rental tractor. Payment is due in ten days.( HINT: USE MAINTENANCE EXPENSE) June 10 Paid salaries for $ 3200. June 15 Equipment rental fees earned amount $ 8900 ,of which $ 7200 was received in cash. June 18 Paid the accounts payable to F.P. distributor. June 19 Collected $ 800 of the accounts receivable. June 23 Rented an equipment to M.L. company at a price $ 110 per day to be paid when returned back. This equipment is expected to remain with M.L company two to three weeks. June 25 Paid salaries $ 3200. June 28 Owner withdrew $ 3000 cash from the business for personal use. June 30 Equipment rent fees earned and received in cash amounted $ 7850. June 30 Received a bill from WAPDA for the month of June $ 340. Payment is due in 15 days. Other data: a. During June, the company earned $ 3210 of rental fees paid in advance on June 3. b. Office supplies on hand at June 30, are estimated at $ 1160. c. The rental equipment is being is being deprecated over a period of 10 years. d. The advance payment of rent on June 3 covered a period of four months. e. As of June 30 seven days rent on equipment rented to M.L .COMPANY has earned. f. As of June 30, interest accrued on note payable amounted to $ 1050. g. Salaries earned by employees amounted to $ 960. h. Required: A. Prepare ledger in T format. B. Prepare a ten column work sheet. C. Prepare four closing entries from work sheet D. Prepare income statement a statement of equity and a

Q 1: NC operates a business closes its accounts and prepares financial statements at the end of each month. During the month of June entered into the following transactions: June 1 Owner deposited $ 150000 cash in a bank account. June 2 Purchased $ 240000 equipment, paid $ 100000 cash and issued a 9 percent note for the balance. June 3 Paid $ 10,000 four months advance rent. June 4 Received $12000 cash as advance payment on equipment from xyz company. June 5 Purchased office supplies on account from ABC $ 1850 payment due in 30 days. June 9 Purchased on account from F.P. distributor $ 290 parts needed to repair a rental tractor. Payment is due in ten days.( HINT: USE MAINTENANCE EXPENSE) June 10 Paid salaries for $ 3200. June 15 Equipment rental fees earned amount $ 8900 ,of which $ 7200 was received in cash. June 18 Paid the accounts payable to F.P. distributor. June 19 Collected $ 800 of the accounts receivable. June 23 Rented an equipment to M.L. company at a price $ 110 per day to be paid when returned back. This equipment is expected to remain with M.L company two to three weeks. June 25 Paid salaries $ 3200. June 28 Owner withdrew $ 3000 cash from the business for personal use. June 30 Equipment rent fees earned and received in cash amounted $ 7850. June 30 Received a bill from WAPDA for the month of June $ 340. Payment is due in 15 days. Other data: a. During June, the company earned $ 3210 of rental fees paid in advance on June 3. b. Office supplies on hand at June 30, are estimated at $ 1160. c. The rental equipment is being is being deprecated over a period of 10 years. d. The advance payment of rent on June 3 covered a period of four months. e. As of June 30 seven days rent on equipment rented to M.L .COMPANY has earned. f. As of June 30, interest accrued on note payable amounted to $ 1050. g. Salaries earned by employees amounted to $ 960. h. Required: A. Prepare ledger in T format. B. Prepare a ten column work sheet. C. Prepare four closing entries from work sheet D. Prepare income statement a statement of equity and a

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 2PB: J. Carrie established Carries Photo Tours during June of this year. The accountant prepared the...

Related questions

Topic Video

Question

Transcribed Image Text:Q 1:

NC operates a business closes its accounts and prepares financial statements at the end of each

month. During the month of June entered into the following transactions:

June 1

Owner deposited $ 150000 cash in a bank account.

June 2

Purchased $ 240000 equipment, paid $ 100000 cash and issued a 9 percent note for the

balance.

June 3 Paid $ 10,000 four months advance rent.

June 4 Received $12000 cash as advance payment on equipment from xyz company.

June 5 Purchased office supplies on account from ABC $ 1850 payment due in 30 days.

June 9 Purchased on account from F.P. distributor $ 290 parts needed to repair a rental tractor.

Payment is due in ten days.( HINT: USE MAINTENANCE EXPENSE)

June 10 Paid salaries for $ 3200.

June 15 Equipment rental fees earned amount $ 8900 ,of which $ 7200 was received in cash.

June

Paid the accounts payable to F.P. distributor.

June 19 Collected $ 800 of the accounts receivable.

June 23 Rented an equipment to M.L. company at a price $ 110 per day to be paid when returned

back. This equipment is expected to remain with M.L company two to three weeks.

June 25 Paid salaries $ 3200.

June 28 Owner withdrew $ 3000 cash from the business for personal use.

June 30 Equipment rent fees earned and received in cash amounted $ 7850.

June 30 Received a bill from WAPDA for the month of June $ 340. Payment is due in 15 days.

Other data:

a. During June, the company earned $ 3210 of rental fees paid in advance on June 3.

b. Office supplies on hand at June 30, are estimated at $ 1160.

c. The rental equipment is being is being deprecated over a period of 10 years.

d. The advance payment of rent on June 3 covered a period of four months.

e. As of June 30 seven days rent on equipment rented to M.L.COMPANY has earned.

f. As of June 30, interest accrued on note payable amounted to $ 1050.

g. Salaries earned by employees amounted to $ 960.

h.

Required:

A. Prepare ledger in T format.

B. Prepare a ten column work sheet.

C. Prepare four closing entries from work sheet

D. Prepare income statement a statement of equity and a

Balance sheet.

||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning