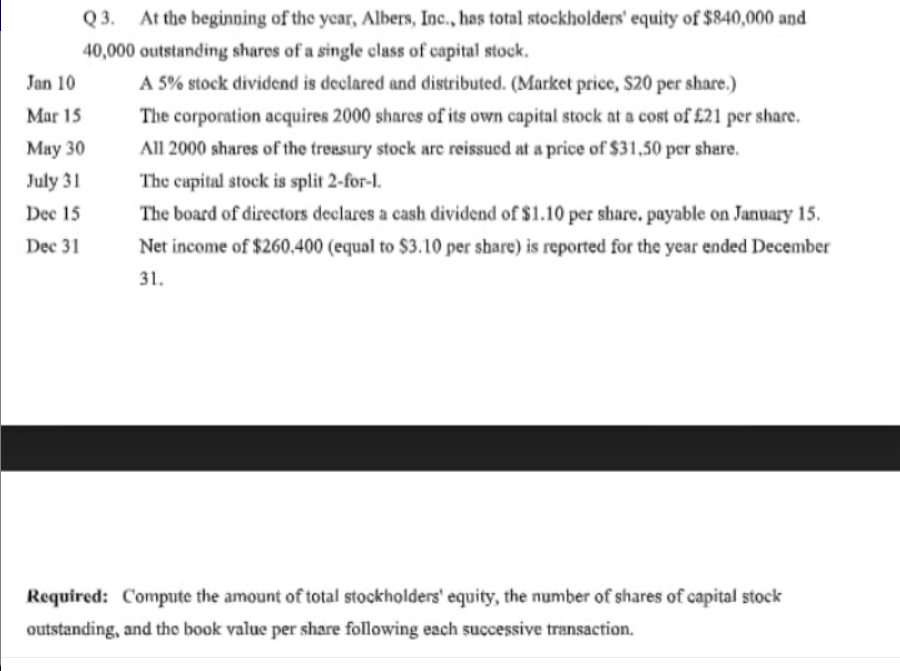

Q 3. At the beginning of the year, Albers, Inc., has total stockholders' equity of $840,000 and 40,000 outstanding shares of a single class of capital stock. Jan 10 A 5% stock dividend is declared and distributed. (Market price, $20 per share.) The corporation acquires 2000 shares of its own capital stock at a cost of £21 per share. All 2000 shares of the treasury stock arc reissued at a price of $31,50 per share. Mar 15 May 30 July 31 The capital stock is split 2-for-l. The board of directors declares a cash dividend of $1.10 per share. payable on January 15. Net income of $260,400 (equal to $3.10 per share) is reported for the year ended December Dec 15 Dec 31 31. Required: Compute the amount of total stockholders' equity, the number of shares of capital stock outstanding, and the book value per share following each successive transaction.

Q 3. At the beginning of the year, Albers, Inc., has total stockholders' equity of $840,000 and 40,000 outstanding shares of a single class of capital stock. Jan 10 A 5% stock dividend is declared and distributed. (Market price, $20 per share.) The corporation acquires 2000 shares of its own capital stock at a cost of £21 per share. All 2000 shares of the treasury stock arc reissued at a price of $31,50 per share. Mar 15 May 30 July 31 The capital stock is split 2-for-l. The board of directors declares a cash dividend of $1.10 per share. payable on January 15. Net income of $260,400 (equal to $3.10 per share) is reported for the year ended December Dec 15 Dec 31 31. Required: Compute the amount of total stockholders' equity, the number of shares of capital stock outstanding, and the book value per share following each successive transaction.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.7EX

Related questions

Question

Transcribed Image Text:Q 3. At the beginning of the year, Albers, Inc., has total stockholders' equity of $840,000 and

40,000 outstanding shares of a single class of capital stock.

Jan 10

A 5% stock dividend is declared and distributed. (Market price, $20 per share.)

The corporation acquires 2000 shares of its own capital stock at a cost of £21 per share.

All 2000 shares of the treasury stock arc reissued at a price of $31,50 per share.

Mar 15

May 30

July 31

The capital stock is split 2-for-l.

The board of directors declares a cash dividend of $1.10 per share. payable on January 15.

Net income of $260,400 (equal to $3.10 per share) is reported for the year ended December

Dec 15

Dec 31

31.

Required: Compute the amount of total stockholders' equity, the number of shares of capital stock

outstanding, and the book value per share following each successive transaction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning