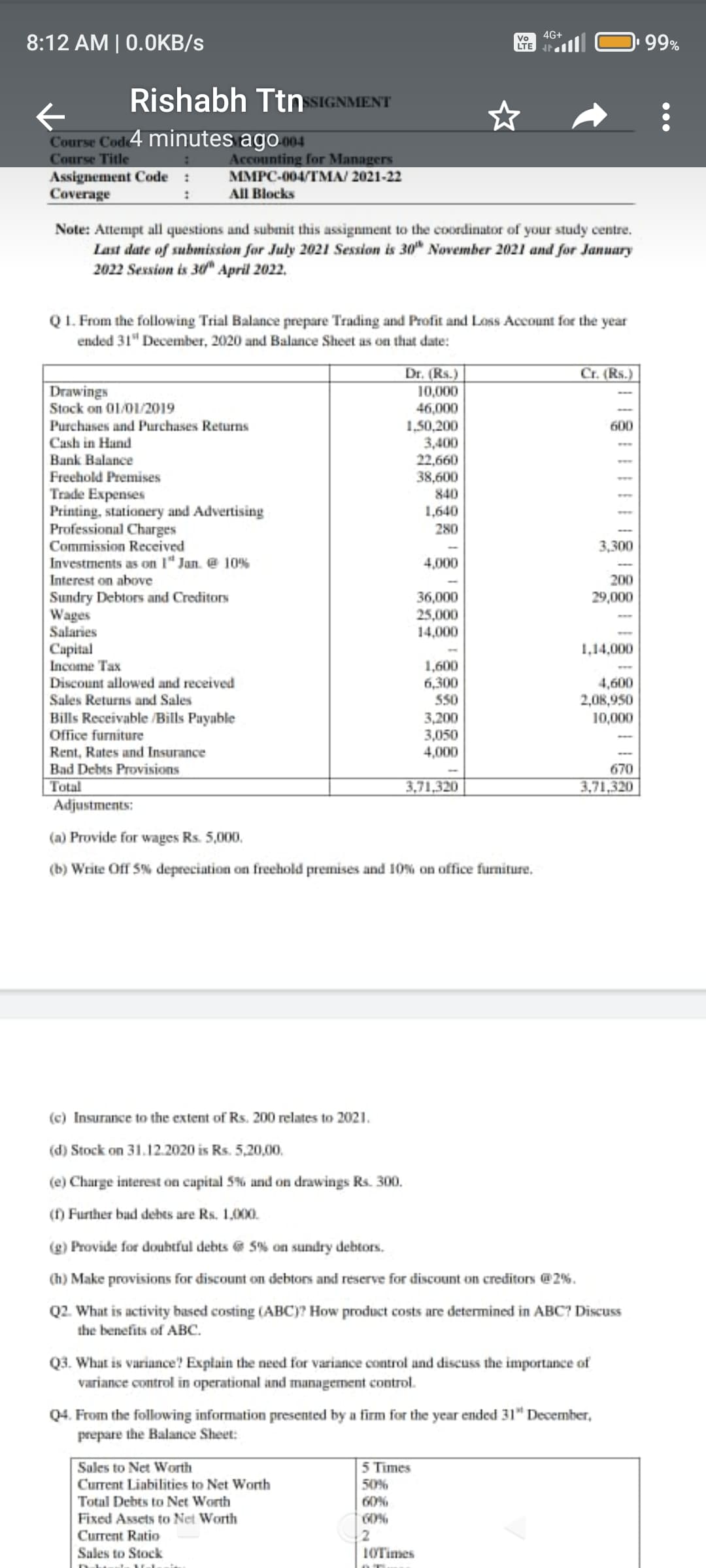

Q L. From the following Trial Balance prepare Trading and Profit and Loss Account for the year ended 31 December, 2020 and Balance Sheet as on that date: Cr. (Rs.) Dr. (Rs.) 10,000 46,000 1,50,200 3,400 22,660 600 38,600 840 1,640 280 3,300 4,000 200 29,000 Drawings Stack on 01/01/2019 Purchases and Purchases Returns Cash in Hand Bank Balance Freehold Premises Trade Expenses Printing, stationery and Advertising Professional Charges Commission Received Investments as on 1" Jan. @ 10% Interest on above Sundry Debtors and Creditors Wages Salaries Capital Income Tax Discount allowed and received Sales Returns and Sales Bills Receivable /Bills Payable Office furniture Rent, Rates and Insurance Bad Debts Provisions Total Adjustments: 36,000 25,000 14,000 1,14,000 1,600 6,300 550 3.200 4,600 2,08,950 10,000 3,050 4,000 670 3.71,320 3,71,320 (a) Provide for wages Rs. 5,000. (b) Write Off 5% depreciation on freehold premises and 10% on office furniture. (c) Insurance to the extent of Rs. 200 relates to 2021. (d) Stock on 31.12.2020 is Rs. 5,20,00 (e) Charge interest on capital 5% and on drawings Rs. 300. (1) Further bad debts are Rs. 1.000. (g) Provide for doubtful debts @ 5% on sundry debtors (h) Make provisions for discount on debtors and reserve for discount on creditors @2%.

Q L. From the following Trial

Cr. (Rs.)

Dr. (Rs.)

10,000

46,000

1,50,200

3,400

22,660

600

38,600

840

1,640

280

3,300

4,000

200 29,000

Drawings

Stack on 01/01/2019

Purchases and Purchases Returns

Cash in Hand

Bank Balance

Freehold Premises

Trade Expenses Printing, stationery and Advertising

Professional Charges

Commission Received

Investments as on 1" Jan. @ 10% Interest on above

Sundry Debtors and Creditors Wages

Salaries Capital

Income Tax Discount allowed and received

Sales Returns and Sales

Bills Receivable /Bills Payable

Office furniture

Rent, Rates and Insurance

Total Adjustments:

36,000

25,000

14,000

1,14,000

1,600

6,300

550 3.200

4,600

2,08,950

10,000

3,050

4,000

670 3.71,320

3,71,320

(a) Provide for wages Rs. 5,000.

(b) Write Off 5%

(c) Insurance to the extent of Rs. 200 relates to 2021.

(d) Stock on 31.12.2020 is Rs. 5,20,00 (e) Charge interest on capital 5% and on drawings Rs. 300.

(1) Further bad debts are Rs. 1.000.

(g) Provide for doubtful debts @ 5% on sundry debtors

(h) Make provisions for discount on debtors and reserve for discount on creditors @2%.

Step by step

Solved in 2 steps