Q Search this Ey- Time value of money c. Find the PV of $1,000 due in 6 years if the discount rate is 12%. Round your answer to the nearest cent. 24 d. A security has a cost of $1,000 and will return $2,000 after 6 years. What rate of return does the security provide? Round your answer to two decimal places. % e. Suppose California's population is 34.3 million people, and its population is expected to grow by 3% annually. How long will it take for the population to double? Round your answer to the nearest whole number. years

Q Search this Ey- Time value of money c. Find the PV of $1,000 due in 6 years if the discount rate is 12%. Round your answer to the nearest cent. 24 d. A security has a cost of $1,000 and will return $2,000 after 6 years. What rate of return does the security provide? Round your answer to two decimal places. % e. Suppose California's population is 34.3 million people, and its population is expected to grow by 3% annually. How long will it take for the population to double? Round your answer to the nearest whole number. years

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 6FPE

Related questions

Question

100%

Transcribed Image Text:Q Search this

Ey- Time value of money

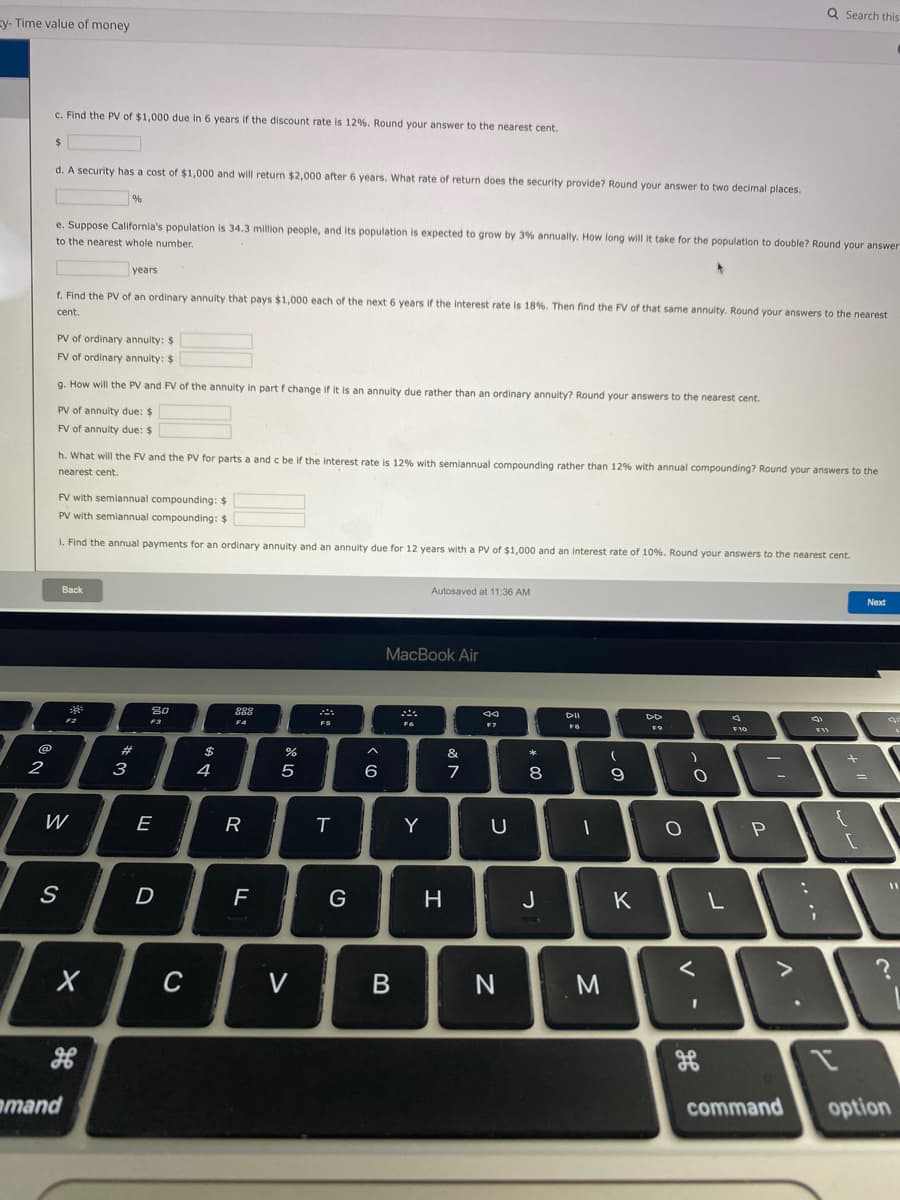

c. Find the PV of $1,000 due in 6 years if the discount rate is 12%. Round your answer to the nearest cent.

24

d. A security has a cost of $1,000 and will return $2,000 after 6 years. What rate of return does the security provide? Round your answer to two decimal places.

%

e. Suppose California's population is 34.3 million people, and its population is expected to grow by 3% annually. How long will it take for the population to double? Round your answer

to the nearest whole number.

years

f. Find the PV of an ordinary annuity that pays $1,000 each of the next 6 years if the interest rate is 18%. Then find the FV of that same annuity. Round your answers to the nearest

cent.

PV of ordinary annuity: $

FV of ordinary annuity: $

g. How will the PV and FV of the annuity in part f change if it is an annuity due rather than an ordinary annuity? Round your answers to the nearest cent.

PV of annuity due: $

FV of annuity due: $

h. What will the FV and the PV for parts a and c be if the interest rate is 12% with semiannual compounding rather than 12% with annual compounding? Round your answers to the

nearest cent.

FV with semiannual compounding: $

PV with semiannual compounding: $

I. Find the annual payments for an ordinary annuity and an annuity due for 12 years with a PV of $1,000 and an interest rate of 10%. Round your answers to the nearest cent.

Back

Autosaved at 11:36 AM

Next

МacВook Air

888

F2

F3

F4

F7

F8

F10

F11

23

$

&

*

2

3

4

5

8

W

E

R

T

Y

%3D

S

G

H

J

K

C

V

N

amand

command

option

.. .-

V

Transcribed Image Text:ne value of money

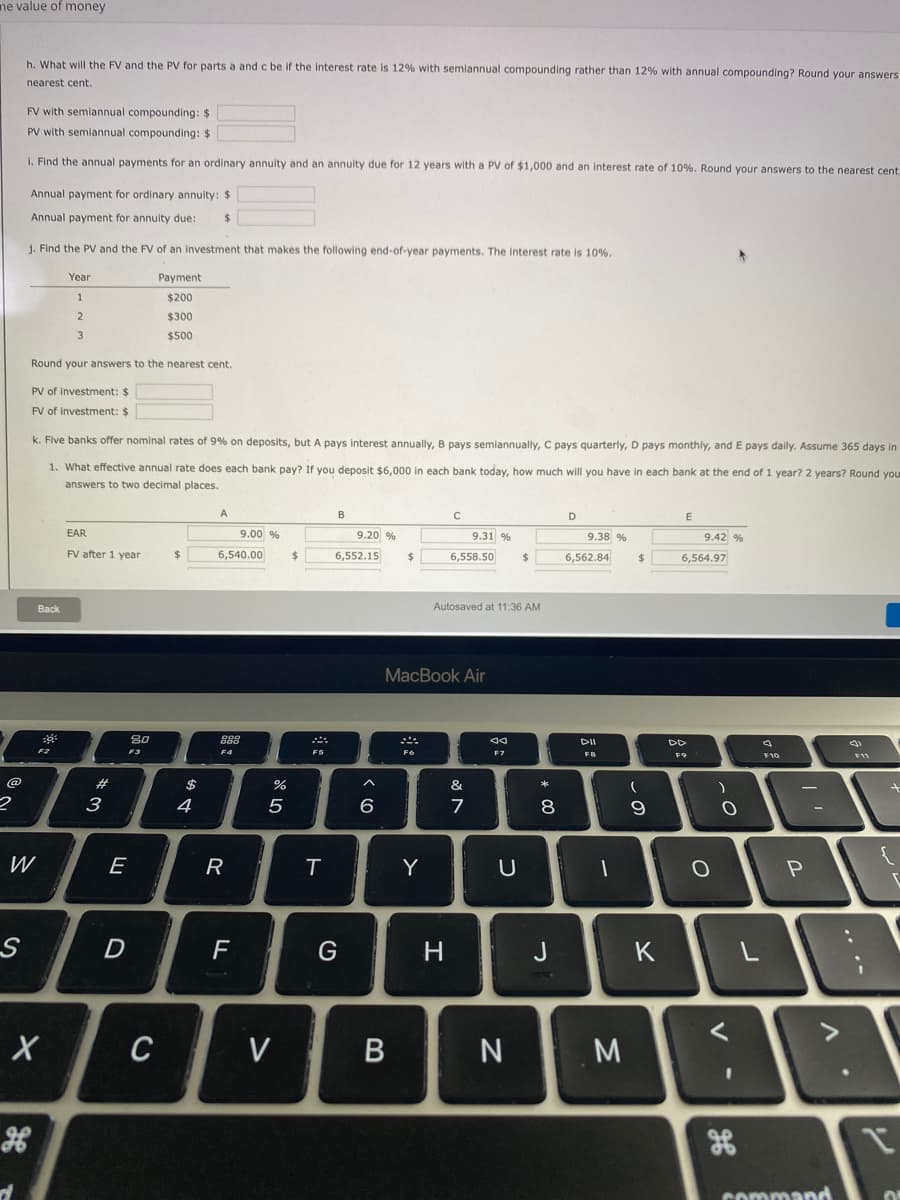

h. What will the FV and the PV for parts a and c be if the interest rate is 12% with semiannual compounding rather than 12% with annual compounding? Round your answers

nearest cent.

FV with semiannual compounding: $

PV with semiannual compounding: $

I. Find the annual payments for an ordinary annuity and an annuity due for 12 years with a PV of $1,000 and an interest rate of 10%. Round your answers to the nearest cent

Annual payment for ordinary annuity: $

Annual payment for annuity due:

%24

j. Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 10%.

Year

Payment

$200

2

$300

3

$500

Round your answers to the nearest cent.

PV of investment: $

FV of investment: $

k. Five banks offer nominal rates of 9% on deposits, but A pays interest annually, B pays semiannually, C pays quarterly, D pays monthly, and E pays daily. Assume 365 days in

1. What effective annual rate does each bank pay? If you deposit $6,000 in each bank today, how much will you have in each bank at the end of 1 year? 2 years? Round your

answers to two decimal places.

B

D

EAR

9.00 %

9.20 %

9.31 %

9.38 %

9.42 %

FV after 1 year

%24

6,540.00

6,552.15

6,558.50

%24

6,562.84

%$4

6,564.97

Back

Autosaved at 11:36 AM

MacBook Air

80

888

DII

DD

F2

F3

F4

F5

F6

F7

FB

F9

F10

@

23

$

&

*

3

4

5

6

7

8

9

W

E

R

Y

U

F

G

H

J

K

C

V

3D

Command

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning