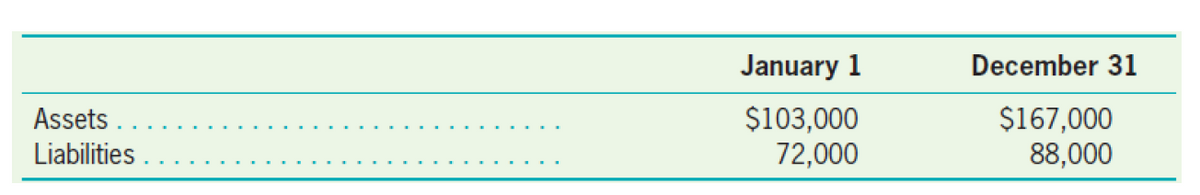

Q. No 1 (A) The total assets and liabilities of Tesla Company at January 1 and December 31, 2016, are presented below. Determine the amount of net income or loss for 2016, applying each of the following assumptions concerning the additional issuance of stock and dividends paid by the firm. Each case is independent of the others. 1. Dividends of $12,100 were paid and no additional stock was issued during the year. 2. Additional stock of $18,000 was issued and no dividends were paid during the year. 3. Additional stock of $72,000 was issued and dividends of $12,400 were paid during the year.

Q. No 1 (A) The total assets and liabilities of Tesla Company at January 1 and December 31, 2016, are presented below. Determine the amount of net income or loss for 2016, applying each of the following assumptions concerning the additional issuance of stock and dividends paid by the firm. Each case is independent of the others. 1. Dividends of $12,100 were paid and no additional stock was issued during the year. 2. Additional stock of $18,000 was issued and no dividends were paid during the year. 3. Additional stock of $72,000 was issued and dividends of $12,400 were paid during the year.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.1EX: Current liabilities Bon Nebo Co. sold 25,000 annual subscriptions of Bjorn for 85 during December...

Related questions

Question

100%

Q. No 1 (A) The total assets and liabilities of Tesla Company at January 1 and December 31, 2016, are presented below.

Determine the amount of net income or loss for 2016, applying each of the following assumptions concerning the additional issuance of stock and dividends paid by the firm. Each case is independent of the others.

1. Dividends of $12,100 were paid and no additional stock was issued during the year.

2. Additional stock of $18,000 was issued and no dividends were paid during the year.

3. Additional stock of $72,000 was issued and dividends of $12,400 were paid during the year.

Transcribed Image Text:January 1

December 31

$103,000

72,000

$167,000

88,000

Assets

Liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning