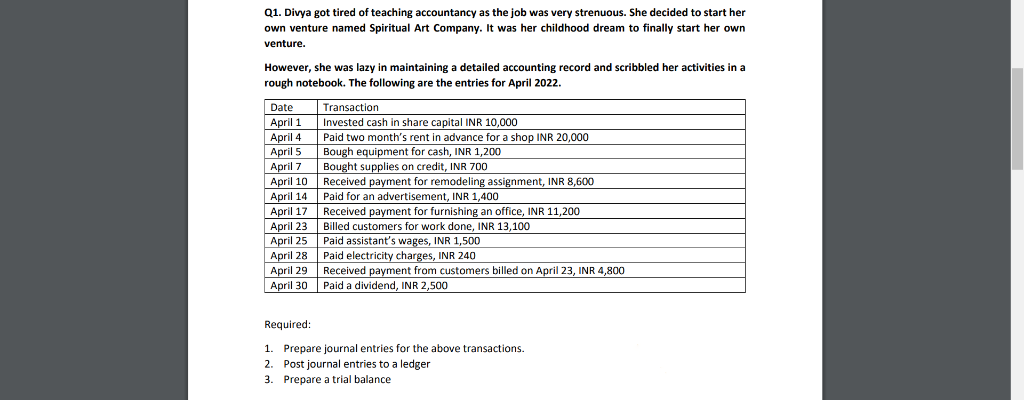

Q1. Divya got tired of teaching accountancy as the job was very strenuous. She decided to start her own venture named Spiritual Art Company. It was her childhood dream to finally start her own venture. However, she was lazy in maintaining a detailed accounting record and scribbled her activities in a rough notebook. The following are the entries for April 2022. Date April 1 April 4 April 5 April 7 April 10 April 14 April 17 April 23 April 25 April 28 April 29 April 30 Transaction Invested cash in share capital INR 10,000 Paid two month's rent in advance for a shop INR 20,000 Bough equipment for cash, INR 1,200 Bought supplies on credit, INR 700 Received payment for remodeling assignment, INR 8,600 Paid for an advertisement, INR 1,400 Received payment for furnishing an office, INR 11,200 Billed customers for work done, INR 13,100 Paid assistant's wages, INR 1,500 Paid electricity charges, INR 240 Received payment from customers billed on April 23, INR 4,800 Paid a dividend, INR 2,500 Required: 1. Prepare journal entries for the above transactions. 2. Post journal entries to a ledger 3. Prepare a trial balance

Q1. Divya got tired of teaching accountancy as the job was very strenuous. She decided to start her own venture named Spiritual Art Company. It was her childhood dream to finally start her own venture. However, she was lazy in maintaining a detailed accounting record and scribbled her activities in a rough notebook. The following are the entries for April 2022. Date April 1 April 4 April 5 April 7 April 10 April 14 April 17 April 23 April 25 April 28 April 29 April 30 Transaction Invested cash in share capital INR 10,000 Paid two month's rent in advance for a shop INR 20,000 Bough equipment for cash, INR 1,200 Bought supplies on credit, INR 700 Received payment for remodeling assignment, INR 8,600 Paid for an advertisement, INR 1,400 Received payment for furnishing an office, INR 11,200 Billed customers for work done, INR 13,100 Paid assistant's wages, INR 1,500 Paid electricity charges, INR 240 Received payment from customers billed on April 23, INR 4,800 Paid a dividend, INR 2,500 Required: 1. Prepare journal entries for the above transactions. 2. Post journal entries to a ledger 3. Prepare a trial balance

Chapter4: Operating Activities: Sales And Cash Receipts

Section: Chapter Questions

Problem 3.9C

Related questions

Question

Transcribed Image Text:Q1. Divya got tired of teaching accountancy as the job was very strenuous. She decided to start her

own venture named Spiritual Art Company. It was her childhood dream to finally start her own

venture.

However, she was lazy in maintaining a detailed accounting record and scribbled her activities in a

rough notebook. The following are the entries for April 2022.

Date

April 1

April 4

April 5

April 7

April 10

April 14

April 17

April 23

April 25

April 28

April 29

April 30

Transaction

Invested cash in share capital INR 10,000

Paid two month's rent in advance for a shop INR 20,000

Bough equipment for cash, INR 1,200

Bought supplies on credit, INR 700

Received payment for remodeling assignment, INR 8,600

Paid for an advertisement, INR 1,400

Received payment for furnishing an office, INR 11,200

Billed customers for work done, INR 13,100

Paid assistant's wages, INR 1,500

Paid electricity charges, INR 240

Received payment from customers billed on April 23, INR 4,800

Paid a dividend, INR 2,500

Required:

Prepare journal entries for the above transactions.

Post journal entries to a ledger

1.

2.

3. Prepare a trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you