Course Name: Principles of Finance Assignment Questions: Q1. Rami deposits $60,000 today in an account that pays 4.6% p.a. interest, compounding semi-annually. How much can be withdrawn from his account in 10 years. (Show your calculations) Q2. You invest $2000 at the end of every 6 months at a rate of 7% p.a. compounding semi- annually. How much money would you have in your account after 8 years? Q3. A portfolio consists of $100,000 in share A that yield 5% and $150,000 in share B with an expected return of 8%. Share A has a variance of 2% and share B has a variance of 3%. The covariance between returns is 0.00782. a. What is the expected return for this $250,000 portfolio? b. What is the variance of the portfolio?

Course Name: Principles of Finance Assignment Questions: Q1. Rami deposits $60,000 today in an account that pays 4.6% p.a. interest, compounding semi-annually. How much can be withdrawn from his account in 10 years. (Show your calculations) Q2. You invest $2000 at the end of every 6 months at a rate of 7% p.a. compounding semi- annually. How much money would you have in your account after 8 years? Q3. A portfolio consists of $100,000 in share A that yield 5% and $150,000 in share B with an expected return of 8%. Share A has a variance of 2% and share B has a variance of 3%. The covariance between returns is 0.00782. a. What is the expected return for this $250,000 portfolio? b. What is the variance of the portfolio?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 6CE: Use Future Value and Present Value Tables to Apply Compound Interest to Accounting Transactions...

Related questions

Question

i need the answer quickly

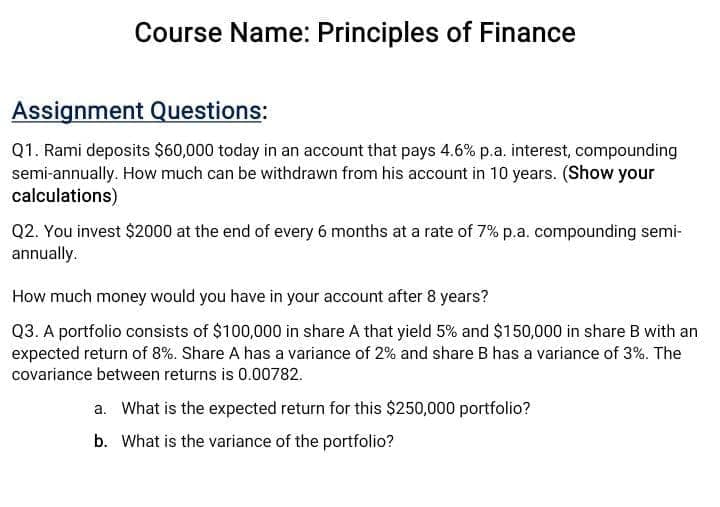

Transcribed Image Text:Course Name: Principles of Finance

Assignment Questions:

Q1. Rami deposits $60,000 today in an account that pays 4.6% p.a. interest, compounding

semi-annually. How much can be withdrawn from his account in 10 years. (Show your

calculations)

Q2. You invest $2000 at the end of every 6 months at a rate of 7% p.a. compounding semi-

annually.

How much money would you have in your account after 8 years?

Q3. A portfolio consists of $100,000 in share A that yield 5% and $150,000 in share B with an

expected return of 8%. Share A has a variance of 2% and share B has a variance of 3%. The

covariance between returns is 0.00782.

a. What is the expected return for this $250,000 portfolio?

b. What is the variance of the portfolio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning