Q1(a) Create simple examples to illustrate the following concepts. i. Time value of money ii. Effective interest iii. Sinking Fund iv. Amortized loan

Q1(a) Create simple examples to illustrate the following concepts. i. Time value of money ii. Effective interest iii. Sinking Fund iv. Amortized loan

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PB: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

100%

Transcribed Image Text:Question 1

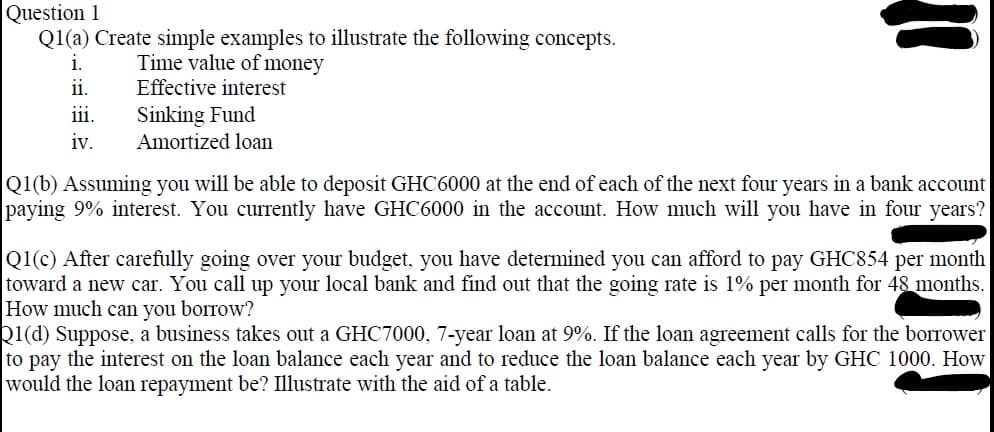

Q1(a) Create simple examples to illustrate the following concepts.

i.

Time value of money

ii.

Effective interest

Sinking Fund

111.

iv.

Amortized loan

Q1(b) Assuming you will be able to deposit GHC6000 at the end of each of the next four years in a bank account

paying 9% interest. You currently have GHC6000 in the account. How much will you have in four years?

Q1(c) After carefully going over your budget, you have determined you can afford to pay GHC854 per month

toward a new car. You call up your local bank and find out that the going rate is 1% per month for 48 months.

How much can you borrow?

Q1(d) Suppose, a business takes out a GHC7000, 7-year loan at 9%. If the loan agreement calls for the borrower

to pay the interest on the loan balance each year and to reduce the loan balance each year by GHC 1000. How

would the loan repayment be? Illustrate with the aid of a table.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning