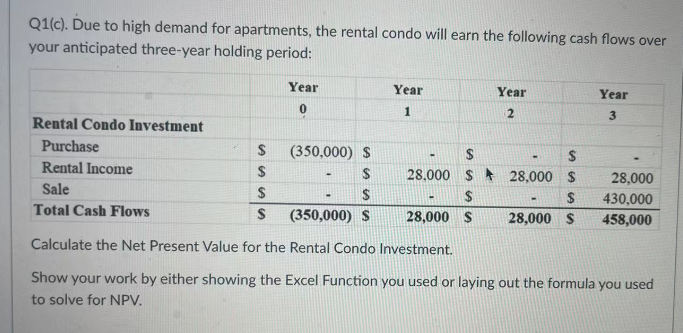

Q1(c). Due to high demand for apartments, the rental condo will earn the following cash flows over your anticipated three-year holding period: Year 0 (350,000) $ $ - Year 1 Rental Condo Investment Purchase S Rental Income $ Sale $ S Total Cash Flows S (350,000) $ 28,000 S Calculate the Net Present Value for the Rental Condo Investment. Show your work by either showing the Excel Function you used or laying out the formula you used to solve for NPV. - Year 2 $ 28,000 $ 28,000 $ $ 28,000 $ 555 - - Year 3 - 28,000 430,000 458,000

Q: 1. In discounted cash flows method, the value of investment opportunities is highly dependent on the…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Sabrina plans to save for next two years. She plans to put away $1000 every 6 months starting 6…

A: The value of the amount saved is the future value of the savings which is the savings amount plus…

Q: Find the periodic payments PMT necessary to accumulate the given amount in an annuity account.…

A: concept. Future value of annuity = PMT * [(1+r)n - 1 ]r where , PMT = periodic payments r= interest…

Q: Columbia Sheetmetal is thinking about purchasing a new machine that will have an expected life of 8…

A: The IRR is a measure of the profitability of a project. It signifies the maximum return for which…

Q: If you transmit a market buy order to the stock exchange, will you buy at the bid or the ask? a.…

A: The process of placing a market buy order on a stock exchange: When an investor places a market buy…

Q: The Dry Dock is considering a project with an initial cost of $108,915 and cash inflows for Years 1…

A: IRR of the project is calculated in excel using IRR function

Q: Tiger Corp expects to sell 15,000 units of product. The average price per unit is $12 and variable…

A: Financial risk is a measure of the uncertainty and potential loss associated with an investment or…

Q: 1 Chester plc are considering a project that is susceptible to risk. An initial investment of…

A: The company generally accepts project that yields positive NPV. The positive NPV is beneficial to…

Q: Q2(d). According to your research, the Market Capitalization Rate for this type of property should…

A: The value of the property is the capitalized value of future cash flows. It is computed by dividing…

Q: When the present value of the cash flows on a large bond portfolio changes because one the issuers…

A: The correct choice here , is the last option , which is option D. When the present value of the cash…

Q: 1. various forms of business organization. Ways of managing a business organization. Overview of…

A: Corporate finance involves the financial decisions, strategies, and activities of an organization.…

Q: Compute the interest paid on a 4-year lease for a $28,842 car if the annual rate of depreciation is…

A: A lease refers to an agreement between two parties known as lessor and the lessee where , the lessor…

Q: Premier, Incorporated, has an odd dividend policy. The company has just paid a dividend of $4 per…

A: Dividend discounting model is a method of finding out the current value of securities after…

Q: Compute and Interpret Liquidity, Solvency and Coverage Ratios Selected balance sheet and income…

A: The current ratio indicates the ability of the company in terms of liquidity. It measures whether…

Q: The price of oil is $70 (spot), $75 (one-year forward), and $80 (two-year forward). Convenience…

A: We have spot and forward prices of different maturities. We need to find the price of a two-year…

Q: Given total Sales of 300.000, gross margin equal to 40% of Sales, total Expenses of 84.000, interest…

A: concept. Result to sales = Result * 100Sales (Here , result = Net income).

Q: When Dan signed a three-year contract as a manager, the company allowed reimbursement of $420 at the…

A: The PV of a contract refers to the value of the future cash flows of the contract after they have…

Q: Netflix has a beta of 2.25 and an expected return of 18%. If the expected return on the market is…

A: Required rate of return of security will be calculated by considering the risk free rate as well as…

Q: Your sister just deposited $11,500 into an investment account. She believes that she will earn an…

A: Value of sister's investment account in 7 years is calculated using following equation Future value…

Q: Ford has a 5 year $100m fixed rate loan with Citibank at 0.061 (annual rate). Ford now thinks rates…

A: The value of the loan is 100m. The loan period is 5 years. The fixed rate on the loan is 0.061.…

Q: that time today is Dec. 13, 2022. Determine what is being asked in each problem. 1. How much is the…

A: Future value of the amount includes the amount that is being deposited over the period of time and…

Q: 5. A bank claims in an advertisement that its certificates of deposit offe a nominal rate of 7.0%…

A: The effective interest rate is the interest rate considering the impact of the compounding effect on…

Q: Which one of the following elements of credit risk does not comprise Standalone Risk Default…

A: Standalone risk is the creation of risk by the specified division, project, or asset. It can be…

Q: A large agribusiness firm has contracted to deliver 100,000 bushels of wheat for $8.50 a bushel at…

A: Solution:- Forward contract means agreement to buy or sell the commodity in future at a price at a…

Q: An underpriced stock provides an expected return which is _______________ the appropriate required…

A: In Assets pricing model the gives the required rate based on risk involved in the stock and stocks…

Q: Question 1: If a principle of $4000 is invested at an interest rate of 6%, how many years will it be…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Mf2. Assume a one-period binomial model in which the initial stock price is S = 60 and in each…

A: u = 7 /3 or down by a factor of d = 2 /3 ((1+r)-d)/U- d 1+1/3-2/3/7/3-2/3 =0.4 1-0.4=0.6 Strike…

Q: Real Property/Land ownership includes air rights and subsurface materials. Group of answer choices…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want…

Q: Calculate the present value of five payments of $1500.00 made at the end of each of five consecutive…

A: Present value is calculated using following equation Present value = P×1-1(1+r)nr Where, P is annual…

Q: Sally earns gross wages of $1200 per week. She has standard deductions for social security and…

A: The employee contributes to the retirement account to support the financial needs after retirement,…

Q: . Debtor purchased a home in 2007 for $100,000. Acme Savings and Loan obtained a first mortgage in…

A: There are several creditors. We need to find who gets how much in case of foreclosure.

Q: C stock is currently at 100. In the next period, the price will either increase by10% or decrease by…

A: Call options gives the opportunity to buy the stock on maturity of period by payment of small…

Q: 3 Which of the following are in keeping with Corporate Governance? A Shareholders run the company…

A: Every organization has its goal, and for the purpose to achieve the company of goal run the…

Q: Your company has been doing well, reaching $1.04 million in earnings, and is considering launching a…

A: Free cash flows for year 0=(11,22,000) Year 1 =1,283,176.46 Year 2 = 1377,453.26…

Q: Describe the most common sources of debt financing? Briefly Explain

A: Debt financing refers to the practice of borrowing money from lenders, such as banks or other…

Q: Study Guide 7. Section 9-1: Ralph is interested in buying a cargo van with a base price of $22,245.…

A: Sticker price includes base price, Options price, and Destination charge. The base price is…

Q: Consider the following annual closing prices of mutual fund ABC, and Treasury bills rate. RF Rate…

A: Sharpe artio calculates the return per unit of risk.It is an important measure to compare wo…

Q: Suppose that, on 5 November 2020, you opened a short position in a two-year futures contract on the…

A:

Q: Suppose the government decides to issue a new savings bond that is guaranteed to double in value if…

A: Present value of annuity is the current value of the future payments that are calculated using the…

Q: Valenzuela, Incorporated, has a cash cycle of 41 days, an operating cycle of 58 days, and an…

A: Given: Particulars Days Cash cycle 41 Operating cycle 58 Inventory period 24.5 Cost of…

Q: ent of a turns

A: and the target company will rise, otherwise, there is no benefits of the merger. But after the…

Q: BergAwesome is an appropriate candidate for one seeking a little above average risk. O BergAwesome…

A: Systematic or market risk is the risk that affects all the companies across all the sectors in the…

Q: Cash flow stream for 2 projects are given below: Year 1 2 3 4 Project A $ 300 400 50 50 Project B $…

A: Concept. 1. Payback period is the time required to recover initial investment. Project having lower…

Q: Jack's Construction Co has 100,000 bonds outstanding that are selling at par value. The bonds yield…

A: In the given case, the treasury bill yield is given , it is a risk free rate. Beta of the stock and…

Q: If a portfolio had a return of 18%, the risk-free asset return was 5%, and the standard deviation of…

A: A risk Premium is a method of determining an investor's return on investment above a risk-free rate.…

Q: The line and arrows at the top of the graph.show: Lilly Ell&Co. (LY) Stod Charts.com

A: The graph shown in the question relates to technical analysis of a stock. In case of technical…

Q: 3. A Cincinnati car dealer is offering a 5-year lease (starting today) at 6% on a vehicle. The deal…

A: An agreement among a lessor and a lessee for the hiring of a particular asset for a given period in…

Q: Which of the following is TRUE regarding unemployment insurance? O The federal government mandates…

A: The government of the United States gives many benefits to their country's people, such as homes,…

Q: You have the opportunity to make a one-time sale if you will give a new customer 30days to pay. You…

A: The giving credit to the customers is very risky because there would cost of credit and also there…

Q: 4) Calculate the WACC given the following information: Stocks 940,000 Bonds 680,000…

A: Stocks = 940,000 Bonds = 680,000 Total capital = 1,620,000 (i.e. 940,000 + 680,000) Cost of debt…

4

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Julie wants to borrow $10,250 from you. She has offered to pay you back $12,250 in a year. If the cost of capital of this investment opportunity is 12%, what is its NPV? Question content area bottom Part 1 The NPV of the investment is $enter your response here. (Round to the nearest cent.)Two investors participate in an investment project and, after an analysis economic, the following results were obtained: • Investor A. TMAR: 13.45; NPV: 570,000. • Investor B. TMAR: 13:00; NPV: −2450. Explain the value of the results of investor B based on the recovery of your investment, profits and your minimum acceptable rate of return.Please explain any and all formulas/calculations using Excel. Mr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments: Cash Flows ($thousands) Project C0 C1 C2 IRR(%) A -450 +250 +300 14 B -225 +120 +179 19.8 The opportunity cost of capital is 5%. Mr. Clops is tempted to take B, which has the higher IRR. However, Mr. Clops is wrong. Show him how to adapt the IRR rule to choose the best project Multiple Choice WIn this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project B when the discount rate is less thant the IIRR= 10% WIn this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project B when the discount rate is less thant the IIRR=…

- Consider two projects: A) with cashlows in years 0-4 of -300$, 120$, 120$, 120$ and respectively 120$, B) with casháows in years 0-3 of -300$, 150$, 150$ and respectively 150$ 4(a) Assume an opportunity cost of capital of 11%. Which of these projects would you accept, if you use the NPV method? 4(b) Which one would you prefer, among the two, based on their ProÖtability Index (PI)? 4(c) Which one would you choose if the cost of capital is 16%? 5(a) What is the payback period of each project?5(b) Is the project with the shortest payback period also the one with the highest NPV? Explain. 6(a) What are the internal rates of return on the two projects?6(b) Does the IRR rule in this case give the same advice i.e. preferred outcome as NPV? please answer only question 5a,b and 6a,b thanksSolve the problem. A financier plans to invest up to $500,000 in two projects. Project A yields a return of 10% on the investment, whereas Project B yields a return of 15% on the investment. Because the investment in Project B is riskier than the investment in Project A, the financier has decided that the investment in Project B should not exceed 40% of the total investment. How much should she invest in each project to maximize the return on her investment?Mr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments: Cash Flows ($thousands) Project C0 C1 C2 IRR(%) A -400 +250 +300 23 B -200 +140 +179 36 The opportunity cost of capital is 5%. Mr. Clops is tempted to take B, which has the higher IRR. Why should not Mr. Clops base his decision on the IRR? Multiple Choice When projects have different sizes (very different cash flows in year 0), the IRR may give the wrong solution.In this case project B has a higher IRR than project A. However, project B is half the size of project A. The NPV gives the right choice. In this case the NPV of Project A is $150 > $50 the NPV of Project B When projects have different sizes (very different cash flows in year 0), the IRR may give the wrong solution.In this case project B has a higher IRR than project A. However, project B is half the size of project A. The NPV gives the right choice. In…

- Mr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments: Cash Flows ($thousands) Project C0 C1 C2 IRR(%) A -400 +250 +300 23 B -200 +140 +179 36 The opportunity cost of capital is 5%. Mr. Clops is tempted to take B, which has the higher IRR. Why should not Mr. Clops base his decision on the IRR? Multiple Choice When projects have different sizes (very different cash flows in year 0), the IRR may give the wrong solution.In this case project B has a higher IRR than project A. However, project B is half the size of project A. The NPV gives the right choice. In this case the NPV of Project B is $120 > $90 the NPV of Project A When projects have different sizes (very different cash flows in year 0), the IRR may give the wrong solution.In this case project B has a higher IRR than project A. However, project B is half the size of project A. The NPV gives the right choice. In…Consider two projects: A) with casháows in years 0-4 of -300$, 120$, 120$, 120$ and respectively 120$, B) with casháows in years 0-3 of -300$, 150$, 150$ and respectively 150$ 4(a) Assume an opportunity cost of capital of 11%. Which of these projects would you accept, if you use the NPV method? 4(b) Which one would you prefer, among the two, based on their ProÖtability Index (PI)? 4(c) Which one would you choose if the cost of capital is 16%? 5(a) What is the payback period of each project?5(b) Is the project with the shortest payback period also the one with the highest NPV? Explain. 6(a) What are the internal rates of return on the two projects?6(b) Does the IRR rule in this case give the same advice i.e. preferred outcome as NPV?You are considering investing in a real estate project. Your one ownership unit would cost $ 30,000. The project is expected to generate annual cash flows for you of $4,500 in year 1, $5.000 in years 2-5. $8,000 in year 6 and $19,000 in year 7. With a discount rate of 5.0%, what is the net present value (NPV) of this investment? Should you invest in this deal? Whyor why not? Please provide the proper keystrokes for the BAIIPlus and the Qualifier Plus IIIfx calculators. Thank you!

- Being Finance Manager of Salalah Textiles Industries, you need to invest an amount for OMR 50,000 in the investment market. Assume the market rate of return is 0.11, risk free rate of return is 2.75% and Beta is .73, then:Required:a) What should be required rate of return for your investment?b) Keeping the answer of question # 2a in mind, if different investment options are available with different returns in the investment market, for example:i. For investment in Project-A, 6.30% return is offered;ii. For investment in Project-B, 10.95% return is offered, andiii. For investment in Project-C, 5.65% return is offered.In above scenario, explain whether any why these investment options are overvalued or undervalued? Keeping the answer of question # 2a and 2b, what will be your investment decision (justify your answer with reasons)A. Assume that you have completed your plans and proformas for the next year of operations. The upcoming year looks promising. What would you most likely do from the following list? a. From your proformas project your company’s weighted average cost of capital and return on assets, and compare the two b. Take a vacation because you have been working so hard c. Purchase a new house for your personal use because the future is looking so good d. Make sure that your company’s weighted average cost of capital exceeds your company’s return on assets, if not, rework your plans and proformas B. Assume that all sales are on account. If the average accounts receivable balance was $1,000,000 and accounts receivable turnover was 12 for the last year of operations, what was sales revenue? a. $10,000,000 b. $15,000,000 c. $12,000,000 d. $6,000,000Consider two projects: A) with casháows in years 0-4 of -300$, 120$, 120$, 120$ and respectively 120$, B) with casháows in years 0-3 of -300$, 150$, 150$ and respectively 150$ (a) Assume an opportunity cost of capital of 11%. Which of these projects would you accept, if you use the NPV method? (b) Which one would you prefer, among the two, based on their ProÖtability Index (PI)? (c) Which one would you choose if the cost of capital is 16%?