Q3. How do book value weights differ from market value weights in measurement of cost of capital? The following is the capital structure of PQR Ltd. : Particulars Amount (Rs.) Equity Share Capital (Face Value Rs.10 per share) 20,00,000

Q3. How do book value weights differ from market value weights in measurement of cost of capital? The following is the capital structure of PQR Ltd. : Particulars Amount (Rs.) Equity Share Capital (Face Value Rs.10 per share) 20,00,000

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Weighted average cost of capital, WACC; after-tax cost of debt,...

Related questions

Question

Do it on ASAP Basis , With Workings

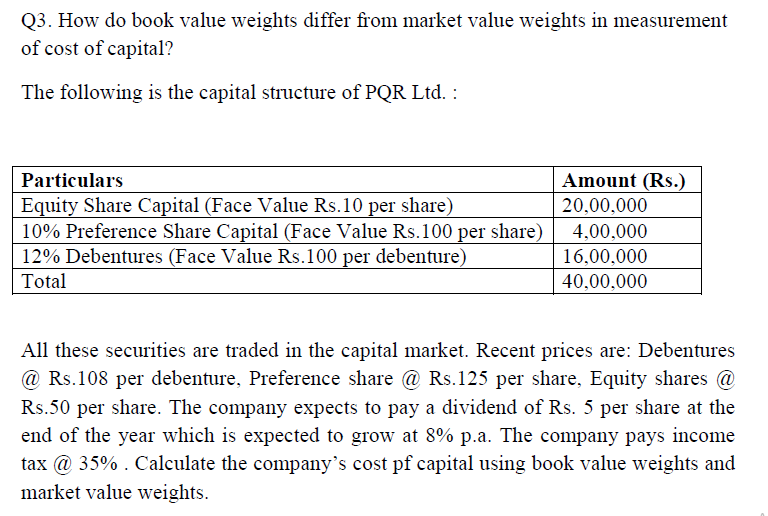

Transcribed Image Text:Q3. How do book value weights differ from market value weights in measurement

of cost of capital?

The following is the capital structure of PQR Ltd. :

Particulars

Amount (Rs.)

Equity Share Capital (Face Value Rs.10 per share)

10% Preference Share Capital (Face Value Rs.100 per share)

12% Debentures (Face Value Rs.100 per debenture)

20,00,000

4,00,000

16,00,000

Total

40,00,000

All these securities are traded in the capital market. Recent prices are: Debentures

@ Rs.108 per debenture, Preference share @ Rs.125 per share, Equity shares @

Rs.50 per share. The company expects to pay a dividend of Rs. 5 per share at the

end of the year which is expected to grow at 8% p.a. The company pays income

tax @ 35% . Calculate the company's cost pf capital using book value weights and

market value weights.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning