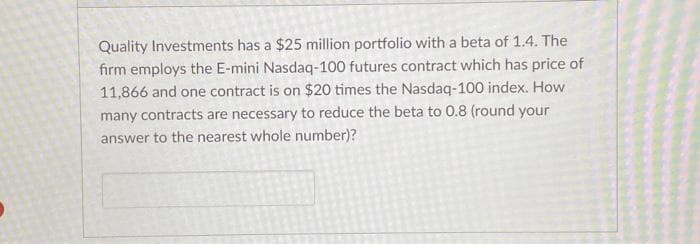

Quality Investments has a $25 million portfolio with a beta of 1.4. The firm employs the E-mini Nasdaq-100 futures contract which has price of 11,866 and one contract is on $20 times the Nasdaq-100 index. How many contracts are necessary to reduce the beta to 0.8 (round your answer to the nearest whole number)?

Q: [The following information applies to the questions displayed below.] Oslo Company prepared the…

A: Degree of operating leverage is an important financial metric. This metric determines the…

Q: Use the following information regarding the allocation of loan portfolios in different sectors for…

A: The SD of asset allocation refers to the risk that the investor faces because of the asset…

Q: Consider a three-bond portfolio as follows. Interest is compounded semiannually, and coupons are…

A: YTM of the portfolio is weighted YTM of the bonds in the portfolio based on the market value of the…

Q: A $51,000 loan at 9.6 % compounded semiannually is to be repaid by semiannual payments of $3,900…

A: Loan amortization refers to a schedule which is prepared to show the periodic loan payments, amount…

Q: 2. You are a bond trader and see on your screen the following information on three bonds with annual…

A: Bonds are debt instruments issued by companies. The issuing company pays periodic interest or…

Q: QUESTION 8 Which of these statements is not true? A The forward exchange rate is a good predictor of…

A: Fuutre exchange transaction also known as future contracts is defined as the situation where one…

Q: (Related to Checkpoint 10.1) (Common stock valuation) Header Motor, Inc., "paid a $3.27 dividend…

A: When the company receives profits and distributes them among the shareholders. That share of profit…

Q: You have taken out a $7,500,000 loan with a 4% interest rate, 30 year amortization and ten year…

A: The concept of calculating the remaining loan balance on an amortizing loan involves key components…

Q: Collateral may mean the acquisition of rights over either assets belonging to a borrower and/or the…

A: Collateral is a financial concept that involves using assets as a form of security in lending and…

Q: A firm's EBIT is $25 billion. It pays $3 billion in interest. What are its earnings? (Note: Enter…

A: Earning per share is a kind of ratio that is used to determine the company's profitability.…

Q: Assume you want to borrow $300,000 and have been presented with two options. The first option is a…

A: Amortization of loan is the process of repayment of loan. In the amortization of the loan. principal…

Q: You observe that the direct quote for the Canadian dollar from the US perspective is $0.895. What is…

A: Direct quote is the number of units of home currency required to purchase foreign currency and…

Q: Last year Ann Arbor Corp had $155,000 of assets (which equals total invested capital), $305,000 of…

A: Given that the total of assets is all the invested capital. The capital is comprised of debt and…

Q: Consider a bond with a 8% coupon and a yield to maturity of 5% maturing in just over 2 Suppose the…

A: Price of a bond is the sum of the flat price of the bond plus accrued interest on the bond and that…

Q: Concord, Inc. began March with 680 units in beginning Work in Process Inventory, 11460 units started…

A: Beginning work in process inventory = 680 unitsStarted into production = 11,460 units

Q: an individual is interested in a five year bond that pays a 6.8 percent coupon rate with interest to…

A: Compound = Semiannually = 2Time = t = 5 * 2 = 10Coupon Rate = 6.8 / 2 = 3.4%Required Rate of Return…

Q: A company with no debt financing has EBIT of $1000. The corporate tax rate is 40%. So the company's…

A: A firm can be called a levered firm if its capital structure contains a proportion of debt.

Q: You are running a hot Internet company. Analysts predict that its earnings will grow at 10% per year…

A: Present value is that amount which is calculated with the help of future benefits from the…

Q: Solve the problems below. Be sure to show your work. If you use the formula, be sure to write it out…

A: Bonds, preferred stock, and other fixed-income assets may all be valued using present value. In…

Q: After learning how to value a stock in his Corporate Finance class, Mark Stark decided to put his…

A: Here Mark uses the dividend discount model in general and the constant growth rate model in…

Q: I purchased 574 shares at $85.47 per share for a total of $49,059.78. By the end, the stock price…

A: Number of shares 574Initial stock price per share$85.47Total investment at the…

Q: (Capital structure analysis) Last year the Rondoelea Products Company had $138 million in annual…

A: The TIE ratio refers to the measurement of the company’s ability to cover the interest obligations…

Q: Which of the following accounts belongs in the liability section of a balance sheet? Select an…

A: Among the options provided, "Accounts payable" belongs in the liability section of a balance sheet..

Q: Arthur is planning on buying a house and needs to take out mortgage for $200,000 . He has two…

A: A mortgage refers to a covered loan that is borrowed to purchase a property which in turn acts as…

Q: Honda Motor Company is considering offering a $2,000 rebate on its minivan, lowering the vehicle's…

A: Variables in the question:Rebate on minivan=$2000Increase in sales due to rebate=54700 -…

Q: 2. Ellen purchased $3,268 worth of stock and paid her broker a 0.6% fee. She sold when the stock…

A: Net proceeds is the amount of profit earned from the market after making an investment in the stock…

Q: The following three defense stocks are to be combined into a stock index in January 2019 (perhaps a…

A: Price-Weighted Index:In the price-weighted index, each security is weighted by the relevant price…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: Given:

Q: You are considering the purchase of a small income producing property for $150,000 that is expected…

A: NPV is also known as Net Present Value. It is a capital budgeting technique which helps in decision…

Q: A U.S. firm holds an asset in France and faces the following scenario: State 1 State 2 State 3…

A: Here, StateExchange Rate per Euro (x)Probabilities (p)P*P (y)State 1 $…

Q: ou want to buy a property in the city of Vancouver and the purchase price is $700,000. You will be…

A: Mortgage loans make buying a home easy because loans are paid in monthly installments that carry…

Q: Consider two securities that pay risk-free cash flows over the next two years and that have the…

A: Arbitrage refers to the profit that an investor earns because of the difference in the value of the…

Q: How much should be invested each year for 10 years to provide you with $8000 per year for the next…

A: Present value includes the value without interest rate and future value includes the value with…

Q: ssume a stock is currently selling for Rs 44.62 per share at the start of 2022. For this company,…

A: Dupont equation is used to calculate return on equity from the asset turn ratio, net profit margins…

Q: Valiant Corp. pays a dividend of $2.5 per share and is expected to pay this amount indefinitely. If…

A: An important financial term is the cost of capital, this shows the costs a business must pay to…

Q: Please show calculation with formula: Calculate the price of a 10-year bond with a face value of…

A: Bonds are fixed-income assets that serve as a representation of investor loans to borrowers…

Q: n January 2009, the GB pound rate was GBP 0.3900 per NZD. Over the year 2009, the GB pound weakened…

A: In the international market some currencies appreciate and some depreciate and the appreciation and…

Q: Calculate the present value of a deferred annuity for 10 years (there are 10 payments). The first…

A: Here,Annulity Payment is $30Effective Interest Rate is 5%Deferred Period is Five years from…

Q: SuperFit wants to build a new fitness facility that costs $7.5 million. Suppose SuperFit currently…

A: The future value of cash flow is the amount that is being deposited and amount of compounded…

Q: Compare the pros and cons of futures, forwards, and options. What are the criteria for the…

A: Derivatives are financial instruments whose values are derived from the performance of underlying…

Q: 1. Present Value (PV Enter the interest rate in the highlighted cell below. Use the cash flows below…

A: Present value is the current date value of all future cash flows discounted over a period of…

Q: Required Information On January 1, 2024, Avalanche Corporation borrowed $126,000 from First Bank by…

A: Please note that the firm has to pay the interest payments on the loan borrowed. Any income or oss…

Q: A stock's current price is $20 and a 3-month call with a strike price of $22 sells for $2. You have…

A: Call option-This is a form of a derivative contract. Under this contract, the call option buyer has…

Q: Q1.26 Construct a cash flow diagram that represents the amount of money that will be accumulated in…

A: Initial Investment20000Annual cash flow3500Tenure,Year7

Q: Bank A pays 5% compounded annually, and bank B pays 5% simple interest. If you want to triple your…

A: Compound Interest formulaFuture value can be calculated usingFV = PV* (1 + r / n)ntWhere,PV =…

Q: The marketing director, Mr. Thomas, has been investigating the market for disposable coffee cups…

A: Calculation used to evaluate the investment and financing decisions that involve cash flows…

Q: The King Carpet Company has $3,010,000 in cash and a total of $12,110,000 in current assets. The…

A: Current assets = $12,110,000Current liabilities = $5,630,000Current ratio = 2.2 The company's…

Q: ou borrow $207,000 to be repaid in monthly installments over the next 25 years. The first payment…

A: Loans are paid by the equal monthly installments and these monthly payments carry payment for…

Q: Glickleys Financial is considering some new equipment. The equipment's price is $10,000, and it…

A: NPV means Net Present value .NPV is a capital budgeting technique used for making investment…

Q: A bank has issued a six-month, $1.5 million negotiable CD with a 0.54 percent quoted annual interest…

A: A bank has issued a Six-month $1.5 million negotiable CD with a 0.54 percent quoted annual interest…

Step by step

Solved in 3 steps with 2 images

- You are currently long on a portfolio of stocks that has a beta of 1.60. Given recent uncertainties, you intend to reduce the portfolio beta to 1.20. Your portfolio currently worth RM2.8 million and FBM KLCI is at 800 points. Show how the objective can be achieved using SIF contracts.The manager of a well-diversified portfolio with a market value of $200 million that mirrors the S&P 500 wants to hedge the portfolio against a market decline in value over the next six months. The portfolio manager wants to use the Mini-S&P 500 contract for hedging. The contract multiplier for this futures contract is $50. The futures price for the contract at the date that the hedge is put on is 4,200. a. Should the portfolio manager buy or sell the futures contract. Explain why. b. How many contracts should the portfolio manager sell or buy? c. Suppose at the delivery date (six months from now), the value of the S&P 500 is 3,800. Show what the outcome for this hedge will be.Suppose that the value of the S&P 500 stock index is 2,000.a. If each E-mini futures contract (with a contract multiplier of $50) costs $25 to trade with a discount broker, how much is the transaction cost per dollar of stock controlled by the futures contract?b. If the average price of a share on the NYSE is about $40, how much is the transaction cost per “typical share” controlled by one futures contract?c. For small investors, a typical transaction cost per share in stocks directly is about 10 cents per share. How many times the transactions costs in futures markets is this?

- A company has a £10 million portfolio with a beta of 0.8 to the stock market. The futures price for a contract on the stock market is 500. Futures contracts can be traded with value equal to £10 multiplied by the futures price. What position should one take in order to completely hedge the market risk? a. Short 2000 contracts b. Long 2000 contracts c. Short 1600 contracts d. Long 1600 contractsDonna Doni, CFA, wants to explore potential inefficiencies in the futures market. The TOBEC stock index has a spot value of 185. TOBEC futures contracts are settled in cash and underlying contract values are determined by multiplying $100 times the index value. The current annual risk-free interest rate is 6.0%.a. Calculate the theoretical price of the futures contract expiring six months from now, using the cost-of-carry model. The index pays no dividends.The total (round-trip) transaction cost for trading a futures contract is $15.b. Calculate the lower bound for the price of the futures contract expiring six months from now.The S&P 500 futures price is 4372 and you have a portfolio of stocks valued at $20,000,000. Each futures contract is worth $250. If the portfolio moves exactly like the index, how many contracts do you need to hedge this portfolio and what is the implied beta?

- Suppose that Ace Insurance Company forecasts that stock market prices are going to increase considerably over the next three months and that they want to purchase500S&P 500 index futures contracts that have settlements that are six months out. If the index has a value of 3,000, and the value of a contract is 250 times the index’s value, then Ace Insurance Company will have invested $______ in the futures contracts.Suppose the 1-year futures price on a stock-index portfolio is 1,914, the stock index currently is 1,900, the 1-year risk-free interest rate is 3%, and the year-end dividend that will be paid on a $1,900 investment in the market index portfolio is $40.a. By how much is the contract mispriced?b. Formulate a zero-net-investment arbitrage portfolio and show that you can lock in riskless profits equal to the futures mispricing.c. Now assume (as is true for small investors) that if you short sell the stocks in the market index, the proceeds of the short sale are kept with the broker, and you do not receive any interest income on the funds. Is there still an arbitrage opportunity (assuming that you don’t already own the shares in the index)? Explain.d. Given the short-sale rules, what is the no-arbitrage band for the stock-futures price relation-ship? That is, given a stock index of 1,900, how high and how low can the futures price be without giving rise to arbitrage opportunities?A portfolio is currently worth $10 million and has a beta of 1.0. An index is currently standing at 800. Explain how a put option on the index with a strike of 700 can be used to provide portfolio insurance.

- A company has a $36 million portfolio with a beta of 1.2. The futures price for a contract on an index is 900. Futures contracts on $250 times the index can be traded. What trade is necessary to reduce beta to 0.9? A. Short 48 contracts B. Long 48 contracts C. Short 192 contracts D. Long 192 contractscompany has a $36 million equity portfolio with a beta of 0.9. The futures price on the S&P index for a contract delivering in 6 months is currently trading at 900. Futures contracts on $250 times the index can be traded. What trade is necessary to increase the beta to 1.2 over the next 4 months? O Long 48 futures contracts and close out the position in 4 months O Long 48 futures contracts and close out the position in 6 months O Short 48 futures contracts and close out the position in 4 months O Short 48 futures contracts and close out the position in 6 months O Short 192 futures contracts and close out the position in 6 monthsSweet Fields has an inventory of 12,320,000 pounds of sugar. The firm wants to place a hedge on this inventory. What should they do to hedge the position if the futures contracts are based on 112,000 pounds and quoted in cents per pound? Upon setup, the spot rate was 9.63. If the price of Sugar falls from 9.63 to 9.51 and the futures contract falls from 9.56 to 9.46; what would have been the result for Sweet Fields? $ What type of risk this this hedge experience?