Quantitative Problem: Bank 1 lends funds at a nominal rate of 9% with payments to be made semiannually. Bank 2 requires payments to be made quarterly. If Bank 2 would like to charge the same effective annual rate as Bank 1, what nominal interest rate will they charge their customers? Do not round intermediate calculations. Round your answer to three decimal places.

Quantitative Problem: Bank 1 lends funds at a nominal rate of 9% with payments to be made semiannually. Bank 2 requires payments to be made quarterly. If Bank 2 would like to charge the same effective annual rate as Bank 1, what nominal interest rate will they charge their customers? Do not round intermediate calculations. Round your answer to three decimal places.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter6: Accounting Quality

Section: Chapter Questions

Problem 4QE

Related questions

Question

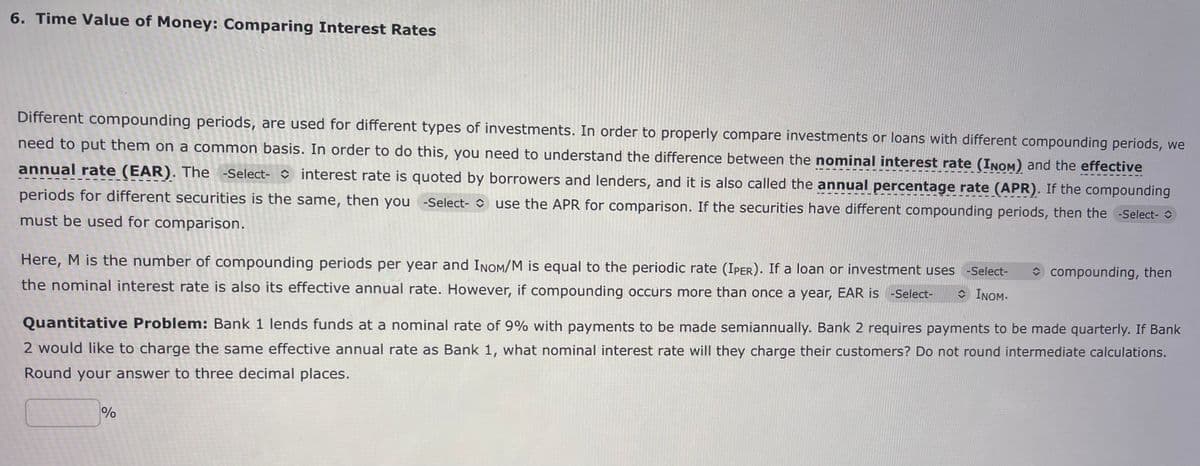

Transcribed Image Text:6. Time Value of Money: Comparing Interest Rates

Different compounding periods, are used for different types of investments. In order to properly compare investments or loans with different compounding periods, we

need to put them on a common basis. In order to do this, you need to understand the difference between the nominal interest rate (INOM) and the effective

annual rate (EAR). The -Select- interest rate is quoted by borrowers and lenders, and it is also called the annual percentage rate (APR). If the compounding

periods for different securities is the same, then you -Select- use the APR for comparison. If the securities have different compounding periods, then the -Select-

must be used for comparison.

Here, M is the number of compounding periods per year and INOM/M is equal to the periodic rate (IPER). If a loan or investment uses -Select-

the nominal interest rate is also its effective annual rate. However, if compounding occurs more than once a year, EAR is -Select- INOM.

Quantitative Problem: Bank 1 lends funds at a nominal rate of 9% with payments to be made semiannually. Bank 2 requires payments to be made quarterly. If Bank

2 would like to charge the same effective annual rate as Bank 1, what nominal interest rate will they charge their customers? Do not round intermediate calculations.

Round your answer to three decimal places.

%

olo

compounding, then

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning