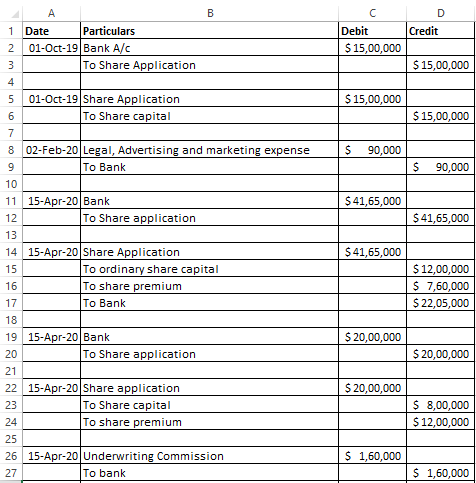

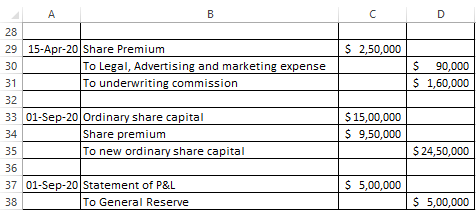

QUESTION 1 Aalwyn Ltd was incorporated with authorized share capital consisting of 800 000 10% preference shares of $ 2 each and 2 000 000 ordinary shares of N$1.50c each. 01 October 2019: The subscribers to the memorandum took and paid for 100 000 ordinary shares at par. During the year, 80% of the remaining ordinary shares and 500 000 preference shares were offered to the public as follows: - The ordinary shares were offered at a premium of 95c per share; and -The preference shares were offered at N$ 5. -01 March 2020: The offer for the subscription of shares opened to the public. -25 March 2020: The offer to the public was closed. -15 April 2020: Allotment of shares offered to public took place and all transactions with the underwriter were also concluded on this date. The issue is being underwritten for a commission of 8%. A total of 400 000 preference shares and 1 700 000 ordinary shares were applied for and the available shares were allotted and the necessary refunds made. The terms of the underwriting agreement were implemented. All share issue and preliminary expenses should be written off against the share premium account in terms of the Companies Act of 2008. Legal, advertising and marketing expenses of N$ 90 000 relating to the establishment of the company, were incurred and paid for on 02 February 2020. On 01 September 2020, the directors of the company at a meeting resolved the following: - to convert the ordinary par value shares into nor par value shares; - to transfer N$ 500 000 to a general reserve; and - declared a dividend of 90c per ordinary share which is only payable on 12 October 2020. The company’s year- end is 30 September. The company declared a profit of N$ 5 000 000 for the year. REQUIRED to: a.) Prepare the extracted statement of financial position as at 30 September 2020. note: find two images below attached for the calculated figures in journals and of the retained earnings(general reserve) & ordinary share capital.

QUESTION 1

Aalwyn Ltd was incorporated with authorized share capital consisting of 800 000 10%

01 October 2019: The subscribers to the memorandum took and paid for 100 000 ordinary shares at par.

During the year, 80% of the remaining ordinary shares and 500 000 preference shares were offered to the public as follows:

- The ordinary shares were offered at a premium of 95c per share; and

-The preference shares were offered at N$ 5.

-01 March 2020: The offer for the subscription of shares opened to the public.

-25 March 2020: The offer to the public was closed.

-15 April 2020: Allotment of shares offered to public took place and all transactions with the underwriter were also concluded on this date.

The issue is being underwritten for a commission of 8%. A total of 400 000 preference shares and 1 700 000 ordinary shares were applied for and the available shares were allotted and the necessary refunds made. The terms of the underwriting agreement were implemented. All share issue and preliminary expenses should be written off against the share premium account in terms of the Companies Act of 2008.

Legal, advertising and marketing expenses of N$ 90 000 relating to the establishment of the company, were incurred and paid for on 02 February 2020.

On 01 September 2020, the directors of the company at a meeting resolved the following:

- to convert the ordinary par value shares into nor par value shares;

- to transfer N$ 500 000 to a general reserve; and

- declared a dividend of 90c per ordinary share which is only payable on 12 October 2020.

The company’s year- end is 30 September.

The company declared a profit of N$ 5 000 000 for the year.

REQUIRED to:

a.) Prepare the extracted

note: find two images below attached for the calculated figures in journals and of the

Trending now

This is a popular solution!

Step by step

Solved in 2 steps