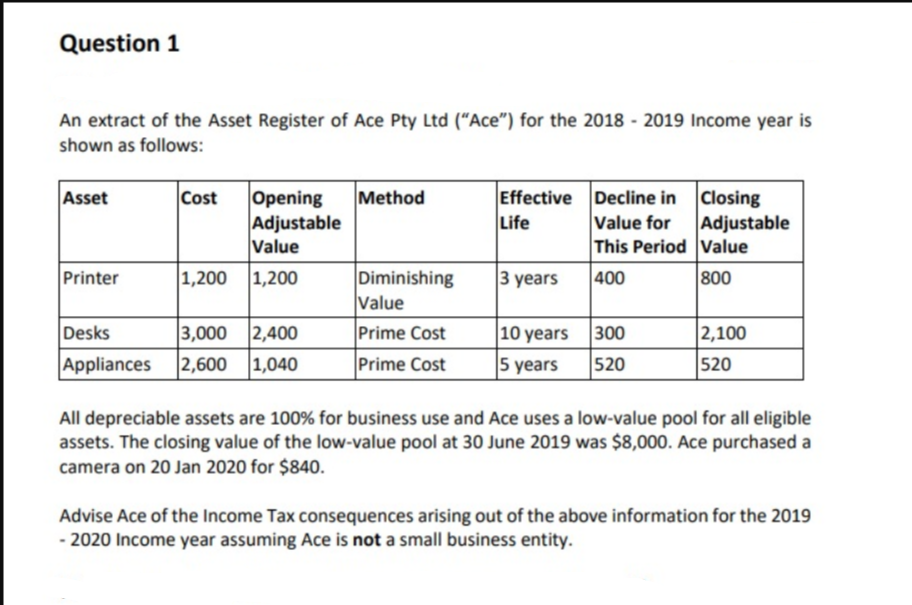

Question 1 An extract of the Asset Register of Ace Pty Ltd ("Ace") for the 2018 - 2019 Income year is shown as follows: Method Effective Decline in Closing Value for Adjustable This Period Value Asset Opening Adjustable Value Cost Life 1,200 1,200 Diminishing Value Printer 3 years |400 800 Desks 3,000 2,400 2,600 1,040 Prime Cost 10 years 300 2,100 Appliances Prime Cost 5 years 520 520 All depreciable assets are 100% for business use and Ace uses a low-value pool for all eligible assets. The closing value of the low-value pool at 30 June 2019 was $8,000. Ace purchased a camera on 20 Jan 2020 for $840. Advise Ace of the Income Tax consequences arising out of the above information for the 2019 - 2020 Income year assuming Ace is not a small business entity.

Question 1 An extract of the Asset Register of Ace Pty Ltd ("Ace") for the 2018 - 2019 Income year is shown as follows: Method Effective Decline in Closing Value for Adjustable This Period Value Asset Opening Adjustable Value Cost Life 1,200 1,200 Diminishing Value Printer 3 years |400 800 Desks 3,000 2,400 2,600 1,040 Prime Cost 10 years 300 2,100 Appliances Prime Cost 5 years 520 520 All depreciable assets are 100% for business use and Ace uses a low-value pool for all eligible assets. The closing value of the low-value pool at 30 June 2019 was $8,000. Ace purchased a camera on 20 Jan 2020 for $840. Advise Ace of the Income Tax consequences arising out of the above information for the 2019 - 2020 Income year assuming Ace is not a small business entity.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

Transcribed Image Text:Question 1

An extract of the Asset Register of Ace Pty Ltd ("Ace") for the 2018 - 2019 Income year is

shown as follows:

Method

Effective Decline in Closing

Value for Adjustable

This Period Value

Asset

Opening

Adjustable

Value

Cost

Life

1,200 1,200

Diminishing

Value

Printer

3 years

|400

800

Desks

3,000 2,400

2,600 1,040

Prime Cost

10 years

300

2,100

Appliances

Prime Cost

5 years

520

520

All depreciable assets are 100% for business use and Ace uses a low-value pool for all eligible

assets. The closing value of the low-value pool at 30 June 2019 was $8,000. Ace purchased a

camera on 20 Jan 2020 for $840.

Advise Ace of the Income Tax consequences arising out of the above information for the 2019

- 2020 Income year assuming Ace is not a small business entity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning