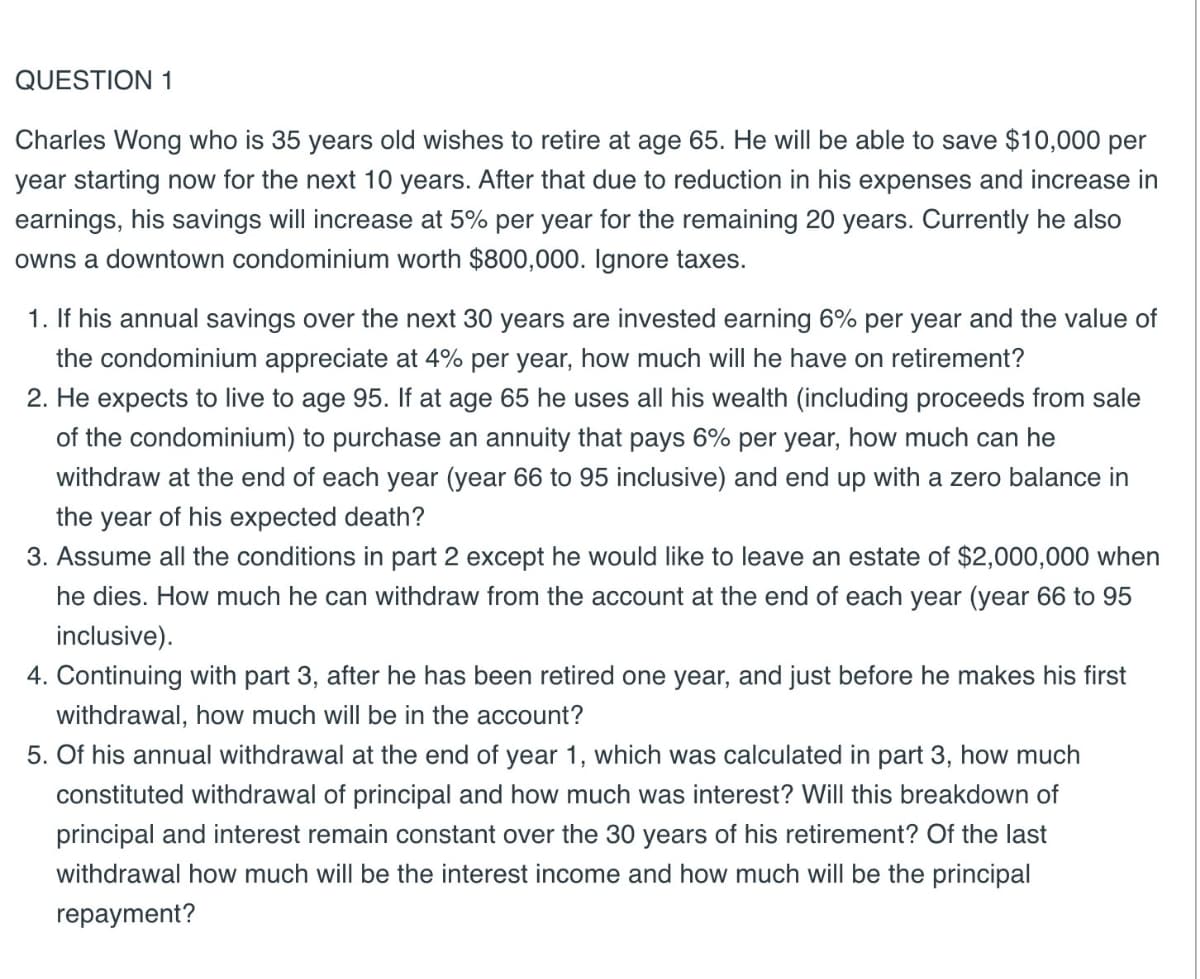

QUESTION 1 Charles Wong who is 35 years old wishes to retire at age 65. He will be able to save $10,000 per year starting now for the next 10 years. After that due to reduction in his expenses and increase in earnings, his savings will increase at 5% per year for the remaining 20 years. Currently he also owns a downtown condominium worth $800,000. Ignore taxes. 1. If his annual savings over the next 30 years are invested earning 6% per year and the value of the condominium appreciate at 4% per year, how much will he have on retirement? 2. He expects to live to age 95. If at age 65 he uses all his wealth (including proceeds from sale of the condominium) to purchase an annuity that pays 6% per year, how much can he withdraw at the end of each year (year 66 to 95 inclusive) and end up with a zero balance in the year of his expected death? 3. Assume all the conditions in part 2 except he would like to leave an estate of $2,000,000 when he dies. How much he can withdraw from the account at the end of each year (year 66 to 95 inclusive).

QUESTION 1 Charles Wong who is 35 years old wishes to retire at age 65. He will be able to save $10,000 per year starting now for the next 10 years. After that due to reduction in his expenses and increase in earnings, his savings will increase at 5% per year for the remaining 20 years. Currently he also owns a downtown condominium worth $800,000. Ignore taxes. 1. If his annual savings over the next 30 years are invested earning 6% per year and the value of the condominium appreciate at 4% per year, how much will he have on retirement? 2. He expects to live to age 95. If at age 65 he uses all his wealth (including proceeds from sale of the condominium) to purchase an annuity that pays 6% per year, how much can he withdraw at the end of each year (year 66 to 95 inclusive) and end up with a zero balance in the year of his expected death? 3. Assume all the conditions in part 2 except he would like to leave an estate of $2,000,000 when he dies. How much he can withdraw from the account at the end of each year (year 66 to 95 inclusive).

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 7FPE: Funding a retirement goal. Austin Miller wishes to have 800,000 in a retirement fund 20 years from...

Related questions

Question

Please try to solve complete within one hour please

Transcribed Image Text:QUESTION 1

Charles Wong who is 35 years old wishes to retire at age 65. He will be able to save $10,000 per

year starting now for the next 10 years. After that due to reduction in his expenses and increase in

earnings, his savings will increase at 5% per year for the remaining 20 years. Currently he also

owns a downtown condominium worth $800,000. Ignore taxes.

1. If his annual savings over the next 30 years are invested earning 6% per year and the value of

the condominium appreciate at 4% per year, how much will he have on retirement?

2. He expects to live to age 95. If at age 65 he uses all his wealth (including proceeds from sale

of the condominium) to purchase an annuity that pays 6% per year, how much can he

withdraw at the end of each year (year 66 to 95 inclusive) and end up with a zero balance in

the year of his expected death?

3. Assume all the conditions in part 2 except he would like to leave an estate of $2,000,000 when

he dies. How much he can withdraw from the account at the end of each year (year 66 to 95

inclusive).

4. Continuing with part 3, after he has been retired one year, and just before he makes his first

withdrawal, how much will be in the account?

5. Of his annual withdrawal at the end of year 1, which was calculated in part 3, how much

constituted withdrawal of principal and how much was interest? Will this breakdown of

principal and interest remain constant over the 30 years of his retirement? Of the last

withdrawal how much will be the interest income and how much will be the principal

repayment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT