QUESTION 1 Izdham sell watches at RM10 each and his variable costs (ie plastics and metal) is RM3 for each watch. To sell this watch, the fixed cost (i.e flat fee of rent, salary) is RM100. If you sell 12 watches in 1 month, how much will you earn / lose? (a) Calculate the Gross Profit / Loss (b) Calculate the Net Profit / Loss (c) Calculate the Break Even Point in units.

QUESTION 1 Izdham sell watches at RM10 each and his variable costs (ie plastics and metal) is RM3 for each watch. To sell this watch, the fixed cost (i.e flat fee of rent, salary) is RM100. If you sell 12 watches in 1 month, how much will you earn / lose? (a) Calculate the Gross Profit / Loss (b) Calculate the Net Profit / Loss (c) Calculate the Break Even Point in units.

Chapter4A: Nopat Breakeven: Revenues Needed To Cover Total Operating Costs

Section: Chapter Questions

Problem 1EP

Related questions

Question

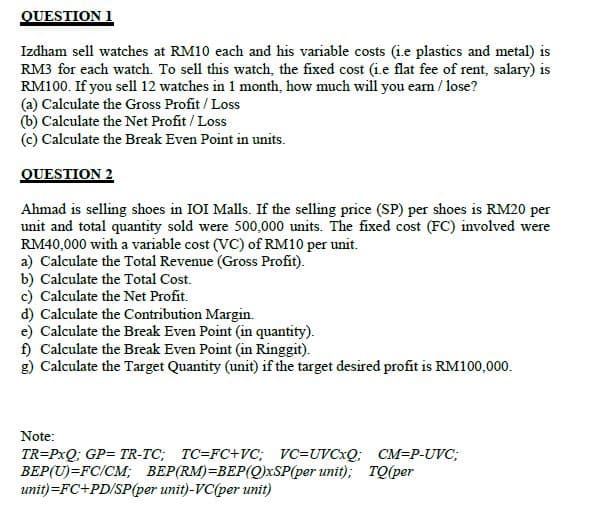

Transcribed Image Text:QUESTION 1

Izdham sell watches at RM10 each and his variable costs (ie plastics and metal) is

RM3 for each watch. To sell this watch, the fixed cost (i.e flat fee of rent, salary) is

RM100. If you sell 12 watches in 1 month, how much will you eam / lose?

(a) Calculate the Gross Profit / Loss

(b) Calculate the Net Profit / Loss

(c) Calculate the Break Even Point in units.

QUESTION 2

Ahmad is selling shoes in IOI Malls. If the selling price (SP) per shoes is RM20 per

unit and total quantity sold were 500,000 units. The fixed cost (FC) involved were

RM40,000 with a variable cost (VC) of RM10 per unit.

a) Calculate the Total Revenue (Gross Profit).

b) Calculate the Total Cost.

c) Calculate the Net Profit.

d) Calculate the Contribution Margin.

e) Calculate the Break Even Point (in quantity).

f) Calculate the Break Even Point (in Ringgit).

g) Calculate the Target Quantity (unit) if the target desired profit is RM100,000.

Note:

TR=PxQ; GP= TR-TC; TC=FC+VC; VC=UVCXQ; CM=P-UVC;

BEP(U)=FC/CM; BEP(RM)=BEP(Q)xSP(per unit); TQ(per

unit)=FC+PD/SP(per unit)-VC(per unit)

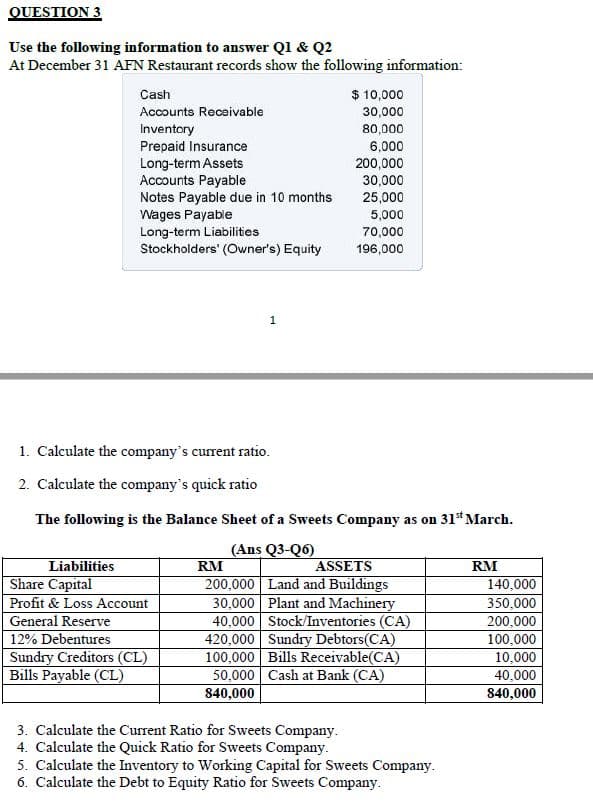

Transcribed Image Text:QUESTION 3

Use the following information to answer Ql & Q2

At December 31 AFN Restaurant records show the following information:

$ 10,000

Cash

Accounts Receivable

30,000

80,000

Inventory

Prepaid Insurance

Long-term Assets

Accounts Payable

Notes Payable due in 10 months

Wages Payable

Long-term Liabilities

Stockholders' (Owner's) Equity

6,000

200,000

30,000

25,000

5,000

70,000

196,000

1

1. Calculate the company's current ratio.

2. Calculate the company's quick ratio

The following is the Balance Sheet of a Sweets Company as on 31* March.

(Ans Q3-Q6)

RM

Liabilities

ASSETS

RM

Share Capital

200,000 Land and Buildings

30,000 Plant and Machinery

40,000 Stock/Inventories (CA)

420,000 Sundry Debtors(CA)

100,000 Bills Receivable(CA)

50,000 Cash at Bank (CA)

840,000

140,000

Profit & Loss Account

350,000

General Reserve

12% Debentures

Sundry Creditors (CL)

Bills Payable (CL)

200,000

100,000

10,000

40,000

840,000

3. Calculate the Current Ratio for Sweets Company.

4. Calculate the Quick Ratio for Sweets Company.

5. Calculate the Inventory to Working Capital for Sweets Company.

6. Calculate the Debt to Equity Ratio for Sweets Company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College