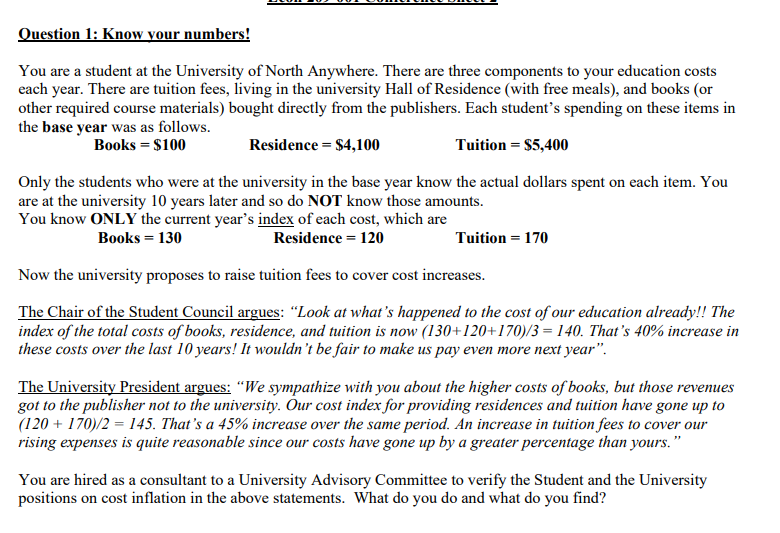

Question 1: Know your numbers! You are a student at the University of North Anywhere. There are three components to your education costs each year. There are tuition fees, living in the university Hall of Residence (with free meals), and books (or other required course materials) bought directly from the publishers. Each student's spending on these items in the base year was as follows. Books = $100 Residence = $4,100 Tuition = $5,400 Only the students who were at the university in the base year know the actual dollars spent on each item. You are at the university 10 years later and so do NOT know those amounts. You know ONLY the current year's index of each cost, which are Books = 130 Residence = 120 Tuition = 170 Now the university proposes to raise tuition fees to cover cost increases. The Chair of the Student Council argues: "Look at what's happened to the cost of our education already!! The index of the total costs of books, residence, and tuition is now (130+120+170)/3 = 140. That's 40% increase in these costs over the last 10 years! It wouldn't be fair to make us pay even more next year". The University President argues: "We sympathize with you about the higher costs of books, but those revenues got to the publisher not to the university. Õur cost index for providing residences and tuition have gone up to (120 + 170)/2 = 145. That's a 45% increase over the same period. An increase in tuition fees to cover our rising expenses is quite reasonable since our costs have gone up by a greater percentage than yours." You are hired as a consultant to a University Advisory Committee to verify the Student and the University positions on cost inflation in the above statements. What do you do and what do you find?

Question 1: Know your numbers! You are a student at the University of North Anywhere. There are three components to your education costs each year. There are tuition fees, living in the university Hall of Residence (with free meals), and books (or other required course materials) bought directly from the publishers. Each student's spending on these items in the base year was as follows. Books = $100 Residence = $4,100 Tuition = $5,400 Only the students who were at the university in the base year know the actual dollars spent on each item. You are at the university 10 years later and so do NOT know those amounts. You know ONLY the current year's index of each cost, which are Books = 130 Residence = 120 Tuition = 170 Now the university proposes to raise tuition fees to cover cost increases. The Chair of the Student Council argues: "Look at what's happened to the cost of our education already!! The index of the total costs of books, residence, and tuition is now (130+120+170)/3 = 140. That's 40% increase in these costs over the last 10 years! It wouldn't be fair to make us pay even more next year". The University President argues: "We sympathize with you about the higher costs of books, but those revenues got to the publisher not to the university. Õur cost index for providing residences and tuition have gone up to (120 + 170)/2 = 145. That's a 45% increase over the same period. An increase in tuition fees to cover our rising expenses is quite reasonable since our costs have gone up by a greater percentage than yours." You are hired as a consultant to a University Advisory Committee to verify the Student and the University positions on cost inflation in the above statements. What do you do and what do you find?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 4TIF

Related questions

Question

Transcribed Image Text:Question 1: Know your numbers!

You are a student at the University of North Anywhere. There are three components to your education costs

each year. There are tuition fees, living in the university Hall of Residence (with free meals), and books (or

other required course materials) bought directly from the publishers. Each student's spending on these items in

the base year was as follows.

Books = $100

Residence = $4,100

Tuition = $5,400

Only the students who were at the university in the base year know the actual dollars spent on each item. You

are at the university 10 years later and so do NOT know those amounts.

You know ONLY the current year's index of each cost, which are

Books = 130

Residence = 120

Tuition = 170

Now the university proposes to raise tuition fees to cover cost increases.

The Chair of the Student Council argues: "Look at what's happened to the cost of our education already!! The

index of the total costs of books, residence, and tuition is now (130+120+170)/3 = 140. That's 40% increase in

these costs over the last 10 years! It wouldn't be fair to make us pay even more next year".

The University President argues: “We sympathize with you about the higher costs of books, but those revenues

got to the publisher not to the university. Our cost index for providing residences and tuition have gone up to

(120 + 170)/2 = 145. That's a 45% increase over the same period. An increase in tuition fees to cover our

rising expenses is quite reasonable since our costs have gone up by a greater percentage than yours.

You are hired as a consultant to a University Advisory Committee to verify the Student and the University

positions on cost inflation in the above statements. What do you do and what do you find?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub