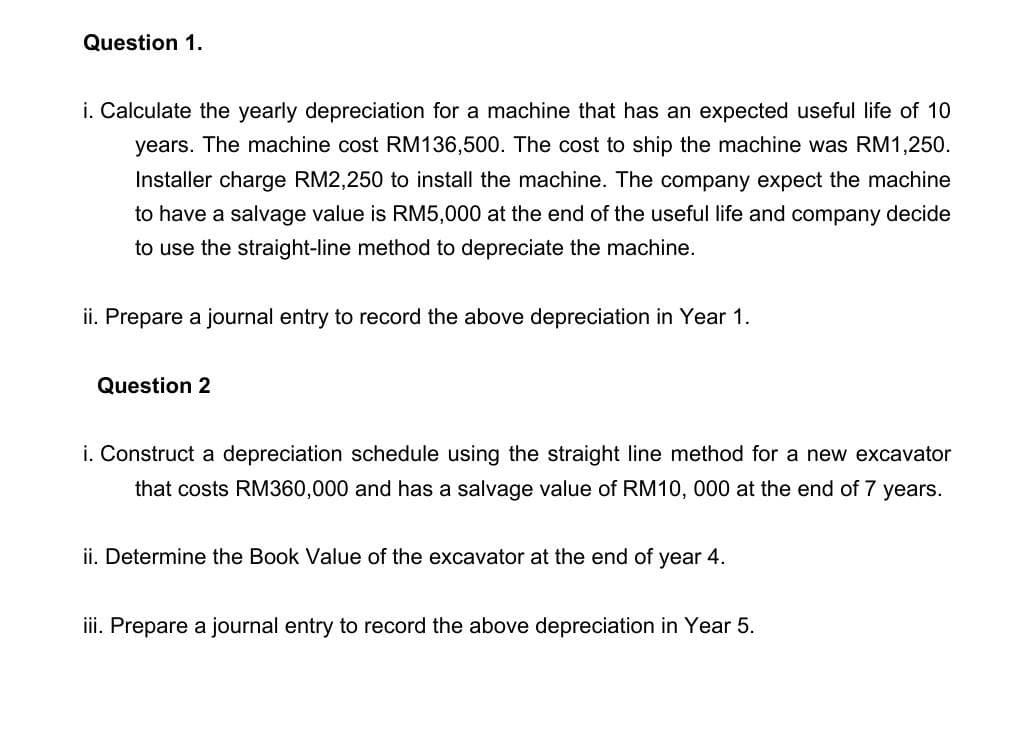

Question 1. i. Calculate the yearly depreciation for a machine that has an expected useful life of 10 years. The machine cost RM136,500. The cost to ship the machine was RM1,250. Installer charge RM2,250 to install the machine. The company expect the machine to have a salvage value is RM5,000 at the end of the useful life and company decide to use the straight-line method to depreciate the machine. ii. Prepare a journal entry to record the above depreciation in Year 1. Question 2 i. Construct a depreciation schedule using the straight line method for a new excavator that costs RM360,000 and has a salvage value of RM10, 000 at the end of 7 years. ii. Determine the Book Value of the excavator at the end of year 4. iii. Prepare a journal entry to record the above depreciation in Year 5.

Question 1. i. Calculate the yearly depreciation for a machine that has an expected useful life of 10 years. The machine cost RM136,500. The cost to ship the machine was RM1,250. Installer charge RM2,250 to install the machine. The company expect the machine to have a salvage value is RM5,000 at the end of the useful life and company decide to use the straight-line method to depreciate the machine. ii. Prepare a journal entry to record the above depreciation in Year 1. Question 2 i. Construct a depreciation schedule using the straight line method for a new excavator that costs RM360,000 and has a salvage value of RM10, 000 at the end of 7 years. ii. Determine the Book Value of the excavator at the end of year 4. iii. Prepare a journal entry to record the above depreciation in Year 5.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 19E

Related questions

Question

Do not answer question 1

Please answer Question 2

answer in word, please no handwritten or no picture/screenshot.

thank u.

Transcribed Image Text:Question 1.

i. Calculate the yearly depreciation for a machine that has an expected useful life of 10

years. The machine cost RM136,500. The cost to ship the machine was RM1,250.

Installer charge RM2,250 to install the machine. The company expect the machine

to have a salvage value is RM5,000 at the end of the useful life and company decide

to use the straight-line method to depreciate the machine.

ii. Prepare a journal entry to record the above depreciation in Year 1.

Question 2

i. Construct a depreciation schedule using the straight line method for a new excavator

that costs RM360,000 and has a salvage value of RM10, 000 at the end of 7 years.

ii. Determine the Book Value of the excavator at the end of year 4.

ii. Prepare a journal entry to record the above depreciation in Year 5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT