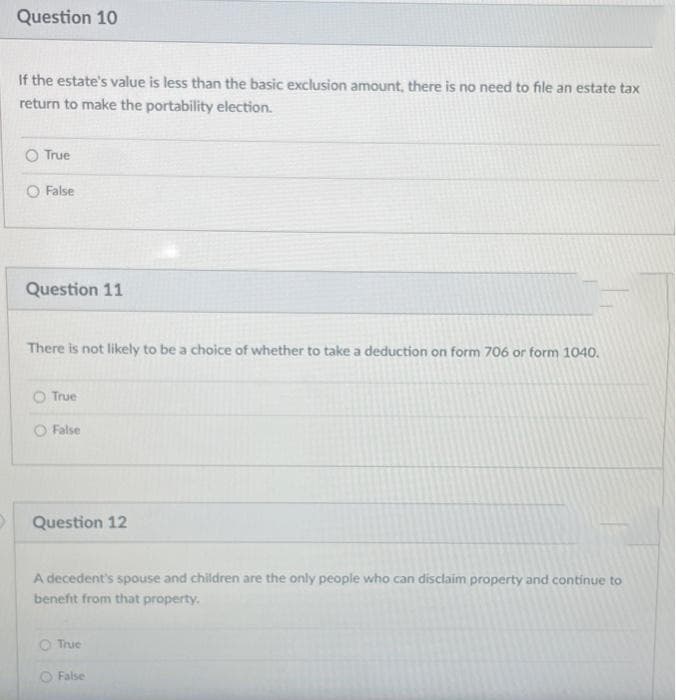

Question 10 If the estate's value is less than the basic exclusion amount, there is no need to file an estate tax return to make the portability election. True O False

Q: The following items were identified to comprise CHI company’s liabilities as of December 31, 2016…

A:

Q: Prepare journal entries to record the following transactions. A. November 19, purchased merchandise…

A: Inventory is one of the important current asset of the business. It can be in the form of raw…

Q: purchased on January 01, 2019 for $600.000. The expected life is 8 years. salvage value is $10000.…

A: Lets understand the basics. Depreciation is a reduction in value of asset due to wear and tear,…

Q: A business provider services to a customer on credit.Which of the following is correct: A.Assets…

A: Lets understand the basics. When business provider provide goods or services to customer on credit…

Q: Alta Company is constructing a production complex that qualifies for interest capitalization. The…

A:

Q: a. All future prices and future dividends are expected values OTrue OFalse

A: Since you have posted multiple questions, we shall be solving the first one for you. In case you…

Q: 1. Perform the preliminary calculations to determine goodwill. 2. Prepare an Amortization Schedule…

A: Goodwill is the amount which might arises at the time of the acquisition of some interest on the…

Q: 20-- Oct. 23 Administrative Salaries 51 2,307.69 Office Salaries 52 4,723.08…

A: 1. Group insurance premium witheld for all employees = 182.10 2. Amount of credit to SUTA taxes…

Q: n October 01, 2000, Mr Alberto opened a computer rental shop. The following transactions occurred…

A: The journal book is the first step to record the transactions of the business. Further T-accounts…

Q: Ray Corporation has two products in its ending inventory, each accounted for at the lower of cost or…

A: The question is related to Valuation of Inventories. The Inventory Should be Valued at lower of…

Q: Using the percentage method in Appendix C (or the IRS federal income tax assistant), calculate the…

A:

Q: Nordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial…

A: In the context of the given question, we compute the financial ratios. So, we explain those formulas…

Q: 2. What investment are you willing to invest? State the considerations that matter in your decision…

A: Ans. The decision regarding kind of investment is a crucial thing. The way the amounts are invested…

Q: 10. The income statement for Jeeves Ltd for 2015 is shown below: Sales (100 000 units) $40 000…

A: Answer 10) Calculation of Contribution Margin Ratio Contribution margin ratio = Contribution margin/…

Q: A tool is purehased for $500,000. The expected life is 25 years. The salvage value is $100,000. what…

A: Depreciation represents the reduction in the value of the asset over a useful life of the asset. It…

Q: Question 24) Sales 500000 258000 250000 Variable and fixed costs both Beginning retained earnings…

A: Sales revenue is the revenue earned from sale of goods and services. It will include cash sales as…

Q: It value of in two years, at 12% compounded annualy, is (rounded to nearest dollar). Use the…

A: Present Value The value in the present of a sum of money, in contrast to some future value it will…

Q: Required information [The following information applies to the questions displayed below.] Hemming…

A: Date Purchase Cost of goods sold Balance Inventory Quantity Cost per Unit (In $) Total Cost…

Q: The City of Greenville condemned 300 acres of Kayla's farmland. Kayla's land was worth $250,000 and…

A: Unrealized Gain- An unrealized gain is the amount of profit earned by an investor simply by holding…

Q: Which of these accounts is an asset? A. Common Stock B. Supplies C. Accounts Payable D. Fees Earned

A: Introduction: Assets: Asset means having Economic value to the resource. Assets are of two types: 1…

Q: Mr. Francis requires Rs. 20,000 at the beginning of each year from 2033 to 2037. The interest rate…

A: Calculation of Present value as in the beginning of 2033 of $ 20,000 to be paid in the beginning of…

Q: Prepare profit statements for each half of the year 2021 using:

A: Marginal costing (GHS) Absorption costing (GHS) Direct materials p.u 15.00 15.00 Direct labour…

Q: Asset purchased for $900,000. The expected life is 5 years. salvage value is $100,000. what is the…

A: Formula used: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life years

Q: A factory has decided to purchase some new équipment for P650, 000. The equipment will be kept for…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: KUALA LUMPUR, March 24 (Bernama) - The Ministry of Human Resources (KSM) is deliberating on the…

A: The minimum wage is the minimum or lowest amount which must be paid by the employer to its employees…

Q: Which statement is true with respect to the tax treatment of a partnership __________? A…

A: Introduction A Partnership is an association between two or more people to trade or carryout…

Q: Which of the following is not an example of control procedures to safeguard cash received from…

A: Cash is one of the important current asset of the business. It's management and valuation is very…

Q: Cushman Company had $816,000 in net sales, $357,000 in gross profit, and $204,000 in operating…

A: Cost of Goods Sold = Sales - Gross Profit

Q: Alberto’s Computer Shop (Sample Balance Sheet) On October 01, 2000, Mr Alberto opened a computer…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Canteen creditors Fixtures & fittings Independence fair expenses Wages for canteen staff Laundry…

A: A balance sheet is a financial statement that depicts a company's assets, liabilities, and…

Q: Calculate the total overhead assigned to each type of tire using the plantwide overhead rate.

A: The question is related to Plantwide Overhead Rate. The Plant Wide overhead rate is calculated with…

Q: 3. Partial information on Statement of Profit and Loss Accounts for Cronuts Sdn. Bhd. for three…

A: Inventory is considered as part of current assets. There are various ratios relating to inventory…

Q: Required information [The following information applies to the questions displayed below] On January…

A: A classified balance sheet is a financial statement under which each item of asset or liability is…

Q: E.F. Lynch Company is a diversified investment company with three operating divisions organized as…

A:

Q: Pit Coporation owns 75% of Stop Company's outstanding common stock. On 01/01/21, Pit sold sold a…

A: Date Company Particulars Debit Credit Jan-01 Pit Bank 2,36,000…

Q: citing atleast 10 different cases discuss the role of the Government of Kenya in promoting…

A: Entrepreneurship- Entrepreneurship is the act of starting a business and making money from it. An…

Q: movie production studio incurred the following costs related to its current movie: Purchased office…

A: In case of credit purchases the accounts payable will be credited.

Q: counting records and bank statement of Jeff's Seashell Store provide the following information at…

A: Bank Reconciliation Statement is not a part of Book Keeping but is a method to ensure that there are…

Q: Pit Coporation owns 75% of Stop Company's outstanding common stock. On 01/01/21, Pit sold sold a…

A: Consolidated means the combination of two firms. When two firms join together into one. For example…

Q: he partners Ma

A: The sharing of profit and loss in accordance with the profit and loss sharing ratio.it completely…

Q: The following lots of Commodity Z were avcilable for sale during the year. Beginning inventory 10…

A: FIFO (First-in First Out): Under FIFO inventory accounting, units purchased are sold first. As the…

Q: [The following information applies to the questions displayed below.] Allied Merchandisers was…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: Required information [The following information applies to the questions displayed below.] The…

A:

Q: The following data summarize the operations during the year. A. Purchase of raw materials on…

A: There are two type of costs being incurred in business of manufacturing or purchases. These may be…

Q: 500000 258000 250000 62000 Ending retained Earnings? Question 24 ) Sales Variable and fixed costs…

A: The retained earnings of the business are affected by net income or loss, or dividend paid during…

Q: Ralston Consulting, Inc., has a $47,000 overdue debt with Supplier No. 1. The company is low on…

A: Business organizations are required to evaluate whether a particular project is profitable or not.…

Q: On 30 June 2018, HTL Bhd classifies a business segment as a disposal group for sale. The carrying…

A: Impairment loss is the result of decline in the fair market value of an…

Q: A citizen receives a notification from the CRIM specifying that his tax obligation is $3,000 per…

A: CRIM is criminal specifying tax obligation, It is tax evasion, if a person or a business avoid…

Q: For the 2019 taxation year, Sylvia Ivany has net employment income of $90,000, spousal support…

A: The RRSP deduction limit is the amount that can be deposited as an RRSP contribution. This is…

Q: Budgeting is important not only for businesses. Also in our personal lives we have scarce resources,…

A: Budgets are the quantitative estimates for revenues and costs for a particular period, which are to…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 59 S1 - Estate tax is a tax on the transfer of estate upon death by the decedent to his beneficiaries. S2 - In all types of decedents, the basis of estate tax is net estate or net taxable estate. Group of answer choices Both are false S2 is true S1 is true Both are trueESSAY QUESTION NO. 02 Mr. A, 90 years old and suffering from an Stage IV Terminal Lung Cancer, decided to sell for valuable and sufficient consideration a property to his son. After one year, Mr. A unfortunately died. In the settlement of Mr. A's estate, the BIR argued that the house and lot were transferred in contemplation of death and should therefore form part of the gross estate for estate tax purposes. Is the BIR correct?Question #5 of 85 Your client wants to purchase a residence for his aging parents, while minimizing the burden of ownership of the property for them and maximizing their enjoyment of it. Which one of the following states an advantage of titling the property in your client's name as sole owner rather than in joint tenancy with right of survivorship with his parents? A) He will avoid gift tax liability by titling the property this way. B) The property will pass to his parents outside of probate. C) The property will receive a step-up in basis when his parents die. D) His parents will have a life estate in the property if he predeceases them.

- 45 1. S1 – nicanor sold his house and lot for Php 5,000,000.00 which is the fair market value of the property. Upon his death, no amount attributable to the property will form part of the estate. S2 – standard deduction is automatic and requires no proof Both are false Both are true S1 is true S2 is true 2. S1 – in claiming insolvency, the fact must be proven and not merely alleged. S2 – Nicanor died, his total gross estate amounted to Php 5 million. A certification by an independent certified public accountant shall be required Both are true S2 is true S1 is true Both are falseQuestion #24 of 85 Question ID: 1251785 To avoid probate, Art is contemplating the transfer of his bond portfolio to an irrevocable trust. He will retain the right to the income from the trust for a specified term of years, after which the principal is to be distributed to his grandchildren. Which of the following statements correctly describe the tax implications of the intrafamily transfer to a grantor retained income trust (GRIT) that Art is considering? Regardless of when Art dies, the total value of the trust at the time of his death will be included in his gross estate. Art is entitled to a gift tax annual exclusion for the present value of the interest that he irrevocably transferred to his grandchildren. For purposes of calculating the gift tax value, Art's retained income interest has a value of zero; therefore, he will have gift tax liability based on the total value of the assets transferred into trust. All income earned by the trust is taxable to Art each year.…MULTIPLE CHOICE 1. In determining whether the taxability of the income is derived from within or without:a. The source of the income is taken into considerationb. The income itself and not the sourcec. The location of the propertyd. All of the above 2. Jessie is a non-VAT seller of goods. Since he has no official receipts or invoices to support hisexpenses, he opted for the Optional Standard Deduction (OSD). When he filed his income tax return,he intentionally applied the rate of 20% on his gross sales. In this case, Jaime applied this type ofscheme:a. Capitalizationb. Shiftingc. Evasiond. Avoidance

- Question 17 The gift tax is an excise tax on the right of one person to transfer his/her property to another person and the tax must be paid by the donee. True False Question 18 True or False. One of the purposes of the gift tax, now known as the inter vivos transfer tax, is to prevent people from avoiding the estate tax by giving away their property before death. True False Question 19 The formula for computing the federal gift tax payable on taxable gifts made in 2020 has the following steps: 1. Calculate the tax on all taxable gifts. 2. Calculate the tax on all taxable gifts made in years prior to 2020. 3. Subtract the number calculated in step 2 from the number calculated in step 1. 4. Subtract the donor's unused gift tax unified credit from the number calculated in step 3. True False#54 of 85 Question ID: 1251845 Last year, your client and his wife gave their adult son a one-third interest in a commercial office building. Each has a one-third interest as tenants in common. If your client dies while still owning the property as a tenant in common, an estate tax implication of this form of property ownership is that A) one-third of the value of the property will be included in your client's gross estate. B) one-half of the value of the property will be included in your client's gross estate. C) the entire value of the property will be included in your client's gross estate because his estate cannot prove contribution by the other tenants in common. D) your client's estate will be entitled automatically to a marital deduction of one-half of the date-of-death value.Question 2 During the year ended 5 April 2022 Eric (a higher rate taxpayer) disposed of the following asset: (a) A small cottage in Devon which he had inherited in August 1988 when its value was £20,000 and he subsequently used as a holiday cottage for his own use. In September 1989 he had added a conservatory to the property at a cost of £3,500. Eric did not use the cottage as his main residence at any stage, and he sold it for £225,000 in July 2021. Eric incurred legal and estate agent’s fees of £1,500 on the disposal of the property. (b) A vacant 8-hectare plot of land for £52,800 in February 2022. The plot was part of a 12-hectare plot originally bought by Eric for £31,700 in October 1988 and not used by him as a business asset nor is it associated with a residential property. Incidental costs of disposal were £1,300. The remaining 4-hectare plot was valued at £22,000 in February 2022. © Eric sold a motor car for £18,400. The car was purchased in January 2012 for £17,800.…