Question 14 Hamad Town Company had the following balances in the stockholders' equity accounts at Dec. 31, 2020: - Common stock, $10 par, 50,000 shares authorized, 30,000 shares issued and outstanding ..$ 300,000 Paid in Capital in Excess of Par Value, Common Stock Retained Eamings The following transactions occurred during 2021: 1. Feb. 20: Purchased 2,000 of its own shares for $ 18 per share. 2. March 10: Declared a $2 per share cash dividend on the outstanding common stock 3. April 07: Paid the cash dividends declared early in March 10. 4. May 20: Sold all treasury shares for $19 each, 5. Oct. 1: Declared 10% stock dividends on the outstanding common stock for the record of Nov. 1 and to be distributed on Dec. 10; The market value of stock on Oct. 1 was $14 per share. 6. Dec. 10: Distributed the shares which declared on Oct. 1. 7. Dec. 25: Implemented a 2-for-1 stock split, when the market value of stock was $26 per share, NOTE: If there is no entry, please write: "NO ENTRY" Required: Prepare Journal entries to record transactions that occurred during 2021. 200,000 500,000 DEDDTE 9 CR EDITS

Question 14 Hamad Town Company had the following balances in the stockholders' equity accounts at Dec. 31, 2020: - Common stock, $10 par, 50,000 shares authorized, 30,000 shares issued and outstanding ..$ 300,000 Paid in Capital in Excess of Par Value, Common Stock Retained Eamings The following transactions occurred during 2021: 1. Feb. 20: Purchased 2,000 of its own shares for $ 18 per share. 2. March 10: Declared a $2 per share cash dividend on the outstanding common stock 3. April 07: Paid the cash dividends declared early in March 10. 4. May 20: Sold all treasury shares for $19 each, 5. Oct. 1: Declared 10% stock dividends on the outstanding common stock for the record of Nov. 1 and to be distributed on Dec. 10; The market value of stock on Oct. 1 was $14 per share. 6. Dec. 10: Distributed the shares which declared on Oct. 1. 7. Dec. 25: Implemented a 2-for-1 stock split, when the market value of stock was $26 per share, NOTE: If there is no entry, please write: "NO ENTRY" Required: Prepare Journal entries to record transactions that occurred during 2021. 200,000 500,000 DEDDTE 9 CR EDITS

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.13AMCP

Related questions

Question

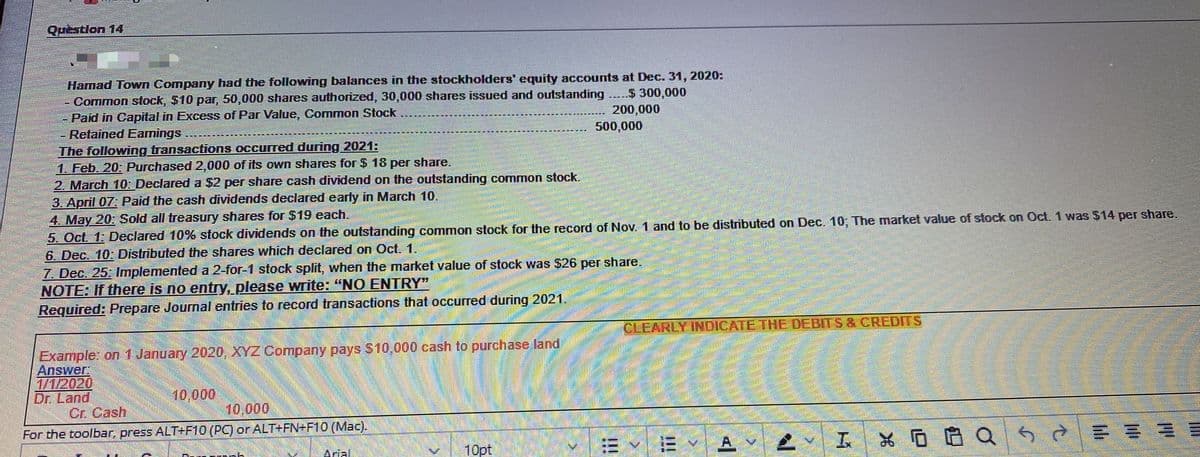

Transcribed Image Text:Question 14

Hamad Town Company had the following balances in the stockholders' equity accounts at Dec. 31, 2020:

- Common stock, $10 par, 50,000 shares authorized, 30,000 shares issued and outstanding ....$ 300,000

Paid in Capital in Excess of Par Value, Common Stock

Retained Eamings

The following transactions occurred during 2021:

1. Feb. 20: Purchased 2,000 of its own shares for $ 18 per share.

2. March 10: Declared a $2 per share cash dividend on the outstanding common stock.

3. April 07: Paid the cash dividends declared early in March 10.

4. May 20: Sold all treasury shares for $19 each.

5. Oct. 1: Declared 10% stock dividends on the outstanding common stock for the record of Nov. 1 and to be distributed on Dec. 10; The market value of stock on Oct. 1 was $14 per share.

6. Dec. 10: Distributed the shares which declared on Oct. 1.

7. Dec. 25: Implemented a 2-for-1 stock split, when the market value of stock was $26 per share.

NOTE: If there is no entry, please write: "NO ENTRY"

Required: Prepare Journal entries to record transactions that occurred during 2021.

200,000

500,000

CLEARLY INDICATE THE DEBITS & CREDITS

Example: on 1 January 2020, XYZ Company pays S10,000 cash to purchase land

Answer:

1/1/2020

Dr. Land

Cr. Cash

10,000

10,000

For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

10pt

*回自Q50

Arial.

!!!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning