Question 14 The current share price of a resources company is $6.85. (a) A shareholder owns 880 shares in the company, and it has announced a dividend per share of 4.5% of the share price. Determine the dividend the investor will receive. (b) Determine the total cost for the shareholder to buy another 250 shares in the company at their current price, given that their broker charges a fee of $40 plus a commission of 1.6% of the value of the shares bought. (c) Over the course of a year, the share price of the company increased from $5.31 to its current price. Determine the percentage increase in the share price.

Question 14 The current share price of a resources company is $6.85. (a) A shareholder owns 880 shares in the company, and it has announced a dividend per share of 4.5% of the share price. Determine the dividend the investor will receive. (b) Determine the total cost for the shareholder to buy another 250 shares in the company at their current price, given that their broker charges a fee of $40 plus a commission of 1.6% of the value of the shares bought. (c) Over the course of a year, the share price of the company increased from $5.31 to its current price. Determine the percentage increase in the share price.

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter10: Sequences, Series, And Probability

Section10.3: Geometric Sequences

Problem 81E

Related questions

Question

show workign out where possible

Transcribed Image Text:Question 14

The current share price of a resources company is $6.85.

(a)

A shareholder owns 880 shares in the company, and it has announced a dividend per

share of 4.5% of the share price. Determine the dividend the investor will receive.

(b)

(c)

(d)

Determine the total cost for the shareholder to buy another 250 shares in the company at

their current price, given that their broker charges a fee of $40 plus a commission of 1.6%

of the value of the shares bought.

Over the course of a year, the share price of the company increased from $5.31 to its

current price. Determine the percentage increase in the share price.

The company reported that its latest earnings per share was 41.5 cents. Determine the

price to earnings ratio for this company.

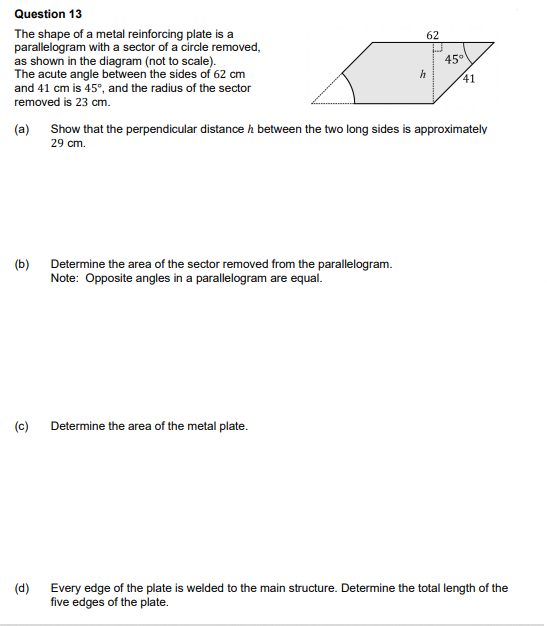

Transcribed Image Text:Question 13

The shape of a metal reinforcing plate is a

parallelogram with a sector of a circle removed,

as shown in the diagram (not to scale).

The acute angle between the sides of 62 cm

and 41 cm is 45°, and the radius of the sector

removed is 23 cm.

(a)

(b)

(c)

(d)

Determine the area of the sector removed from the parallelogram.

Note: Opposite angles in a parallelogram are equal.

62

Determine the area of the metal plate.

h

45°

Show that the perpendicular distance between the two long sides is approximately

29 cm.

41

Every edge of the plate is welded to the main structure. Determine the total length of the

five edges of the plate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage