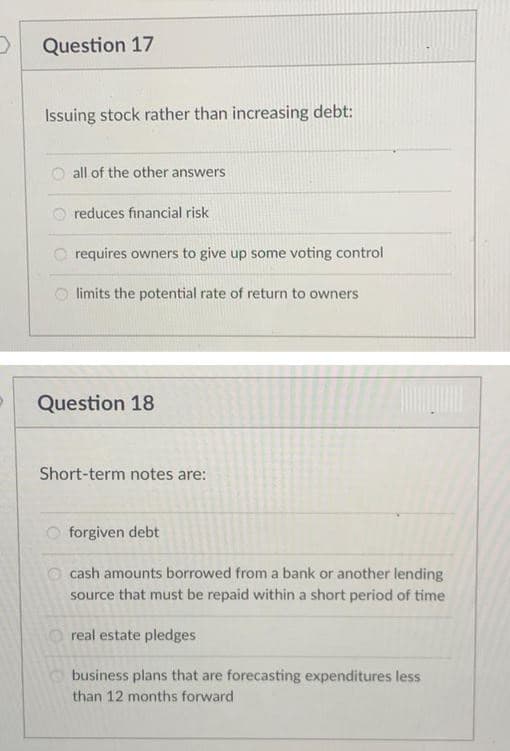

Question 17 Issuing stock rather than increasing debt: O all of the other answers O reduces financial risk O requires owners to give up some voting control O limits the potential rate of return to owners

Q: In the spot market, P1 = 100 USD, 1 USD = 0.95 Yen, and 1 Yen = 5.50 British Pound. What is the exch...

A: The cross rate functions can be used to calculate the exchange rate of Peso and Pound

Q: Required a. Calculate the revised carrying amount of the assets for this CGU for the year ending 31 ...

A: Whenever the impairment case arises, the impairment is first allocated to goodwill and then other as...

Q: nominal annual interest rate on 6-month USD Treasury Bill is 4.50%. The spot rate of the Euro is $3....

A: If the interest parity hold than spot rate and forward must be in equilibrium with interest rates of...

Q: has issued 10-year bonds, with a face value of $1,000,000, in $1,000 units. Interest at 8% is paid q...

A: The price of bond is present value of coupon payment and present value of par value of bond to be re...

Q: dream A person wants to triple a sum of money by investing it for 17 years, and is shopping around f...

A: Solution:- When an amount is invested somewhere, it earns interest on it. So, the amount at maturity...

Q: Your uncle is trying to figure out how much he has to have set aside today to pay for his son's unde...

A: The value of current payment or upcoming flow of payments at any future date when flow of payment te...

Q: A construction company agreed to lease payments of $481.44 on construction equipment to be made at t...

A: Calculate the value of the Present Value of Original Lease Contract (PV): Here, the original lease c...

Q: 3 | I5 LTN Best, worst, and average returns for various stock/bond allocations, 1997-2019 Portfolio ...

A: Data given:: Bond Stock Investment % ...

Q: III. Break-Even Point 1. Sale Revenue = 450,000 Fixed Cost = 100,000 Cost = 10,000 BP = ? 2. Sale Re...

A: The Break-even point is the point where the company is no gain and no loss position. The Break-even ...

Q: A company has a P1,200 face value bond with 8 years until maturity. The bond possesses a characteris...

A: Approximate Yield to maturity is the rate of return of a bond with an assumption that the bond will ...

Q: The following data are gathered for: · The real risk-free rate is 1.25% · Inflation ...

A: The real risk-free rate (RP) = 1.25%Inflation premium is constant (IP) = 2.50%Default risk premium ...

Q: This term is often used by various industries to determine the amount of risk an individual presents...

A: Analysis of the given options: i) Capital- Capital is money put to use for economic purpose and help...

Q: A certain machinery costs P 50,000 lasts 12 years with a salvage value of P 5,000. If the owner dec...

A: Depreciation is the allocation of cost of asset over the useful period of life. Under double declini...

Q: Find the future value of the following ordinary annuity. Periodic Interest Rate Payment Interval Ter...

A: The time value of money states that the same amount of money will have more value today than in the ...

Q: Bulldogs Inc. wants to establish a bond portfolio consisting only of BDO bonds which has a maturity ...

A: Par value (P) = P 1000 Coupon (C) = 5% of 1000 = P 50 r = YTM = 10% We need to find the total portfo...

Q: What is the difference between VaR as it has been traditionally measured and stressed VaR? Explain y...

A: Value at Risk is to Define as :- Value at risk (VaR) is a statistic that quantifies the extent of po...

Q: A car loan of $28,641.62 is to be repaid with end-of-month payments of $582.15. If interest is 4% co...

A: EMI stands for equated monthly instalments. It is a series of payment provided by the borrower to a ...

Q: Consider a portfolio with a market value of $50 million and a modified duration of 7 years. Its mana...

A: Modified duration is the change in duration of re-coverability of investment due to change in yiel...

Q: An investor is considering an investment that will pay $2,290 at the end of each year for the next 1...

A: The payment required to be made today for the investment can be calculated as the present value of a...

Q: analyst is trying to determine the intrinsic value of a certain share. Which of the following is tru...

A: To find out the intrinsic value o the stock there two methods one is dividend discount model and fre...

Q: 10. Growth Rates The stock price of Alps Co. is $67. Investors require a return of 10.5 percent on s...

A: The growth rate of the dividend can be calculated as per the dividend discount model

Q: Instruction: Solve the following problems on a piece of paper. Show your solution. 1. A man buys a t...

A: The present value of the loan is equal to the sum of the present values of all the future installmen...

Q: udy has just completed the development of a better face shield for health workers. The new product i...

A: Annual revenue = $150,000 Investment = $9000.34 Life = 5 years Salvage value = $3000 Working capital...

Q: Required: a. How much should he pay today for the investment? b. How much should he pay if the inves...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: You are considering a 30-year, $1,000 par value bond. Its coupon rate is 8%, and interest is paid se...

A: Effective annual rate = 10.38% Effective semiannual rate = (1+Interest rate)^(6/12)-1 = 1.1038^.5-...

Q: Find the present value of $6000, due after 4J years, if money can earn interest at the rate (.08,m =...

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: You have an opportunity to invest in a FinTech start up. You will have to make two annual payments -...

A: Expected annual return or IRR indicates the anticipated compound annual rate of return earned on an ...

Q: Thorley Inc. is considering a project that has the following cash flow data. What is the project's I...

A: IRR is the rate of return at which the present value of cash inflows equal the project cost

Q: You are an investor who is interested in purchasing AC shares which is currently trading at a price ...

A: Growth rate (g) = 3% Required return (r) = 8% Expected dividend (D1) = P25

Q: George deposits $500 at the end of each quarter for 6 years, in an account paying 12 % compounded qu...

A: An annuity is a type of financial product offered by insurance companies and financial institutions....

Q: Suppose you obtain a 30-year mortgage loan of $193,000 at an annual interest rate of 8.6%. The annua...

A: Mortgage loan is a kind of secured loan, whereby, the lender provides the desired funds to the borro...

Q: ur uncle is trying to figure out how much he has to de today to pay for his son's undergraduate educ...

A: Effective interest rate is interest rate considering the impact of compounding and is more with more...

Q: After the repurchase how many shares

A: Shares are the equity ownership of the corporation. Dividends to be paid out of profits to all the e...

Q: The selection of certain tenants for a retail center that will promote a complementary relationship ...

A: Tenant mix- it is the combination of business in a shopping mall that produces optimum sales. It is ...

Q: Bulldogs Inc. has a financial break-even point at P163,500. How much is the total preferred dividend...

A: Financial breakeven deals with bottom line of company income statement. It is the level of EBIT at w...

Q: deposit function, the bank is the _____ and the depositors are the ______ a. drawee - payees b. de...

A: Banks do many function for customers and the one of the main function is the deposits made by the cu...

Q: equipment R20000, accumulated depreciation R16000. Depreciation is calculated at 20% p.a. on a dimin...

A: Depreciation: It is the wear and tear of the value of the equipment over the period of the time due ...

Q: You are looking at a project analysis, which yields a net present value of $ 18,829. The project ana...

A: Working capital involves for the amount of cash put for maintain short-term assets as they are requi...

Q: Suppose Ford sold an issue of bonds with a 14-year maturity, a $1400 par value, a 10% coupon rate, a...

A: Price of the bond is calculated by discounting all the future cash flows by the discounting rate. Pr...

Q: four-year lease agreement requires payments of $10,000 at the beginning of every year. If the intere...

A: Effective Annual Rate The effective annual rate of interest is the actual or the real rate of intere...

Q: Find the future value of the following ordinary annuity. Periodic Payment Interest Rate Payment Inte...

A: The value of current payment or upcoming flow of payments at any future date when flow of payment te...

Q: A construction company agreed to lease payments of $481.44 on construction equipment to be made at t...

A: a) Original lease payment PNT=$481.44 (Quarterly) n= 5*4= 20 Months i= 7/4= 1.75%= 0.0175 PVn= PNT1...

Q: Jie purchased a computer priced at $891.06, financing it by paying $60.38 on the date of purchase, a...

A: Solution:- We know, when an asset is purchased, it may be possible that the amount is paid in equal...

Q: The following data are available for a bond Face value 7 1,000 Coupon Rate 16% Years to Maturity Red...

A: Face Value = 1,000 Coupon rate = 16% Years to maturity = 6 Redemption value = 1,000 Yield to matur...

Q: ¿How much is the Customer Lifetime Value? (Select best answer) Assumptions: Retention Rate= 75%, Av...

A: We need to write down what we have given in this Question Retentions Rate=75% Average Annual Costume...

Q: The required price per share will be $

A: Face Value or Maturity value of Bond = $1000 Conversion ratio = 31 Required price of share = Face V...

Q: A four-year lease agreement requires payments of $20,000 at the beginning of every year. If the inte...

A: Annual payment (P) = $20,000 Interest rate = 7% Effective annual interest rate (r) = [1+(0.07/12)]12...

Q: What is the basic or essential function of the financial markets? Briefly explain how and in what al...

A: Financial market is referred as the market, where the people used to trade the financial derivatives...

Q: You own a put option on Ford stock with a strike price of $9. When you bought the put, its cost to y...

A: Put Option: A put option gives the holder the right, but not an obligation to sell the underlying as...

Q: Suppose that P 4500 is deposited each year into a bank account that pays 8% interest compounded quar...

A: When an amount is deposited in any account, it pays interest. A series of equal annual payments is c...

Step by step

Solved in 2 steps

- Question 23 Which of the following is an advantage of equity financing vs debt financing? A If the company makes no profit in a year it has no legal obligation to pay a dividend. B paid to shareholders attract tax relief and so lower the company tax bill. C Equity holders can exert significant pressure of management of a company. D Equity financing can typically be used for all sizes of financing from a few hundred pounds to billions.Ch. 13. For questions 7, 8, and 9, use the following information: Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt? Format as a percentage and round to two places past the decimal point as "X.XX"Module 6 Question 2 (Individual or component costs of capital) Compute the cost of capital for the firm for the following: a. Currently bonds with a similar credit rating and maturity as the firm's outstanding debt are selling to yield 8.00 percent while the borrowing firm's corporate tax rate is 34 percent. b. Common stock for a firm that paid a $1.05 dividend last year. The dividends are expected to grow at a rate of 5.0 percent per year into the foreseeable future. The price of this stock is now $25.00. c. A bond that has a $1,000 par value and a coupon interest rate of 12.0 percent with interest paid semiannually. A new issue would sell for $1,150 per bond and mature in 20 years. The firm's tax rate is 34 percent. d. A preferred stock paying a dividend of 7.0 percent on a $100 par value. If a new issue is offered, the shares would sell for $85.00 per share. a. The after-tax cost of debt debt for the firm is ________%.

- Problem 20-03 Fill in the table using the following information.Assets required for operation: $11,000Firm A uses only equity financingFirm B uses 30% debt with an 8% interest rate and 70% equityFirm C uses 50% debt with a 10% interest rate and 50% equityFirm D uses 50% preferred stock financing with a dividend rate of 10% and 50% equity financingEarnings before interest and taxes: $1,100If your answer is zero, enter "0". Round your answers for monetary values to the nearest cent. Round your answers for percentage values to one decimal place. A B C D Debt $ $ $ $ Preferred stock $ $ $ $ Common stock $ $ $ $ Earnings before interest and taxes $1,100.00 $1,100.00 $1,100.00 $1,100.00 Interest expense $ $ $ $ Earnings before taxes $ $ $ $ Taxes (40% of earnings) $ $ $ $ Preferred stock dividends $ $ $ $ Income available to common stockholders $…Ch. 13. For questions 7, 8, and 9, use the following information: 7.) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt? Format as a percentage and round to two places past the decimal point as "X.XX" 5.53 8.) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. Using the pretax cost of debt from Question…QUESTION 65 The assets of Uptown Stores are currently worth $346,000. These assets are expected to be worth either $320,000 or $365,000 one year from now. The company has a pure discount bond outstanding with a $350,000 face value and a maturity date of one year. The risk-free rate is 3.9 percent. What is the value of the equity in this firm? • $11,347 • $9,507 • $10,015 • $9.915 O $12,671

- 1. Explain FOUR(4) reasons that make money market instruments a popular investment among investors even though the return is low 2. On 1st January 2021, Howard bought a Treasury bill with RM 950. The T-bill has face value of RM1,000 and maturity day of 180 days. Calculate the annualized holding period yield if Howard sells the T-bill on24thMarch 2021 with the price of RM980 3. Elaborate THREE (3) internal factors that contributes to the price volatility of a listed company stock. 4. “When a stock is overvalued, its return is less than the required rate of return.” Is this statement true or false? Justify.Question No 01: Organization ABC Stock is traded in the Lahore Stock Exchange and has a Market Price of Rs.13. The Company has fixed the Dividend to be Rs.2 per share. The Par Value of each offer is Rs.10. You expect the Price should be Rs.13 after 2 years. As the financial specialist, you expect a Minimum Required Return of 10% because you can earn that much from a bank deposit account almost risk-free. BUT, Stocks are generally more risky investments than bank deposits SO you will only invest in risky stock IF the expected return is higher than 10% - let's say 15%. Figure the estimation of Stock Value.Question 1Firm A’s capital structure contains 20% debt and 80% equity. Firm B’s capital structurecontains 50% debt and 50% equity.Both firms pay 7% annual interest on their debt. Firm A’s shares have a beta of 1.0and Firm B’s beta of 1.375. The risk-free rate of interest equals 4%, and the expectedreturn on the market portfolio equals 12%. RequiredA. Calculate the WACC for each firm assuming there are no taxes.B. Recalculate the WACC figures assuming that the two firms face a marginaltax rate of 34%. What do you conclude about the impact of taxes from yourWACC calculations? C. Explain the simplifying assumptions managers make when using WACC asa project discounting method and discuss some of the common pitfallswhen using WACC in capital budgeting.

- Exercise 4 (it's only one question)In 2016 the company FinTech.Inc had a capital structure which is as follows: Capital structure Book value Long-term bank debt $2,000,000 Bond loan $5,000,000 Preferred shares NV=$70 $7,000,000 Ordinary actions 200,000 shares $10,000,000 Non-distributed profit $3,000,000 The annual interest rate of the bank debt is 6%, the company issued its bond loan by offering a nominal annual coupon rate pf 8%, the maturity date is scheduled in 15 years, the bond currently being exchanged on the bond market at a price of $1,260, the issuance of a new bond loan at the market price with a 15 years maturity will gnerate deductible issue costs of 3%of the nominal value of the bond.The common share is currently trading on the stock market at a price of $65, an issue of shares at market price will cost 2% of the sale price in issue costs which are tax deductible, the next dividend is estimated at $2.2 the dividend growth rate is 5%, the company only…Debt To Equity Data: 2018: 0.27x 2019: 0.23x 2020: 0.21x 2021: 0.18x 2022: 0.17x Question: which of the following transactions and events would result in a deterioration in Debt to Equity in year 2021? 1) a share buy-back 2) receiving cash for unearned sales revenue 3) the purchase of machinery financed entirely by a reducing-balance bank loan 4) A and B only 5) A and C only 6) B and C only 7) All of the above 8) None of the aboveINV 1 3a Your analysis has indicated that the shares of Levi’s Riveting Co. are highly over-valued. To take advantage of this expectation, you decide to sell short 900 shares at $20 each. The initial margin for short sales in your brokerage account is set at 60% (i.e., 160% of the value of the short sale). The minimum margin requirement is 40%. The stock will pay no dividends during the period, and you will not remove any money from the account before making the offsetting transaction. At what price would you face a margin call?