Question 17 Koda Agriculture is doing a CBA (cost benefit analysis) on a investment project renewing the machinery used on the farm. The old machinery is sold in the beginning of the project for 33.000 euro. The investment must have positive NPV (net present value) within 5 years. In the end of the period (5 years) the planned reselling value (scrap value) of the equipment is 100.000 euro. The rates used are 8% and inflation is estimated to be 3% a year. List of cost items and benefit items are listed below: What is the NPV? New equipment Initial investment Quantity Cost/item (€) Benefits/year (C) Total improved yield better products labor cost reduction 23.000 tractors conveyor belt threshing machine grain separator irrigation system 3- 50.000 25.000 1- 2- 2- 25.000 23.000 7.000 19.000 1- 60.000 Cost per year Quantity Cost/item (e) operation cost facility cost insurance cost 1- 6.000 1- 12- 3.000 700

Question 17 Koda Agriculture is doing a CBA (cost benefit analysis) on a investment project renewing the machinery used on the farm. The old machinery is sold in the beginning of the project for 33.000 euro. The investment must have positive NPV (net present value) within 5 years. In the end of the period (5 years) the planned reselling value (scrap value) of the equipment is 100.000 euro. The rates used are 8% and inflation is estimated to be 3% a year. List of cost items and benefit items are listed below: What is the NPV? New equipment Initial investment Quantity Cost/item (€) Benefits/year (C) Total improved yield better products labor cost reduction 23.000 tractors conveyor belt threshing machine grain separator irrigation system 3- 50.000 25.000 1- 2- 2- 25.000 23.000 7.000 19.000 1- 60.000 Cost per year Quantity Cost/item (e) operation cost facility cost insurance cost 1- 6.000 1- 12- 3.000 700

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 8PROB

Related questions

Question

Transcribed Image Text:Question 17

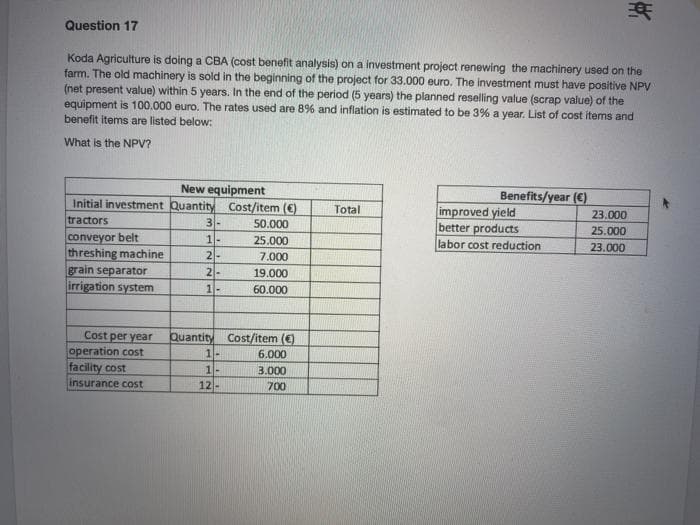

Koda Agriculture is doing a CBA (cost benefit analysis) on a investment project renewing the machinery used on the

farm. The old machinery is sold in the beginning of the project for 33.000 euro. The investment must have positive NPV

(net present value) within 5 years. In the end of the period (5 years) the planned reselling value (scrap value) of the

equipment is 100.000 euro. The rates used are 8% and inflation is estimated to be 3% a year. List of cost items and

benefit items are listed below:

What is the NPV?

New equipment

Initial investment Quantity Cost/item (€)

Benefits/year (C)

improved yield

better products

Total

23.000

tractors

3-

50.000

25.000

conveyor belt

threshing machine

grain separator

irrigation system

1-

25.000

labor cost reduction

23.000

2-

7.000

2-

1-

19.000

60.000

Cost per year

Quantity Cost/item (€)

operation cost

facility cost

insurance cost

6.000

1-

3.000

12-

700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning