Question 18: What is the total Medicare tax rate for an employee who is subject to both standard Medicare tax and Additional Medicare tax? Answer: А. O 2.35% В. O 2.45% С. O 6.2% D. O 7,65%

Q: On August 15, 2021, Bob bought a rental house. The property cost $310,000. Of this, the land was val...

A: As per GDS MACRS method, for residential rental property- 27.5 year, straight line class with mid mo...

Q: which of the following will not be deducted to compute the consolidated cost of goods sold? A. Inte...

A: Consolidated financial statements means financial statements of overall group where company have one...

Q: The role of management accountant has changed considerably over the last few decades from being prim...

A: Nowadays most good companies in public and private sector employs Management accountants, their du...

Q: Jasper makes a $36,000, 90-day, 9% cash loan to Clayborn Company. Jasper's entry to record the colle...

A: Calculation of Interest amount at maturity date Loan amount - $36,000 Interest rate - 9% Number of d...

Q: Alexander Company purchased a piece of equipment for $14,000 and depreciated it for three years over...

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If yo...

Q: Bing Company sells its product for $106 per unit. Variable manufacturing costs per unit are $47, and...

A: Fixed manufacturing costs per unit = fixed manufacturing costs / Units produced Total Fixed manufact...

Q: Question 14: The original Social Security tax rate was of taxable earnings. Answer: A. 10% O 1% с. 5...

A: Retirement Planning: Retirement planning alludes to monetary techniques of saving, ventures, and, at...

Q: On decmeber 31, the trial balance indicates that the supplies account has a balance, prior to the ad...

A: The journal entries are prepared to keep the record of day to day transactions of the business. The...

Q: Units-of-Production Method A machine is purchased January 1 at a cost of $59,000. It is expected to ...

A: Rate of depreciation per unit Cost of the machine - salvage value / expected number of units that ca...

Q: A company that manufactures general-purpose transducers invested P2 million 4 years ago in high-yiel...

A: Interest means the extra amount which we received because of investment made and will be paid in cas...

Q: For each action for X co. below you should draw up a balance sheet and income statement that reflect...

A: Balance Sheet, comprise of assets, liabilities and shareholder's funds that helps several users to t...

Q: On February 1, 20x21, Paco Corp. acquired outstanding ordinary shares of School Inc. for cash. The i...

A: Control premium: Control premium refers to a sum that the buyer will pay over the honest assessment ...

Q: On July 1, 2020, Shroff Company leased a warehouse building under a 10-year lease agreement. The lea...

A:

Q: inventories

A: Computation of Consolidated net income for the year 20x2

Q: 3. Dumble Mr Dumble owns a large but very run-down castle, Doors Castle, and is thinking of runnin...

A: Net Present Value=Present Value of Annual Cash Flows+Present Value of Terminal Cash Flow-Initial Cas...

Q: Kyle Struck's filing status is single, and he has earned gross pay of $2,340. Each period he makes a...

A: Medicare tax refers to the tax levied by the government that helps in funding the Hospital Insurance...

Q: Muller Computers stores its inventory in a warehouse that burned to the ground in late November, 201...

A: Calculation of ending inventory Ending inventory = Beginning inventory + Purchases - Cost of Goods s...

Q: TSC uses job costing and applies overhead using a normal costing system using direct labour hours as...

A: Formula: Overhead Allocation rate = Total estimated overhead / Estimated direct labor hours

Q: The following table summarizes cash flows for a project: Year Cash Flow at End of Year $-5,100 1 $3,...

A: The student has particularly asked for part'c' of the question. Internal rate of return refers to th...

Q: assuming the beginning of the year (20X3) balance |in the Investment in A account is $716,000 comple...

A: Consolidated worksheet is a statement which is prepared as a financial help for creating other finan...

Q: Costs assigned to an activity pool for teaching children to swim at the county park are $2,700 per m...

A: Here in this case we are required to calculate allocation rate for activity. Allocation rate is a ra...

Q: Oriole Company began the year with owner's equity of $301000. During the year, the company recorded ...

A: GIVEN Beginning stockholder's Equity=$301,000 Revenues = $386,000 Expense =$289,000 Dividends ...

Q: Discuss the relevant accounting treatments. At the date of acquisition, assets of Sahara Berhad in...

A: In accounting, intangible assets means non monetary assets that can not be seen ,touched and physica...

Q: QUESTION 1 Which of the following statements is true: LAgency theory suggests that the principal's j...

A: Answer:- Definition of Agency theory:- The relationship of agency is created when one person usuall...

Q: On January 1, 2021, MANGO Corp. issues $100 million of convertible bonds at par value. The bonds ha...

A:

Q: Walman Company has budgeted to produce 44,000 units of Product Y for March 20Y9. To make one unit of...

A: Given Walman Company has budgeted to produce 44,000 units Actual beginning and desired ending inven...

Q: Question 12: Employees are required to contribute toward the purchase of disability insurance in all...

A: Amount for Long-term disability insurance is fully contributed by employers/companies for benefit of...

Q: An employer in Newark, New Jersey employs three individuals, whose taxable earnings to date (prior t...

A:

Q: ABC Corporation acquired 70 percent of XYZ Corporation on August 1 for P420,000. On that date, XYZ C...

A: Purchase acquisition accounting is a method that is used for recording the purchase of a company on ...

Q: ABC Corporation acquired 80 percent of XYZ Corporation on August 1 for P500,000. On that date, XYZ C...

A: Identifiable net asset and share of NCI: Amount (P) Cash 60,000 Inventory ...

Q: 31. A, VAT-registered, made the following purchases during the month of January 2018 Goods for sale,...

A: VAT is the tax levied on goods and services produced by the manufacturer and is paid to the govern...

Q: If the Revenue (sales) decreases and everything else remains the same, what happens to the Food Cost...

A: Cost percentage or Cost ratio is the accounting ratio which shows the amount of cost incurred by fir...

Q: Question 11: The Additional Medicare Tax is owed on a portion of employee earnings by which of the f...

A: The Additional Medicare Tax applies to people who make more than a set income level for the year.The...

Q: Jervis accepts all major bank credit cards, including those issued by Northern Bank (NB), which asse...

A: Credit card expense = $4,900 x 5% = $245 Credit card expense is borne by the seller and the seller r...

Q: 1. A minimum company will produce drinks of type XYZ. From the data for the last 1 month, the larges...

A: Given, Biggest demand = 6000 bottles per day Smallest demand = 500 bottles per day Stock (max) =80...

Q: QUESTION 2 Which of the following statements is false O A positive net working capital is desirable ...

A: The income statement and balance sheet are the important financial statements of the business. The i...

Q: Valır Co., which began operations on January 1, 2021, appropriately uses the installment method of a...

A: Installment method of accounting is the method in which the owners books the profit when it is reali...

Q: On January 1, 2021, Nath-Langstrom Services, Inc., a computer software training firm, leased several...

A: Journal entry refers to recording the financial data of any organization in the chronological order,...

Q: An employer in Juneau, Alaska employs three individuals, whose taxable earnings to date (prior to th...

A: Calculation of SUTA , FUTA tax are as follows.

Q: Problem #1 (Adapted) Jack and Jill are partners who share profit or loss in the ratio of 3:2. They h...

A: Journal entry - It refers to the process where the business transactions are recorded in the books o...

Q: smail business, lor plan designed, Ists of le wer than Answer: A. 50 O 100 с. 500 D. O 1,000 B.

A: The correct answer is option (b) 100

Q: Following data were taken from the books of Cyclops Corporation from 2021: 2020 2021 Installment sal...

A: Introduction: An income statement or profit and loss account (also known as a profit and loss statem...

Q: Question 3: Which of the following is taxable for Social Security tax? Answer: A. O Contributions to...

A: Social Security taxes fund the retirement, disability, and survivor ship (benefits paid to a survi...

Q: Question 7: Contributions to which of the following retirement plans are subject to federal income t...

A: When employees are paid their paycheck, certain amounts will be withheld as federal income tax. This...

Q: Hickory Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. Th...

A: (1.) Which of the four activities is a product-level activity? Answer: (a) Product design. The produ...

Q: . Entity A leases computer equipment to customers under direct-financing leases. The equipment has n...

A: A lease is an arrangement where a lessor agrees to allow a lessee to control the use of the asset fo...

Q: ABC Corporation acquired 70 percent of XYZ Corporation on August 1 for P420,000. On that date, XYZ C...

A: Market Value 700,000 Less: Book Value 620,000 Purchase Differential 8...

Q: At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $170,000. It is e...

A: Formula: Straight line method = ( Asset cost - Salvage value ) / Useful life

Q: Mort is the owner of an apartment building containing ten identical apartments. Mort resides in one ...

A: Net income (NI), also known as net profits, is calculated by deducting sales from the cost of goods ...

Q: In 2020, the company's inventory turnover ratio was 7.64. What is their Inventory Turnover ratio for...

A: Inventory is the stock which the company has for the purpose to sell and the business has been estab...

Step by step

Solved in 2 steps

- Use Figure 12.15 to complete the following problem. Roland Inc. employees monthly gross pay information and their W-4 Form withholding allowances follow. Rolands payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax (based on withholdings table) of gross pay, state income tax at 3% of gross pay, and health insurance coverage premiums of $1,000 split 50% employees and 50% employer. Assume each employee files as single, gross income is the same amount each month, October is the first month of business operation for the company, and salaries have yet to be paid. Record the entry or entries for accumulated employee and employer payroll for the month of October; dated October 31.Reference Figure 12.15 and use the following information to complete the requirements. A. Determine the federal income tax withholdings amount per monthly pay period for each employee. B. Record the employee payroll entry (all employees) for the month of January assuming FICA Social Security is 6.2%, FICA Medicare is 1.45%, and state income tax is equal to 3% of gross income. (Round to the nearest cent if necessary.)In 2019, what is the top tax rate for individual long-term capital gains and the top tax rate for long-term capital gains of collectible items assuming that the Medicare tax does not apply. 10; 20 20; 28 15; 25 25; 28

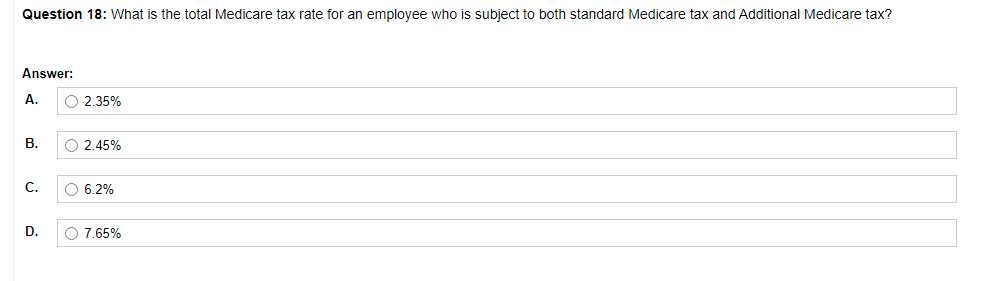

- Use Figure 12.15 as a reference to answer the following questions. A. If an employee makes $1,400 per month and files as single with no withholding allowances, what would be his monthly income tax withholding? B. What would it be if an employee makes $2,500 per month and files as single with two withholding allowances?An employee earns $8,000 in the first pay period. The FICA Social Security Tax rate is 6.2%, and the FICA Medicare tax rate is 1.45%. What is the employees FICA taxes responsibility? A. $535.50 B. $612 C. None, only the employer pays FICA taxes D. $597.50 E. $5501. What is the total Medicare tax rate for an employee who is subject to both standard Medicare tax and Additional Medicare tax? Answer: A. 2.35% B. 2.45% C. 6.2% D. 7.65% 2. Prior to the current period, Jamie Pratt, whose tax return filing status is single, had earnings subject to Medicare tax of $248,000. This week, Jamie has gross earnings of $3,700. His employer will withhold $_______ in total Medicare tax. 3. What type of institution might offer a 403(b) plan to its employees? Answer: A. A small business B. Private colleges C. Fortune 500 companies D. Public education institutions and certain tax-exempt organizations E. All of these options

- 1. The original Social Security tax rate was _____ of taxable earnings. Answer: A. 10% B. 1% C. 5% D. 7% 2. The 2021 Social Security wage base is _____. Answer: A. $100,000 B. $113,700 C. $125,000 D. $142,800 3. What is the earnings threshold over which an employee whose filing status is Married Filing Separately will be subject to the additional Medicare tax? Answer: A. $117,000 B. $125,000 C. $200,000 D. $250,00052. Subject : - Accounting Rachel receives employer provided health insurance. The employer's cost of the health insurance is $6,100 annually. What is her employer's after-tax cost of providing the health insurance, assuming that the employer's marginal tax rate is 21 percent and is profitable?1. What self-employment tax rate is applied to earnings that exceed $142,800 in a year and also do NOT exceed the additional Medicare tax threshold? Answer: A. 15.3% B. 12.4% C. 2.9% D. 1.45% 2. What is the standard credit applied to the FUTA tax rate in non-credit reduction states? Answer: A. 0.6% B. 0.9% C. 5.4% D. 6% 3. An employer in a non-credit reduction state would pay FUTA taxes of _____ for an employee whose year-to-date earnings prior to the current period are $7,200 and who earns $1,100 during the current period. Answer: A. $0 B. $6.60 C. $43.20 D. $49.80

- 19.Solve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax. What are the social security and Medicare withholdings (in $) for an executive whose annual gross earnings are $131,500? Social Security$ Medicare$Question 13 of 15. A single taxpayer who is a dependent under age 65 has to file a tax return if their unearned income exceeds more than which amount? $1,100 $1,200 $4,200 $4,400 Mark for follow upEmployee's Rates Matching Rates Paid bythe Employer Self-Employed Rates 7.65% on first $118,500 of income 1.45% on income above $118,500 7.65% on first $118,500 paid in wages 1.45% on wages above $118,500 13.3% on first $118,500 of net earnings 2.9% on earnings above $118,500 1FICA taxes include Social Security and Medicare. The Social Security tax applies to the first $118,500 of income, while the Medicare tax applies to all income. Suppose Holly has $227,100 of income from work and is not self-employed. How much will Holly have to pay in FICA taxes?