QUESTION 19 1 Use the 2018 Payroll Tax Withholding Tables from IRS Pub. 15. Circular E(see Mastering Payroll, 20-93), compute FITW for the following • Sandy is married, claims 3 allowances on her W4 and is paid $645 a week. . Sofia is single, claims 6 allowances on her W-4 and in paid $1,500 every 2 weeks. • Carlos is married, claims 6 allowances on his W-4 and is paid $1.500 every week Sam is single, claims 0 allowance on his W-4 and is paid $950 every 2 weeks.

QUESTION 19 1 Use the 2018 Payroll Tax Withholding Tables from IRS Pub. 15. Circular E(see Mastering Payroll, 20-93), compute FITW for the following • Sandy is married, claims 3 allowances on her W4 and is paid $645 a week. . Sofia is single, claims 6 allowances on her W-4 and in paid $1,500 every 2 weeks. • Carlos is married, claims 6 allowances on his W-4 and is paid $1.500 every week Sam is single, claims 0 allowance on his W-4 and is paid $950 every 2 weeks.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 3E

Related questions

Question

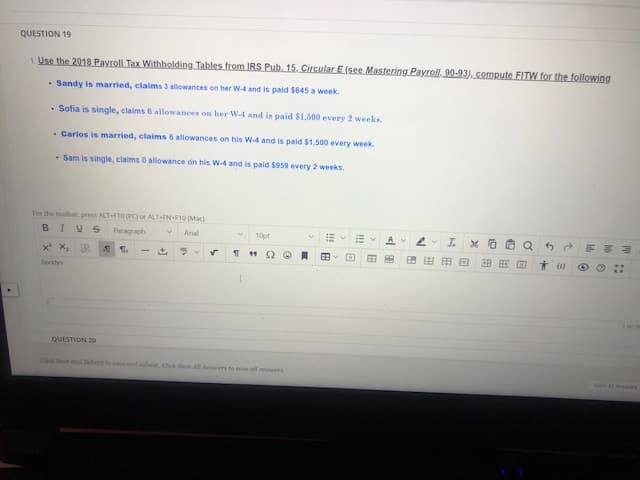

Transcribed Image Text:QUESTION 19

1. Use the 2018 Payroll Tax Withholding Tables from IRS Pub. 15. Circular E(see Mastering Payroll, 90-93), compute FITW for the following

. Sandy is married, claims 3 allowances on her W-4 and is paid $645 a week.

• Sofia is single, claims 6 allowances on her W-4 and is paid $1,500 every 2 weeks.

• Carlos is married, claims 6 allowances on his W-4 and is paid $1,500 every week.

• Sam is single, claims 0 allowance on his W-4 and is paid $959 every 2 weeks.

For the toolbar, press ALT F10(P) or ALTIN+F1O (Mac)

B

Paragraph

Arial

10pt

Av

I.

F制制

x X,

田田用国

* ()

Sandys

QUESTION 20

Clk Se and Suie to e and ir. Cick Se AllA ers

se all ansers

Save Al A ers

!!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT