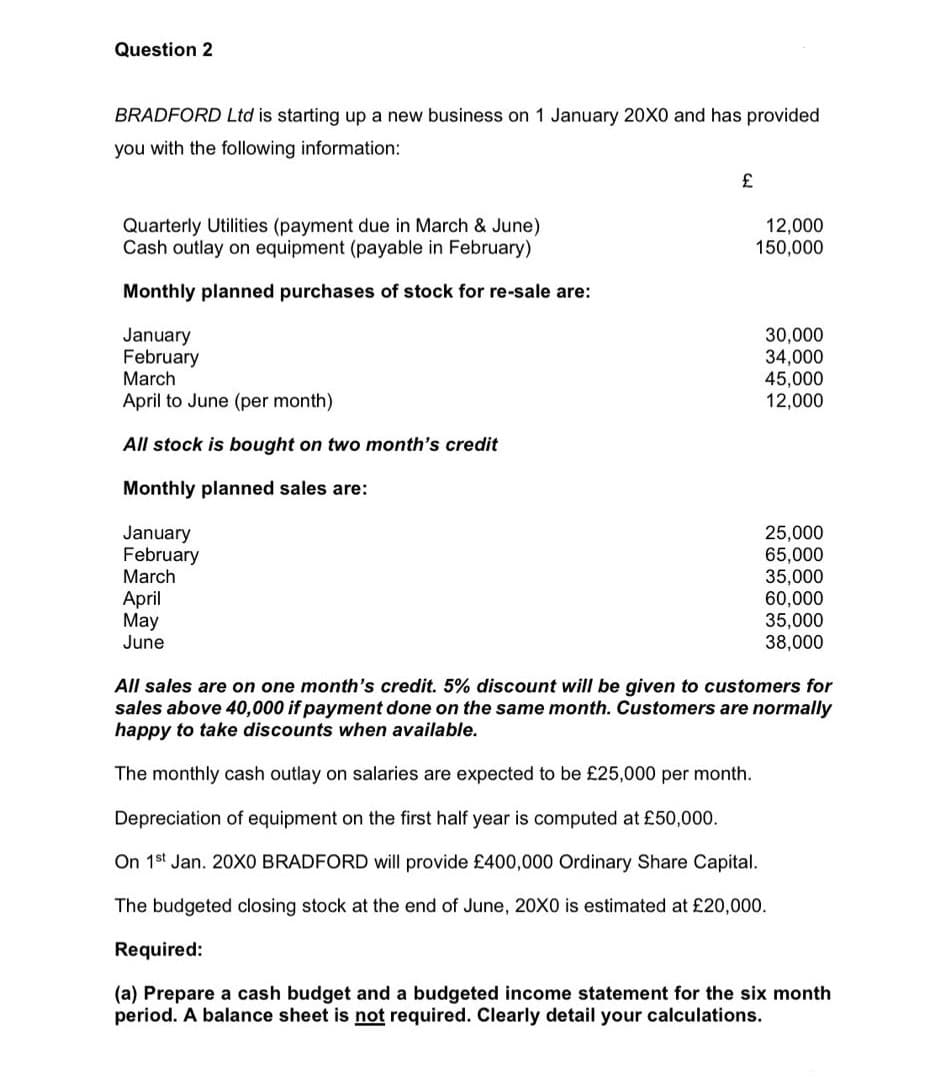

Question 2 BRADFORD Ltd is starting up a new business on 1 January 20X0 and has provided you with the following information: £ Quarterly Utilities (payment due in March & June) Cash outlay on equipment (payable in February) 12,000 150,000 Monthly planned purchases of stock for re-sale are: January February March April to June (per month) 30,000 34,000 45,000 12,000 All stock is bought on two month's credit Monthly planned sales are January February March 25,000 65,000 35,000 60,000 35,000 38,000 April May June All sales are on one month's credit. 5% discount will be given to customers for sales above 40,000 if payment done on the same month. Customers are normally happy to take discounts when available. The monthly cash outlay on salaries are expected to be £25,000 per month. Depreciation of equipment on the first half year is computed at £50,000. On 1st Jan. 20X0 BRADFORD will provide £400,000 Ordinary Share Capital. The budgeted closing stock at the end of June, 20XO is estimated at £20,000. Required: (a) Prepare a cash budget and a budgeted income statement for the six month period. A balance sheet is not required. Clearly detail your calculations.

Question 2 BRADFORD Ltd is starting up a new business on 1 January 20X0 and has provided you with the following information: £ Quarterly Utilities (payment due in March & June) Cash outlay on equipment (payable in February) 12,000 150,000 Monthly planned purchases of stock for re-sale are: January February March April to June (per month) 30,000 34,000 45,000 12,000 All stock is bought on two month's credit Monthly planned sales are January February March 25,000 65,000 35,000 60,000 35,000 38,000 April May June All sales are on one month's credit. 5% discount will be given to customers for sales above 40,000 if payment done on the same month. Customers are normally happy to take discounts when available. The monthly cash outlay on salaries are expected to be £25,000 per month. Depreciation of equipment on the first half year is computed at £50,000. On 1st Jan. 20X0 BRADFORD will provide £400,000 Ordinary Share Capital. The budgeted closing stock at the end of June, 20XO is estimated at £20,000. Required: (a) Prepare a cash budget and a budgeted income statement for the six month period. A balance sheet is not required. Clearly detail your calculations.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 19E: Schedule of cash payments for service company Horizon Financial Inc. was organized on February 28....

Related questions

Question

i need in word

not screenshots or no pic

Transcribed Image Text:Question 2

BRADFORD Ltd is starting up a new business on 1 January 20X0 and has provided

you with the following information:

Quarterly Utilities (payment due in March & June)

Cash outlay on equipment (payable in February)

12,000

150,000

Monthly planned purchases of stock for re-sale are:

January

February

March

30,000

34,000

45,000

12,000

April to June (per month)

All stock is bought on two month's credit

Monthly planned sales are:

January

February

March

25,000

65,000

35,000

60,000

35,000

38,000

April

May

June

All sales are on one month's credit. 5% discount will be given to customers for

sales above 40,000 if payment done on the same month. Customers are normally

happy to take discounts when available.

The monthly cash outlay on salaries are expected to be £25,000 per month.

Depreciation of equipment on the first half year is computed at £50,000.

On 1st Jan. 20XO BRADFORD will provide £400,000 Ordinary Share Capital.

The budgeted closing stock at the end of June, 20X0 is estimated at £20,000.

Required:

(a) Prepare a cash budget and a budgeted income statement for the six month

period. A balance sheet is not required. Clearly detail your calculations.

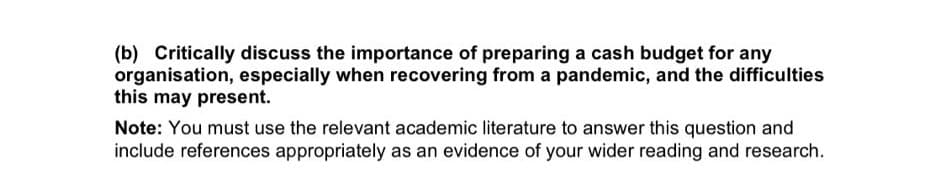

Transcribed Image Text:(b) Critically discuss the importance of preparing a cash budget for any

organisation, especially when recovering from a pandemic, and the difficulties

this may present.

Note: You must use the relevant academic literature to answer this question and

include references appropriately as an evidence of your wider reading and research.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub