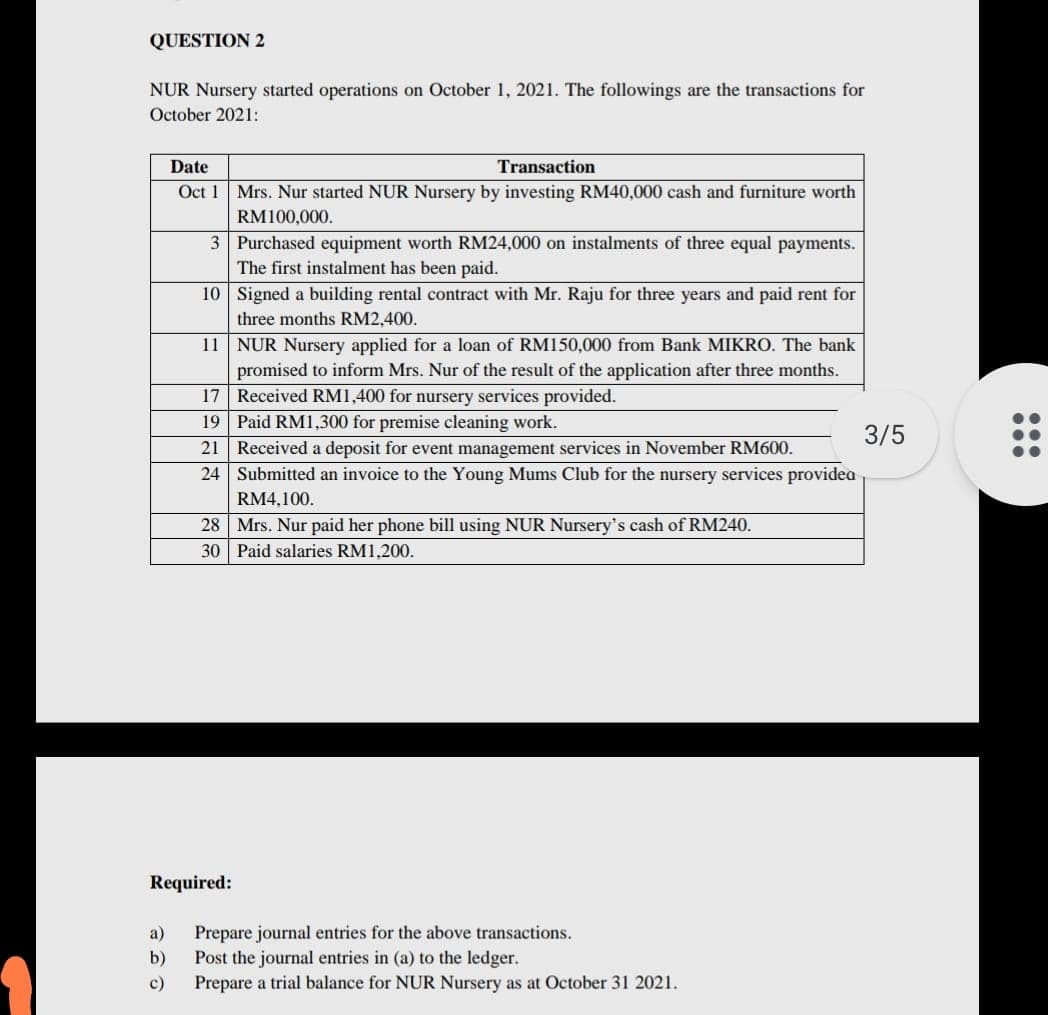

QUESTION 2 NUR Nursery started operations on October 1, 2021. The followings are the transactions for October 2021: Date Transaction Oct 1 Mrs. Nur started NUR Nursery by investing RM40,000 cash and furniture worth RM100,000. 3 Purchased equipment worth RM24,000 on instalments of three equal payments. The first instalment has been paid. 10 Signed a building rental contract with Mr. Raju for three years and paid rent for three months RM2,400. 11 NUR Nursery applied for a loan of RM150,000 from Bank MIKRO. The bank promised to inform Mrs. Nur of the result of the application after three months. 17 Received RM1,400 for nursery services provided. 19 Paid RM1,300 for premise cleaning work. 3/5 21 Received a deposit for event management services in November RM600. Submitted an invoice to the Young Mums Club for the nursery services providea RM4,100. 24 28 Mrs. Nur paid her phone bill using NUR Nursery's cash of RM240. Paid salaries RM1,200. 30 Required: a) Prepare journal entries for the above transactions. Post the journal entries in (a) to the ledger. b) c) Prepare a trial balance for NUR Nursery as at October 31 2021.

QUESTION 2 NUR Nursery started operations on October 1, 2021. The followings are the transactions for October 2021: Date Transaction Oct 1 Mrs. Nur started NUR Nursery by investing RM40,000 cash and furniture worth RM100,000. 3 Purchased equipment worth RM24,000 on instalments of three equal payments. The first instalment has been paid. 10 Signed a building rental contract with Mr. Raju for three years and paid rent for three months RM2,400. 11 NUR Nursery applied for a loan of RM150,000 from Bank MIKRO. The bank promised to inform Mrs. Nur of the result of the application after three months. 17 Received RM1,400 for nursery services provided. 19 Paid RM1,300 for premise cleaning work. 3/5 21 Received a deposit for event management services in November RM600. Submitted an invoice to the Young Mums Club for the nursery services providea RM4,100. 24 28 Mrs. Nur paid her phone bill using NUR Nursery's cash of RM240. Paid salaries RM1,200. 30 Required: a) Prepare journal entries for the above transactions. Post the journal entries in (a) to the ledger. b) c) Prepare a trial balance for NUR Nursery as at October 31 2021.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 9PA: Mohammed LLC is a growing consulting firm. The following transactions take place during the current...

Related questions

Question

Transcribed Image Text:QUESTION 2

NUR Nursery started operations on October 1, 2021. The followings are the transactions for

October 2021:

Date

Transaction

Oct 1

Mrs. Nur started NUR Nursery by investing RM40,000 cash and furniture worth

RM100,000.

3

Purchased equipment worth RM24,000 on instalments of three equal payments.

The first instalment has been paid.

10

Signed a building rental contract with Mr. Raju for three years and paid rent for

three months RM2,400.

11

NUR Nursery applied for a loan of RM150,000 from Bank MIKRO. The bank

promised to inform Mrs. Nur of the result of the application after three months.

17 Received RM1,400 for nursery services provided.

19 Paid RM1,300 for premise cleaning work.

3/5

21

Received a deposit for event management services in November RM600.

24 Submitted an invoice to the Young Mums Club for the nursery services providea

RM4,100.

28 Mrs. Nur paid her phone bill using NUR Nursery's cash of RM240.

30

Paid salaries RM1,200.

Required:

a)

Prepare journal entries for the above transactions.

b)

Post the journal entries in (a) to the ledger.

c)

Prepare a trial balance for NUR Nursery as at October 31 2021.

...

●●●

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 15 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning