Question 2 The December 31, 2009, balance sheet of Anna's Tennis Shop, Inc., showed current assets of $2,263 and current liabilities of $1,290. The December 31, 2010, balance sheet showed current assets of $1,612 and current liabilities of $1,414. What was the company's 2010 change in net working capital, or NWC? Question 3 M Given the following information for Sookie's Cookies Co., calculate the depreciation expense: sales - $97,009; costs - $52,981: addition to retained earnings $1,062: dividends paid $1,821: interest expense - $1,439; tax rate - 39 percent. (Hint: Build the Income Statement and fill in the missing pieces until you get to the depreciation expense. You may have to work from bottom up.)

Question 2 The December 31, 2009, balance sheet of Anna's Tennis Shop, Inc., showed current assets of $2,263 and current liabilities of $1,290. The December 31, 2010, balance sheet showed current assets of $1,612 and current liabilities of $1,414. What was the company's 2010 change in net working capital, or NWC? Question 3 M Given the following information for Sookie's Cookies Co., calculate the depreciation expense: sales - $97,009; costs - $52,981: addition to retained earnings $1,062: dividends paid $1,821: interest expense - $1,439; tax rate - 39 percent. (Hint: Build the Income Statement and fill in the missing pieces until you get to the depreciation expense. You may have to work from bottom up.)

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 1.2BE

Related questions

Topic Video

Question

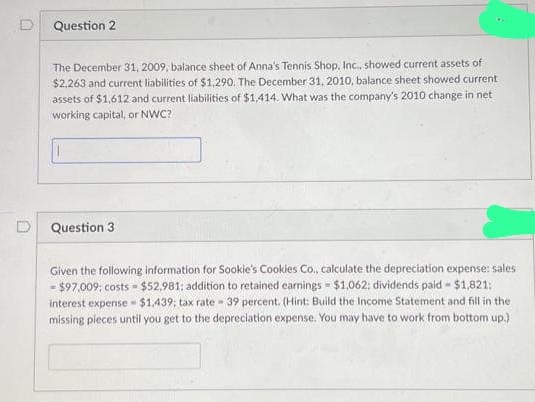

Transcribed Image Text:Question 2

The December 31, 2009, balance sheet of Anna's Tennis Shop, Inc., showed current assets of

$2,263 and current liabilities of $1,290. The December 31, 2010, balance sheet showed current

assets of $1,612 and current liabilities of $1,414. What was the company's 2010 change in net

working capital, or NWC?

Question 3

M

Given the following information for Sookie's Cookies Co., calculate the depreciation expense: sales

- $97,009; costs - $52,981; addition to retained earnings $1,062: dividends paid $1,821:

interest expense - $1,439; tax rate - 39 percent. (Hint: Build the Income Statement and fill in the

missing pieces until you get to the depreciation expense. You may have to work from bottom up.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning