Question 2 View Policies Current Attempt in Progress Drew Enterprises reports all its sales on credit, and pays operating costs in the month incurred. Estimated amounts for the months of June through October are: August September October July June $310,000 $330,000 $300,000 $280,000 $260,000 Budgeted sales Budgeted purchases $144,000 $120,000 $128,000 $132,000 $90,000 . Customer amounts on account are collected 60% in the month of sale and 40% in the following month. . Cost of goods sold is 45% of sales. . Drew purchases and pays for merchandise 30% in the month of acquisition and 70% in the following month. How much cash is budgeted to be received during August? $312,000. O $318,000. O $291,000. $180,000. ) hp 19 4 fn + ins prt sc delete home end & 7 6 num backspace lock P home H J K 4 enter

Question 2 View Policies Current Attempt in Progress Drew Enterprises reports all its sales on credit, and pays operating costs in the month incurred. Estimated amounts for the months of June through October are: August September October July June $310,000 $330,000 $300,000 $280,000 $260,000 Budgeted sales Budgeted purchases $144,000 $120,000 $128,000 $132,000 $90,000 . Customer amounts on account are collected 60% in the month of sale and 40% in the following month. . Cost of goods sold is 45% of sales. . Drew purchases and pays for merchandise 30% in the month of acquisition and 70% in the following month. How much cash is budgeted to be received during August? $312,000. O $318,000. O $291,000. $180,000. ) hp 19 4 fn + ins prt sc delete home end & 7 6 num backspace lock P home H J K 4 enter

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 54E: Exercise 4-54 Operating Cycle and Current Receivables a. Dither and Sly are attorneys-at-law who...

Related questions

Question

Transcribed Image Text:Question 2

View Policies

Current Attempt in Progress

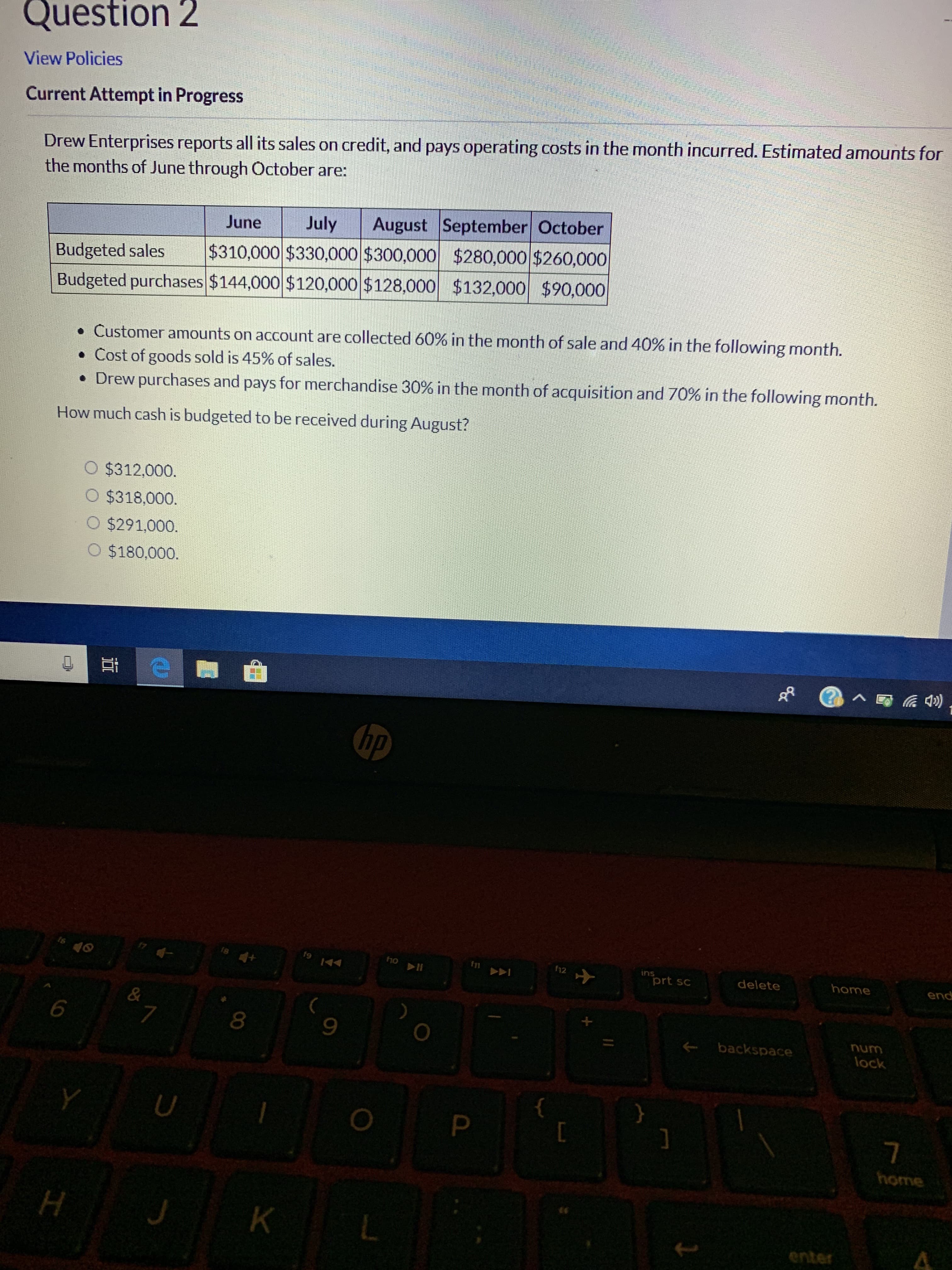

Drew Enterprises reports all its sales on credit, and pays operating costs in the month incurred. Estimated amounts for

the months of June through October are:

August September October

July

June

$310,000 $330,000 $300,000 $280,000 $260,000

Budgeted sales

Budgeted purchases $144,000 $120,000 $128,000 $132,000 $90,000

. Customer amounts on account are collected 60% in the month of sale and 40% in the following month.

. Cost of goods sold is 45% of sales.

. Drew purchases and pays for merchandise 30% in the month of acquisition and 70% in the following month.

How much cash is budgeted to be received during August?

$312,000.

O $318,000.

O $291,000.

$180,000.

)

hp

19 4

fn

+

ins

prt sc

delete

home

end

&

7

6

num

backspace

lock

P

home

H

J

K

4

enter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning