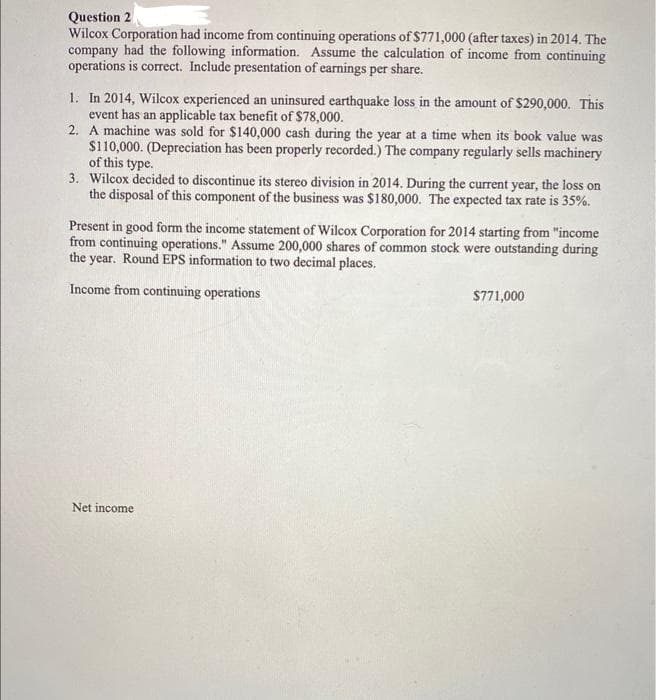

Question 2 Wilcox Corporation had income from continuing operations of $771,000 (after taxes) in 2014. The company had the following information. Assume the calculation of income from continuing operations is correct. Include presentation of earnings per share. 1. In 2014, Wilcox experienced an uninsured earthquake loss in the amount of $290,000. This event has an applicable tax benefit of $78,000. 2. A machine was sold for $140,000 cash during the year at a time when its book value was $110,000. (Depreciation has been properly recorded.) The company regularly sells machinery of this type. 3. Wilcox decided to discontinue its stereo division in 2014. During the current year, the loss on the disposal of this component of the business was $180,000. The expected tax rate is 35%. Present in good form the income statement of Wilcox Corporation for 2014 starting from "income from continuing operations." Assume 200,000 shares of common stock were outstanding during the year. Round EPS information to two decimal places. Income from continuing operations $771,000

Question 2 Wilcox Corporation had income from continuing operations of $771,000 (after taxes) in 2014. The company had the following information. Assume the calculation of income from continuing operations is correct. Include presentation of earnings per share. 1. In 2014, Wilcox experienced an uninsured earthquake loss in the amount of $290,000. This event has an applicable tax benefit of $78,000. 2. A machine was sold for $140,000 cash during the year at a time when its book value was $110,000. (Depreciation has been properly recorded.) The company regularly sells machinery of this type. 3. Wilcox decided to discontinue its stereo division in 2014. During the current year, the loss on the disposal of this component of the business was $180,000. The expected tax rate is 35%. Present in good form the income statement of Wilcox Corporation for 2014 starting from "income from continuing operations." Assume 200,000 shares of common stock were outstanding during the year. Round EPS information to two decimal places. Income from continuing operations $771,000

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

Please help me

Transcribed Image Text:Question 2

Wilcox Corporation had income from continuing operations of $771,000 (after taxes) in 2014. The

company had the following information. Assume the calculation of income from continuing

operations is correct. Include presentation of earnings per share.

1. In 2014, Wilcox experienced an uninsured earthquake loss in the amount of $290,000. This

event has an applicable tax benefit of $78,000.

2. A machine was sold for $140,000 cash during the year at a time when its book value was

$110,000. (Depreciation has been properly recorded.) The company regularly sells machinery

of this type.

3. Wilcox decided to discontinue its stereo division in 2014. During the current year, the loss on

the disposal of this component of the business was $180,000. The expected tax rate is 35%.

Present in good form the income statement of Wilcox Corporation for 2014 starting from "income

from continuing operations." Assume 200,000 shares of common stock were outstanding during

the year. Round EPS information to two decimal places.

Income from continuing operations

Net income

$771,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning