Question 2 With the following data, compute the NET FUTA Tax. Gross FUTA Tax DUE $6,750 Credit against FUTA (assume $3,100 applicable) O $3,650 O $7,000 O $3,100 O $6,750

Question 2 With the following data, compute the NET FUTA Tax. Gross FUTA Tax DUE $6,750 Credit against FUTA (assume $3,100 applicable) O $3,650 O $7,000 O $3,100 O $6,750

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 15DQ: LO.5 Beige Corporation has a fiscal year ending April 30. For the year ending April 30, 2018, Beige...

Related questions

Question

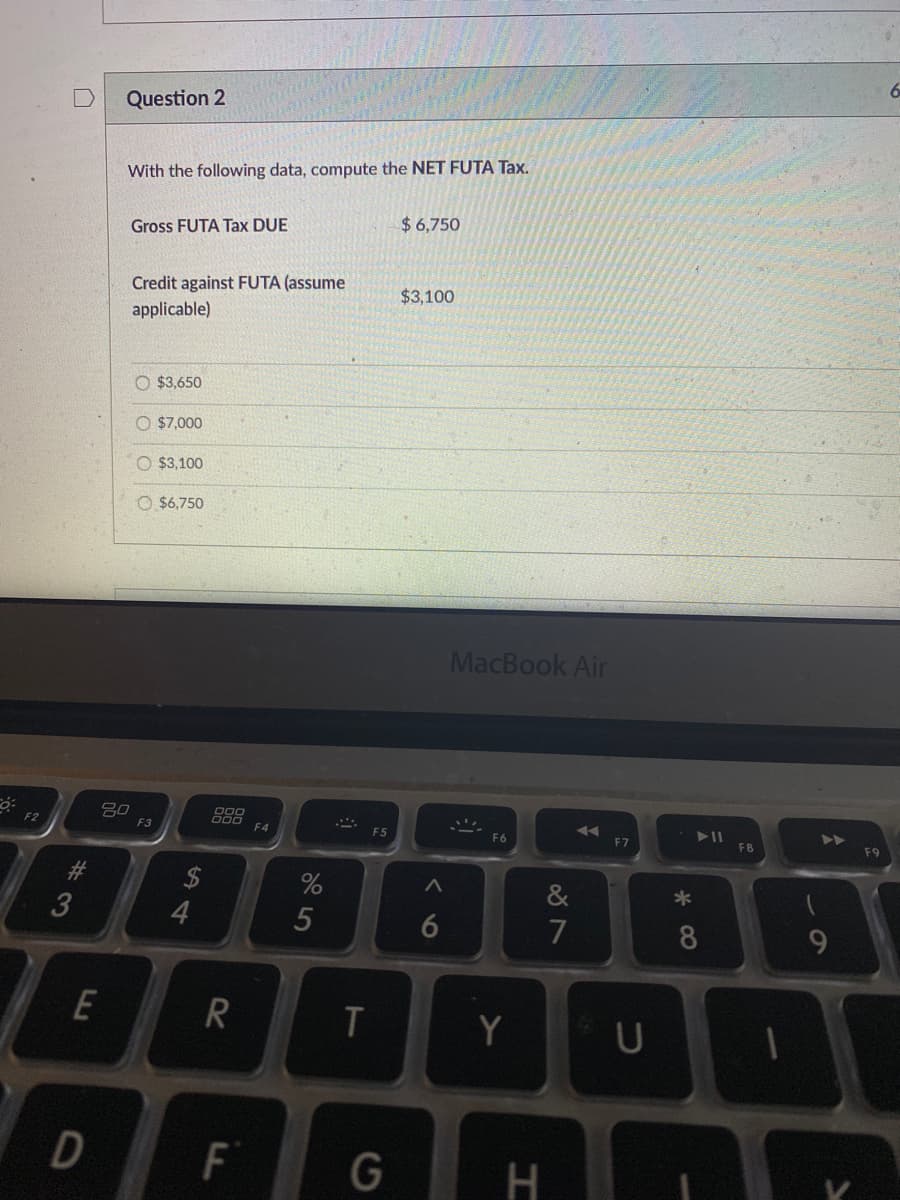

Transcribed Image Text:Question 2

With the following data, compute the NET FUTA Tax.

$6,750

Gross FUTA Tax DUE

Credit against FUTA (assume

$3,100

applicable)

O $3,650

O $7,000

O $3,100

$6,750

MacBook Air

80

F3

F2

F4

F5

F6

F7

FB

F9

3

4.

5

7

8

9.

E

T

Y

D

G

< 6

F.

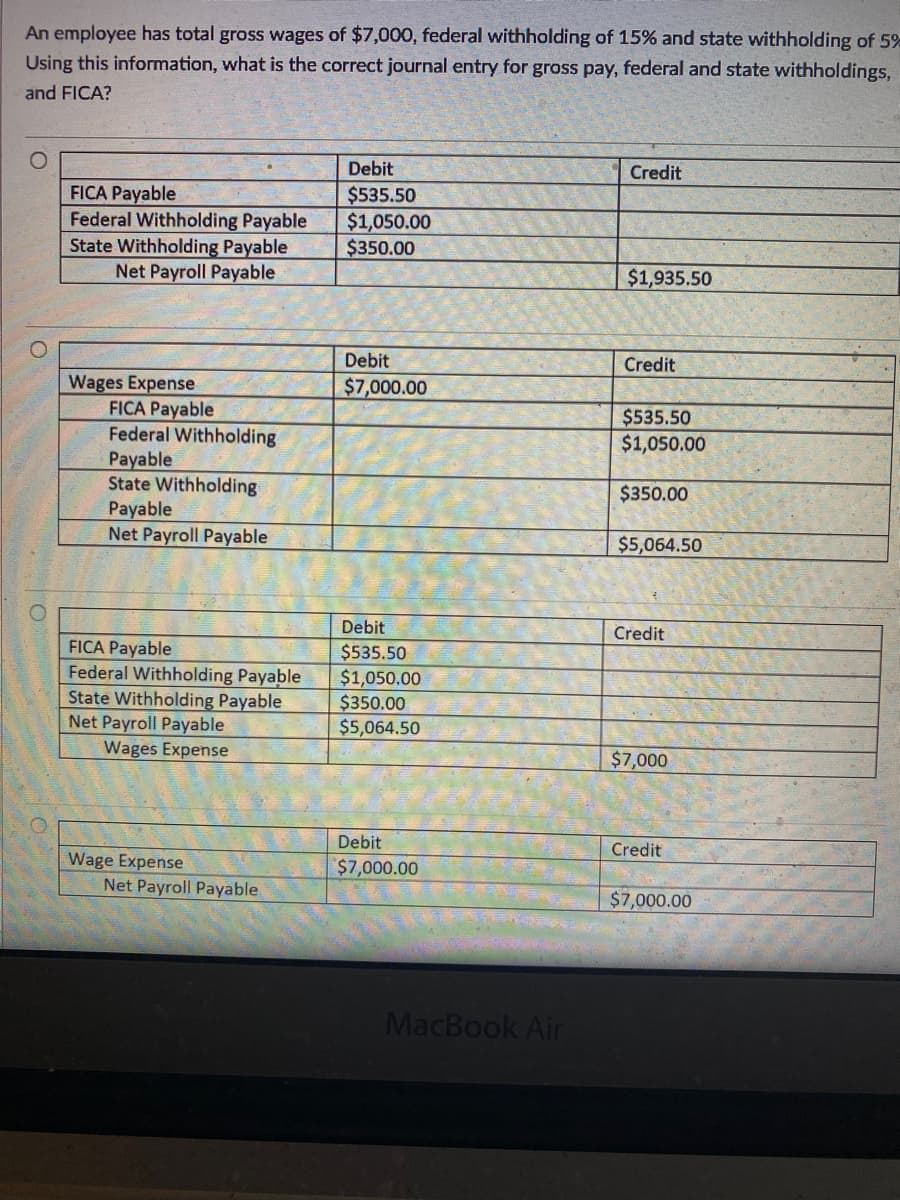

Transcribed Image Text:An employee has total gross wages of $7,000, federal withholding of 15% and state withholding of 5%

Using this information, what is the correct journal entry for gross pay, federal and state withholdings,

and FICA?

Debit

Credit

FICA Payable

Federal Withholding Payable

State Withholding Payable

Net Payroll Payable

$535.50

$1,050.00

$350.00

$1,935.50

Debit

Credit

Wages Expense

FICA Payable

Federal Withholding

Payable

State Withholding

Payable

Net Payroll Payable

$7,000.00

$535.50

$1,050.00

$350.00

$5,064.50

Debit

Credit

FICA Payable

$535.50

Federal Withholding Payable

State Withholding Payable

Net Payroll Payable

Wages Expense

$1,050.00

$350.00

$5,064.50

$7,000

Debit

Credit

Wage Expense

Net Payroll Payable

$7,000.00

$7,000.00

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,